After the Storm: Bitcoin Reclaims $30K As ETH Trades Above $1,000

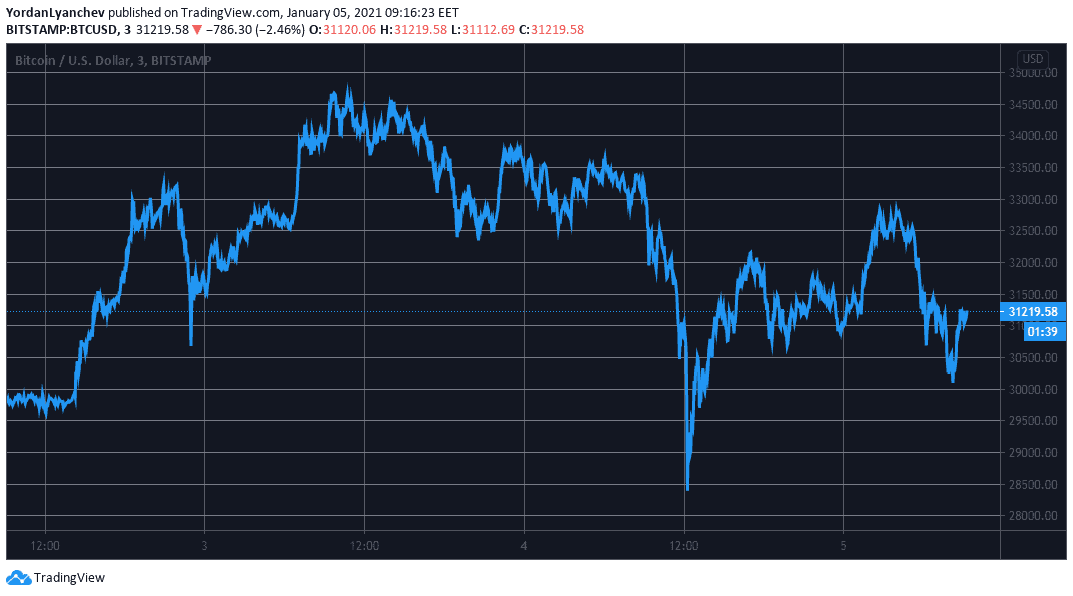

After a highly volatile day that saw a significant $5,500 move from bitcoin to beneath $28,000, the cryptocurrency has calmed above $30,000. Most alternative coins have retraced from yesterday’s highs as well, but Ethereum still hovers above $1,000.

Bitcoin’s Roller-Coaster Calms At $31K

The new year began wildly positive for the primary cryptocurrency with consecutive all-time highs – the latest neared $35,000. However, bitcoin went on a volatile ride that saw about $5,500 of its value evaporate in merely hours as Monday came.

Speculations emerged that BTC’s massive drop was triggered by a gap left opened on the Chicago Mercantile Exchange from last week. Bitcoin filled the gap at $29,000 and surged back above $30,000 shortly after.

The cryptocurrency even initiated a leg up that took it up to $33,000 in the following hours. However, the bears took control once more and pushed it down to its current level of approximately $31,000.

From a technical perspective, the key support levels situated at $30,300, $30,000, and $29,300 could assist in case of another retracement. Alternatively, the resistance lines at $32,200, $33,100, and the ATH at $34,800 are the first major obstacles if BTC resumes its bull run.

Retracing Altcoins, ETH Reconquers $1K

The increased volatility didn’t miss the altcoin market yesterday. Ethereum was among the most notable performers as it pumped to its highest price tag in almost three years at $1,170.

However, ETH dumped rather vigorously to $900 almost immediately after its peak. Nevertheless, the second-largest digital asset reclaimed $1,000 and current hovers above it.

Ripple is about 10% down on a 24-hour scale to $0.23. Bitcoin Cash (-11%), Binance Coin (-6%), Chainlink (-11%), Polkadot (-7%), Cardano (-6%), and Litecoin (-8%) are also in the red.

Further losses are evident from Ren (-11%), TRON (-11%), Ontology (-11%), Verge (-11%), NEAR Protocol (-10%), and BitTorrent (-10%).

The total market cap has dropped from yesterday’s peak of $920 billion to $850 billion. Bitcoin’s dominance has decreased slightly from the recent highs to 68.1%.