After Losing 20% Weekly, ETH Might Plunge Even Lower (Ethereum Price Analysis)

Following a drop to a 3.5-week lohasETH had seen a slight recovery in today’s market action as the price is struggling to maintain above Now of now, all eyes are on the support, which lies on yesterday’s low at $1500, where lies the 50-day moving average line.

Technical Analysis

By: Grizzly

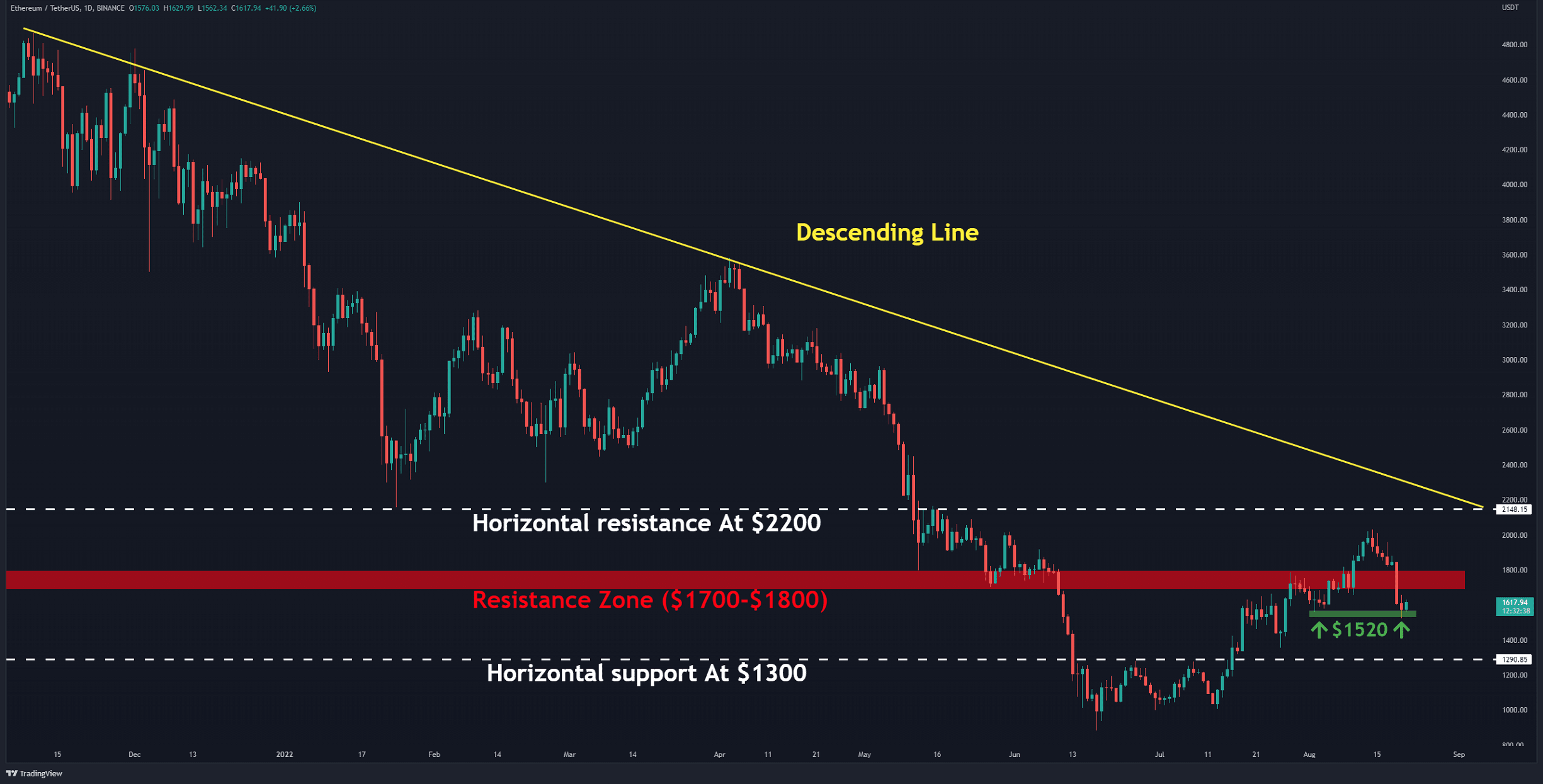

The Daily Chart

The ETH/USDT trading pair could not avoid the recent crypto correction, which triggered a rapid downward move from around $2,000, which was recorded just a week ago.

Ethereum is in a position for further gains so long as the bulls don’t allow prices to slip below the mentioned key support. Therefore,

From the bullish side, if ETH maintains this level, ETH’s further targets lie around the horizontal resistance at $2,200, which intersects with the resistance of the descending line (in yellow).

