After The Bloodbath Bitcoin Reclaims $19K: The Calm After The Storm? (Market Watch)

After charging to a new all-time high and plummeting nearly $2,000 minutes later, Bitcoin has calmed around $19,000. Most alternative coins followed BTC’s extreme volatility. Ethereum jumped to a new yearly high following the ETH 2.0 launch and dived below $600.

Bitcoin’s Wild 24 Hours

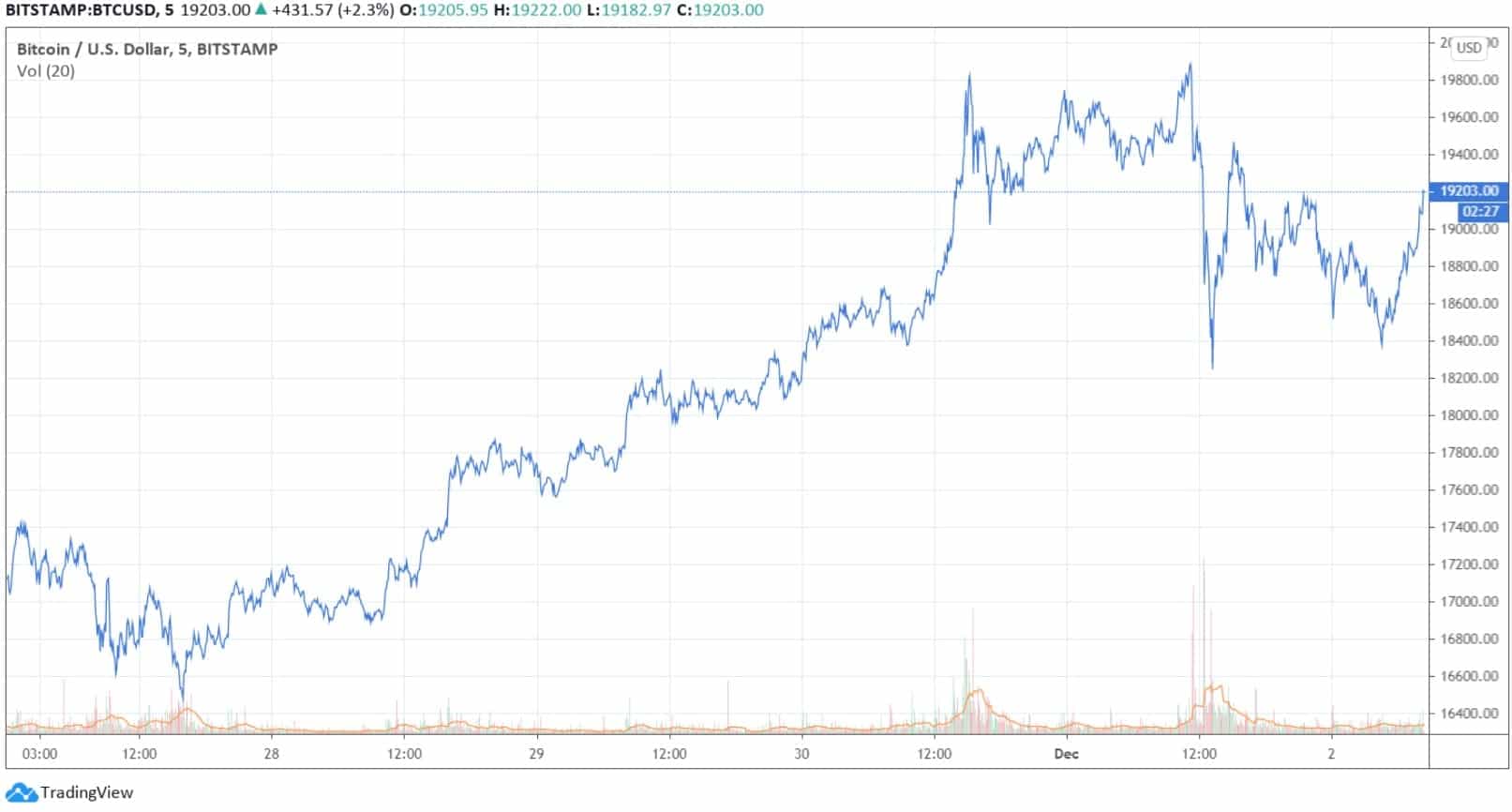

It took a few days, but BTC recovered all of its losses from the Thanksgiving massacre last week. The primary cryptocurrency was gradually increasing before it skyrocketed to a new all-time high on some exchanges.

