AI Crypto Tokens Lose Steam as Post-Nvidia Earnings Hype Wears Off

Artificial intelligence (AI)-related tokens have lost as much as 25% of their value in June, as hype around the sector wore off after chip-maker Nvidia’s (NVDA) recent blowout quarter.

In 2023, AI cryptos have been on a tear, boosted by the fact that the technology is increasingly reaching the mainstream with the likes of OpenAI’s ChatGPT. In late May, after chipmaker Nvidia (NVDA) revealed its bullish outlook for AI sales, some AI tokens saw a short-lived boom.

Two weeks later, however, interest has cooled off. The sub-sector has lost 16.7% over the past seven days, compared to a 6.9% contraction in the broader crypto market, according to Lewis Harland, portfolio manager at Decentral Park Capital.

SingularityNE (AGIX), the second-biggest AI token by market capitalization, has lost 19% of its value in the past week, according to data from CoinGecko.

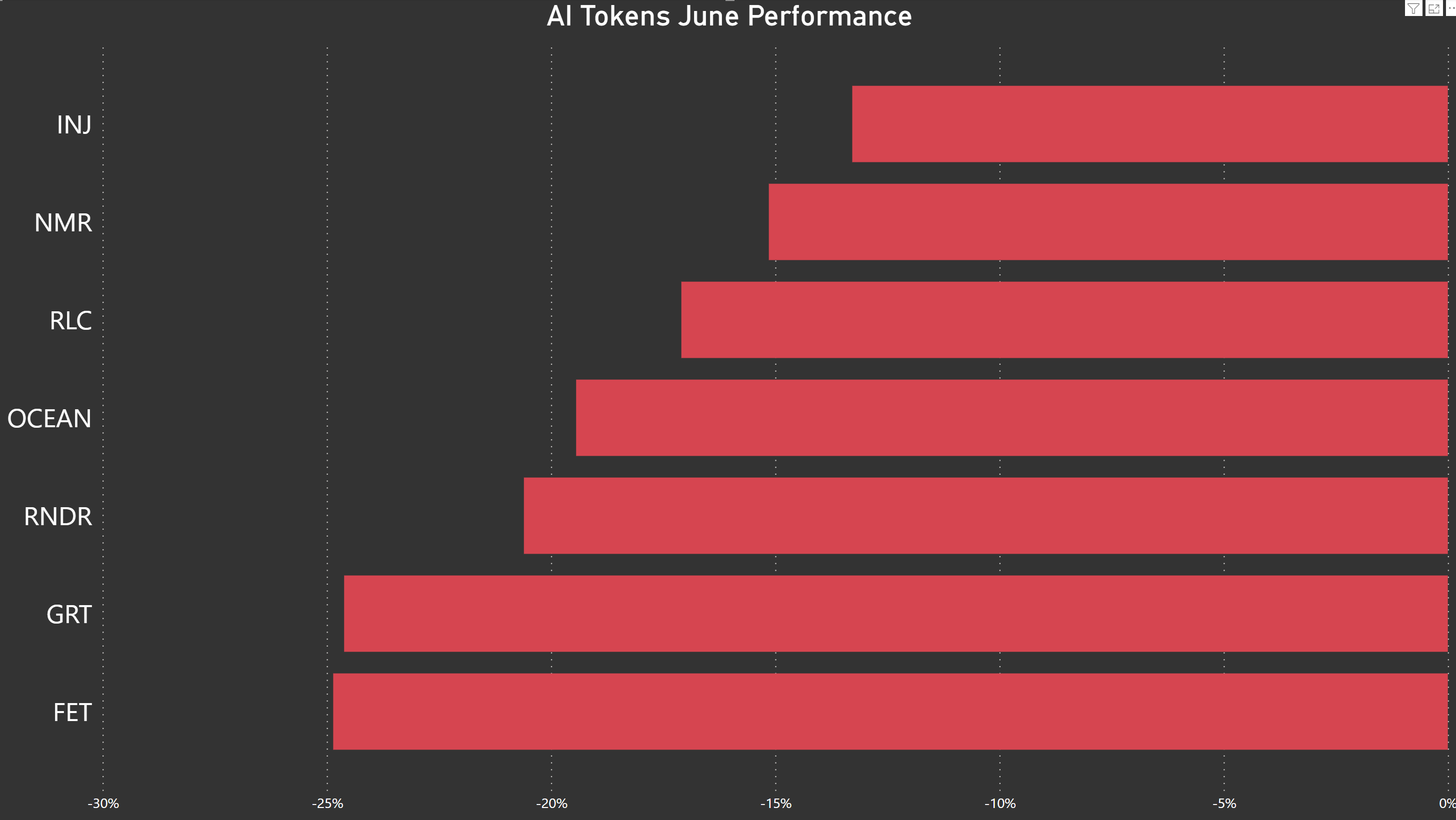

Since the start of June, Fetch.ai (FET) and The Graph (GRT) have both lost almost 25% of their value, according to CoinDesk Indices analysis.

Breaking the Nvidia connection

AI crypto tokens such as Render (RNDR) have been more strongly correlated with Nvidia shares, compared to the wider crypto market, said Harland.

However, the U.S. Securities and Exchange Commission’s lawsuits against Binance and Coinbase (COIN) threw a wrench in that relationship, said the analyst. The regulation by enforcement has spread worries around the crypto sector that haven’t touched the AI industry, yet.

Nvidia shares have gained about 7% in the past week, according to data from TradingView, while the top ten AI tokens by market cap tracked by information platform CoinGecko have lost about 14% of their value on average.

One of the AI-related tokens that has a “unique case in the AI bucket” is the Render token that has been “picked up as a key project,” said Harland.

The token diverged from other AI-related projects since the start of the second quarter, he said. The Render Network aims to decentralize graphics processing unit (GPU) rendering, a type of computing-intensive image processing that is integral to creative industries, virtual reality and generative AI tools such as Midjourney.

Render’s exceptionalism is “likely” because it shares a connection with Nvidia, in that it is focused on GPU-based computing, similar to the chip firm, said Harland.

“You can think of Nvidia as representing the supply/production layer, Render as the distribution layer, and Midjourney as the application layer,” he said.

There was also speculation around Render being used by consumer hardware giant Apple (AAPL). At an event last week unveiling its virtual reality headset, among other products, Apple mentioned Octane, a rendering tool designed by the team behind Render, which led to speculation that Render will be used in Apple’s VR headset.

The current dip doesn’t mean that all is lost as projects still have time ahead of them to develop use cases.

The fact that the hype has died down is “not to say that projects with real utility won’t rise back to the top at some point, though if they do, it’s likely to be a slower rise based on real utility rather than hype,” said market trend analyst at AI investment platform Q.ai Jason Mountford.

However, Mountford thinks that AI-related tokens will “continue to struggle for the foreseeable future, barring a major announcement in AI tech more generally,” which could lead to another short-lived boom.