Conversely, a drop below $1500 will likely cause ETH to retest lower targets, such as $1,300. This will also mean a higher low for ETH, which is textbook bearish.

Key Support Levels: $1500 & $1300

Key Resistance Levels: $1700 & $2000

Daily Moving Averages:

MA20: $1767

MA50: $1539

MA100: $1557

MA200: $2225

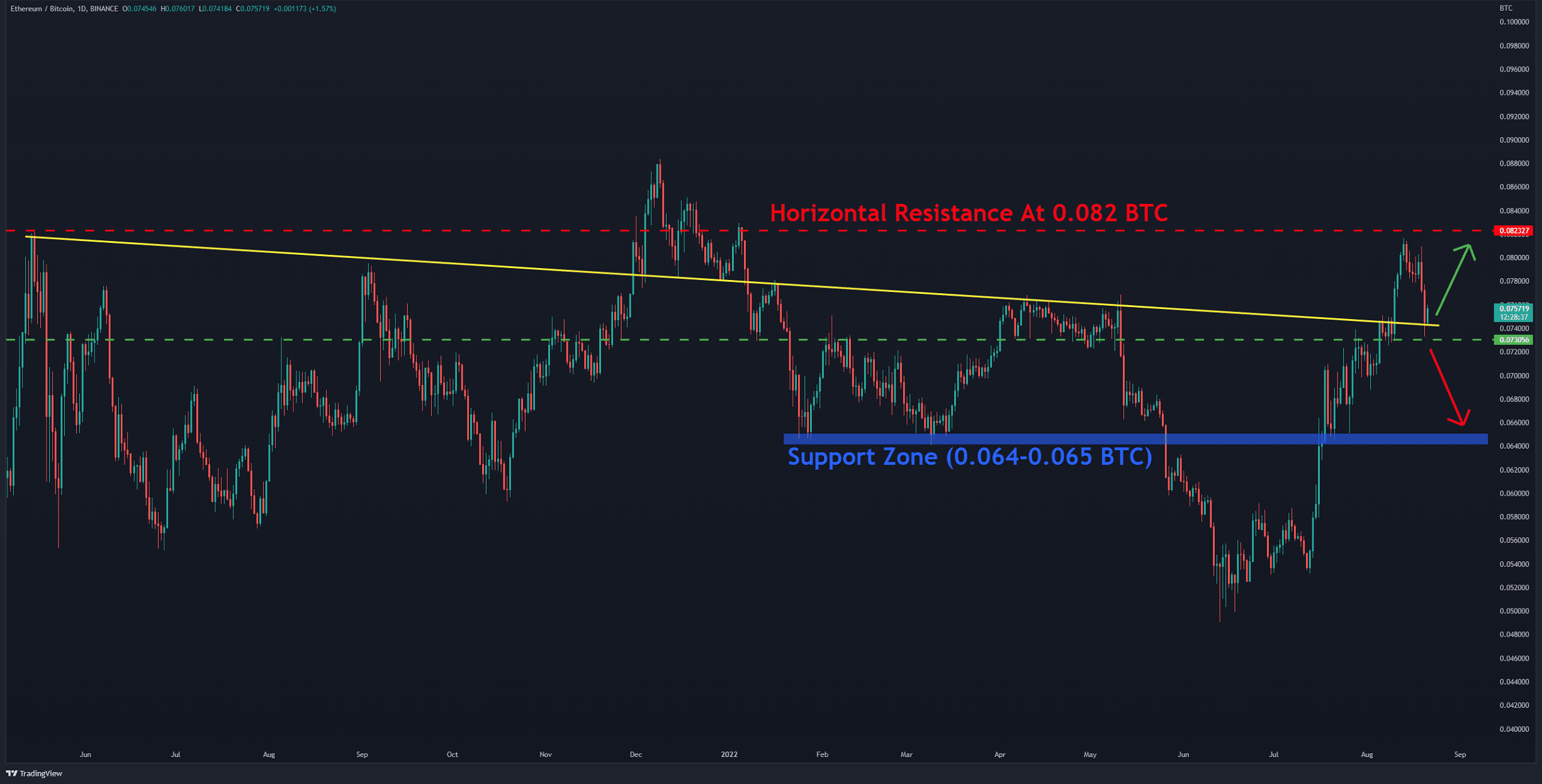

The ETH/BTC Chart

Against Bitcoin, ETH is experiencing a pullback to the descending line (in yellow). This line overlaps with the horizontal resistance at 0.073 BTC (in green). A break and close below this zone can signal further downside action, with a possible target around 0.065 BTC (in blue).

