Against the Odds, Some Bitcoin Traders Are Betting on a $36K Price by Year’s End

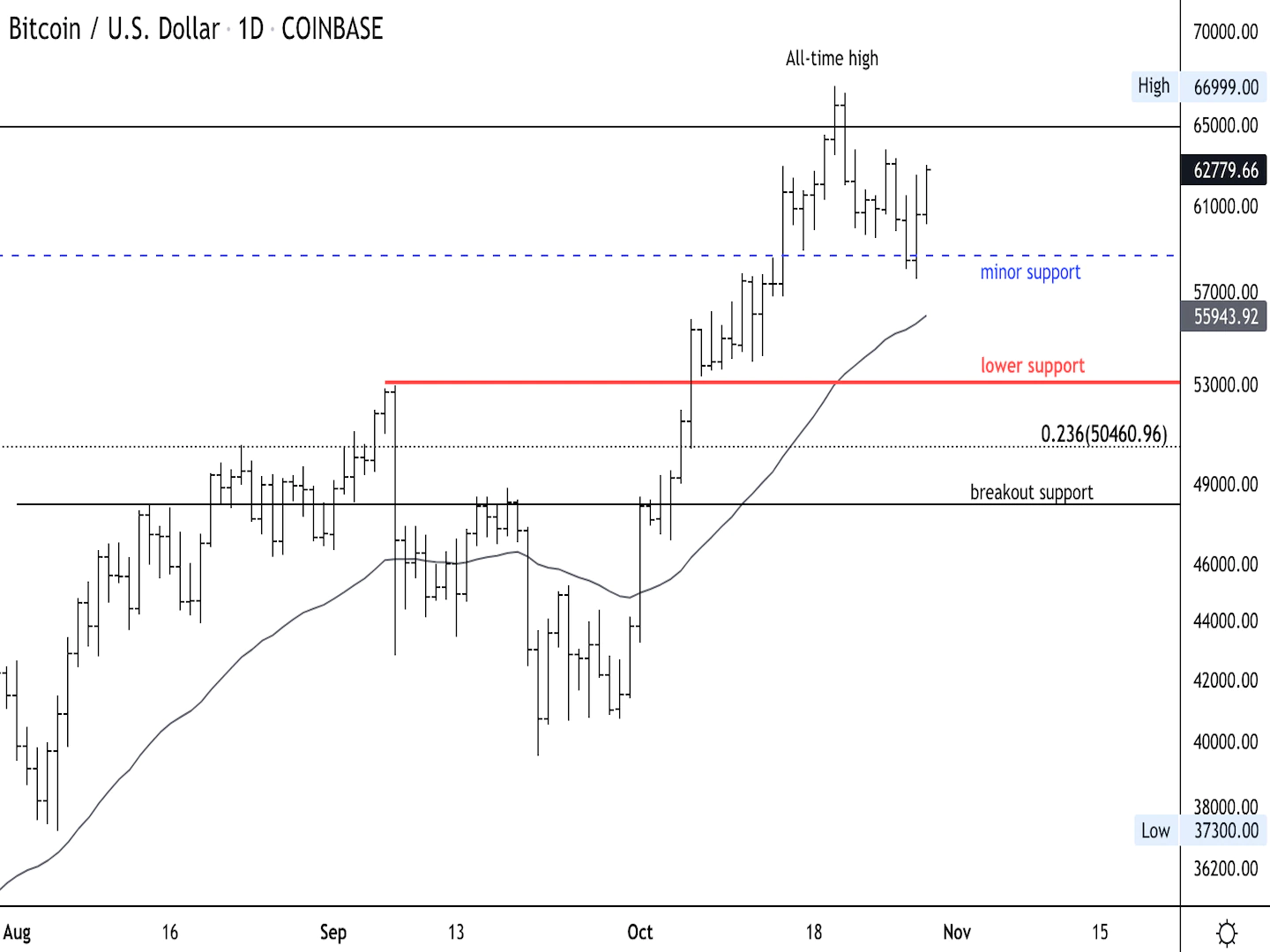

Change in open interest on BTC options at Deribit (Chart: Skew)

Against the Odds, Some Bitcoin Traders Are Betting on a $36K Price by Year’s End

The Deribit crypto derivatives exchange is seeing increasing investor interest in bitcoin options that would profit from prices rallying as high as $36,000 by the end of 2020.

- As of Sunday, call options at $36,000 and $32,000 strike prices expiring on Dec. 25 were seeing the most daily positions opened.

- “We saw some out of the ordinary activity in the $36,000 December call,” Luuk Strijers, CCO of Deribit, told CoinDesk in a Telegram chat. “Few buyers with most likely bullish expectations executed these trades.”

- A call option gives the holder the right but not the obligation to buy the underlying asset at a predetermined price on or before a particular date. A put option represents a right to sell.

- Open interest refers to the number of contracts traded, but not squared off with an offsetting position.

- The most new open positions were seen in the $36,000 December call, with 752 contracts.

- The number of open positions in the $32,000 call rose by 462 contracts.

- Relatively small additions were observed in the $28,000 December expiry call, as well as the $9,750 and $9,000 puts expiring this month.

- Buy positions in the out-of-the-money $36,000 and $32,000 calls were executed during Sunday’s European trading hours when the liquidity was low (wider bid-offer spread).

- As such, these traders paid significantly more in costs than they would have incurred on a weekday.

- The aggressive weekend trading is a little perplexing, given the options market sees a very low probability of prices reaching a new record high above $20,000 by the end of December.

- The odds of bitcoin setting a new lifetime high over $20,000 by the year’s end are just 5%, the data suggests, while the likelihood of prices crossing $28,000 is 2%.

- Further, the market sees only a 9% chance of bitcoin crossing above $20,000 by the end of Q1 2021.

- While prospects of bitcoin rising to $36,000 are quite low, these deep out-of-the-money options are not expensive.

- In other words, the maximum loss in this trade is limited to the extent of the price paid to buy the option.

- That may have motivated these weekend traders to take a long shot on a new ATH.

- At press time, bitcoin is changing hands near $10,420. The cryptocurrency has been restricted mostly to a narrow range of $10,500 to $10,000 since Sept. 4.

- On-chain developments favor a range breakout, which could fuel a rally to the psychological hurdle of $11,000.