Following a sharp retrace, BTC neared $20,000 once again yesterday. This time, the rejection was even more vigorous. In a matter of minutes, Bitcoin lost nearly $2,000 of value and bottomed at $18,100.

The volatility continued, and the bulls quickly drove the asset to $19,450 shortly after before dropping beneath $19,000 once more. The cryptocurrency has calmed a bit since then and still struggles beneath the $19,000 price level.

Altcoins Covered In Red

The alternative coins also recovered most of its losses from last week. Ethereum was among the best large-cap performers. ETH dipped to $485 but skyrocketed in the following days.

As anticipation built up for the release of ETH 2.0 yesterday, the second-largest digital asset by market cap surged to a new yearly high of almost $640. However, Ether mimicked BTC’s fluctuations and plummeted in minutes to $570.

As of writing these lines, ETH has recovered to some extent but the asset still trades beneath $600.

Most alternative coins endured similar price developments. On a 24-hour scale, though, red dominates the market.

Ripple (-6.5%), Bitcoin Cash (-7%), Binance Coin (-5%), Chainlink (-7%), Polkadot (-5%), and Cardano (-7%) are all down.

Further losses are evident from Horizen (12%), HedgeTrade (-10%), Terra (-10%), Ethereum Classic (-8%), NXM (-8%), and TRON (-7%).

In contrast, several tokens, primary DeFi coins, have marked serious gains. SushiSwap leads with a 21% surge taking SUSHI to $2.20. THORChain (11%), Aave (8%), Synthetix (8%), and Yearn.Finance (6%) follow.

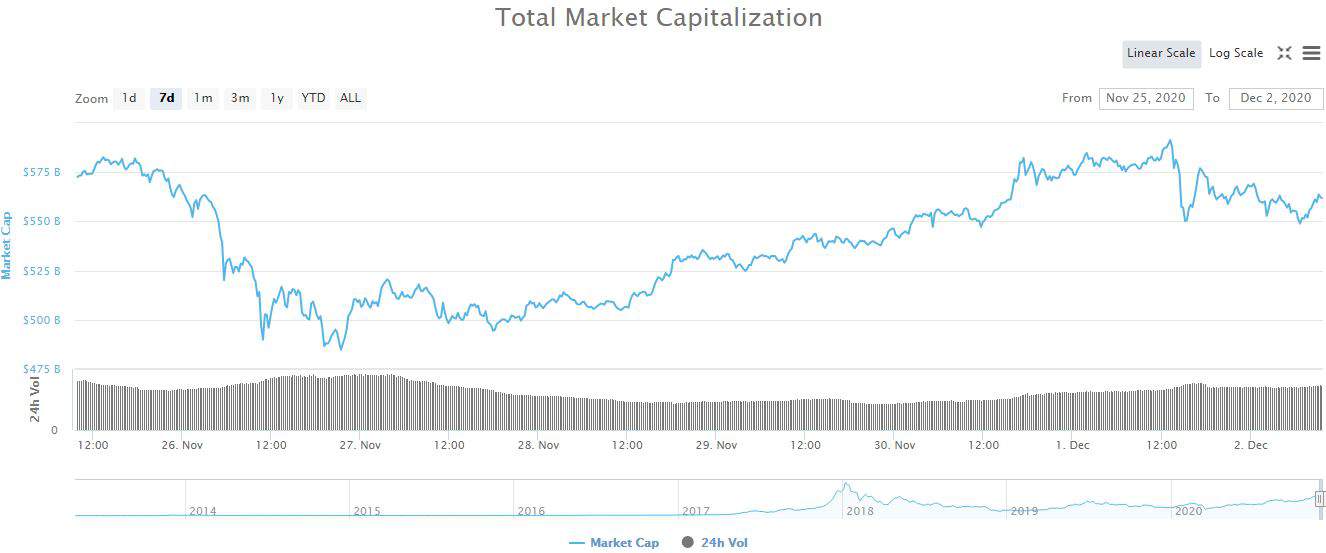

Ultimately, though, the cumulative market capitalization of all cryptocurrency assets nosedived from $591 billion to $551 billion in a day.