However, if we speculate that the bulls overpower the bears in this area, the overhead resistance at 0.082 BTC (in red) is expected to be retested.

Key Support Levels: 0.0.073 & 0.065 BTC

Key Resistance Levels: 0.082 & 0.088 BTC

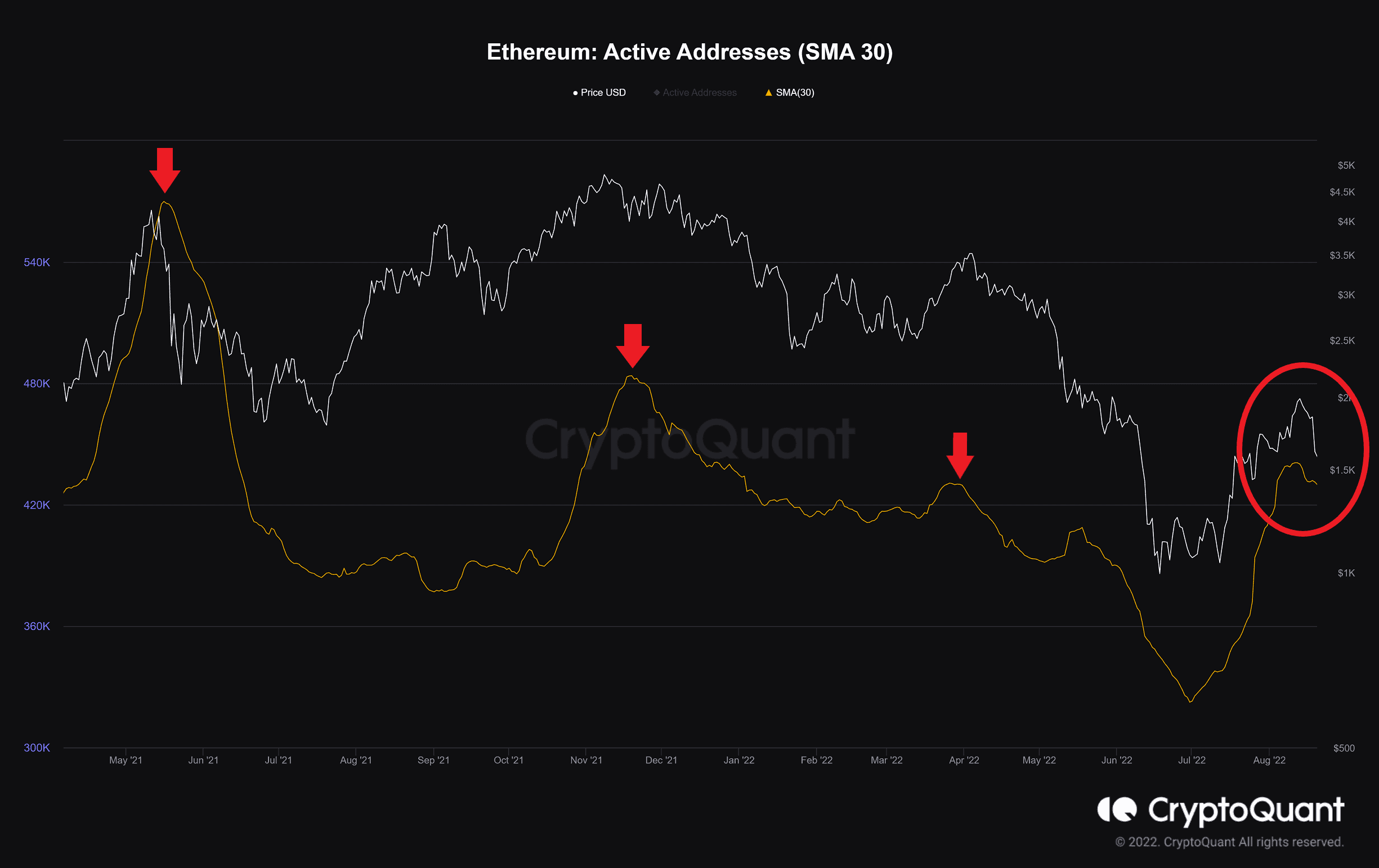

Sentiment On-Chain Analysis

Active Addresses (SMA 30): The total number of unique active addresses, including senders and receivers.

Bullish trends are often accompanied by increased on-chain activity, suggesting a healthy pattern. In the last three months, the number of active addresses increased sharply, but this growth slowed when the price reached technical resistance.

Considering the historical data as follows, if this decline in this particular metric continues, there is a possibility of touching lower levels in the price chart.

The post After Losing 20% Weekly, ETH Might Plunge Even Lower (Ethereum Price Analysis) appeared first on CryptoPotato.