AI-Related Tokens Hold Gains After Nvidia’s Big Beat Solidifies Bullish Outlook

Artificial Intelligence (AI) related cryptocurrencies continued to hold sizable advances Wednesday as Nvidia (NVDA) easily topped second quarter earnings estimates, proving the bullish AI trend is here to stay.

Nvidia reported Q2 revenue of $13.51 billion versus consensus estimates of $11.19 billion, according to FactSet data. The company’s Q2 earnings per share was $2.70 beating estimates of $2.08. The chipmaker also said it expects third quarter revenue to be about $16 billion (plus or minus 2%) versus estimates of just $12.59 billion.

“Companies worldwide are transitioning from general-purpose to accelerated computing and generative AI,” said Jensen Huang, founder and CEO of Nvidia in a press release. “The race is on to adopt generative AI,” he added.

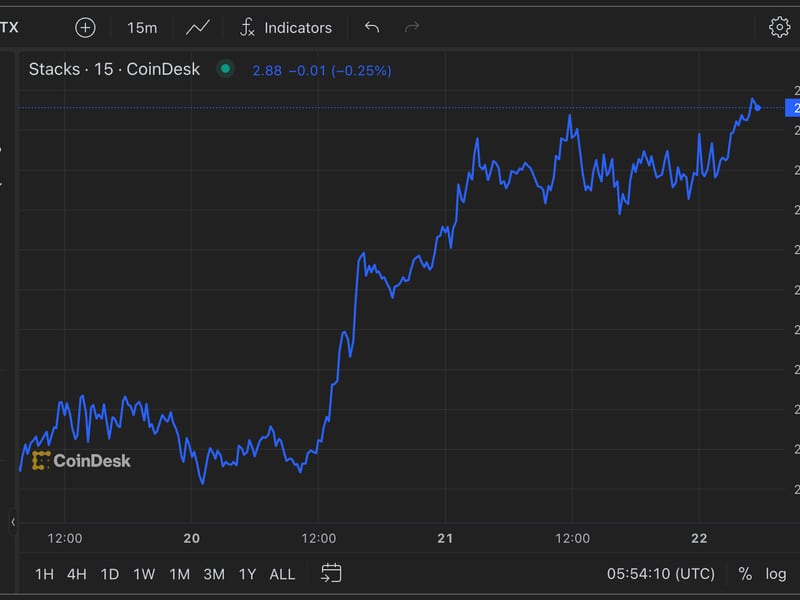

Tokens such as FET, GRT, INJ, RNDR and AGIX all were up more than 4% over the past 24 hours, outperforming the CoinDesk Market Index’s (CMI) 3% advance.

Today’s result follows Nvidia’s blowout first quarter results from last May which revealed an extremely bullish outlook for revenue tied to AI. This sentiment, coupled with increasingly AI mainstream reach with the likes of OpenAI’s ChatGPT, spilled over onto AI-related cryptocurrencies, sending them soaring, even though they’ve fallen back over the summer along with the rest of the market.

Nvidia’s shares rose more than 7% in U.S. after-hours trading after gaining about 3% during the regular session. The stock is higher by more than 200% this year, according to TradingView data.

Edited by Stephen Alpher.