After 2021, The Fed’s “Price Stability” Mandate No Longer Applies

Bitcoin is the answer to what was actually a deceptive claim of price stability, as no such thing exists in a fiat monetary system.

“But he hasn’t got anything on,” a little child said. – Hans Christian Andersen, The Emperor’s New Clothes

The 21st year of the 21st century was the moment when central bankers’ masks came off and the ugly truth was revealed: there is no master plan, no expert guidance behind the fiat monetary policy. The only ambition is to kick the can down the road for at least a couple of more years.

Monetary policy of perpetual inflation acts as an inadvertent marketing for Bitcoin, as more and more people look for a lifeboat for their purchasing power.

Inflation: Not So Transitory Anymore

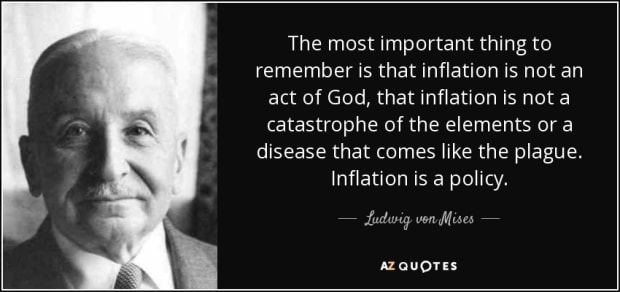

Central bankers around the world, fearful of the “deflationary spiral” as they are, have been trying to incite inflation for more than a decade, ever since the Great Recession of 2008. Finally they have succeeded. And make no mistake — the inflation rates we are seeing right now are the direct result of money printing. As Ludwig von Mises pointed out already in a 1959 lecture published in 1979, inflation is a policy, not an accident:

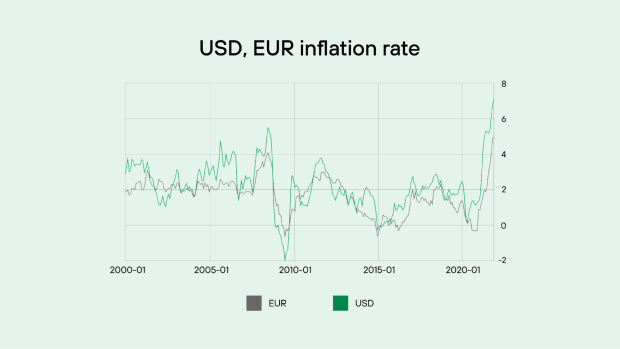

Inflation, once unleashed, is a beast that can quickly get out of control. Even the central bankers seem a bit perplexed with how quickly inflation ran up. In Q1, 2021, the consensus among “professional forecasters” surveyed by the Philadelphia branch of the Federal Reserve predicted an inflation rate of 2.2% for the end of 2021. The reality? Almost 7% for the last quarter of the year. The European Central Bank (ECB) was similarly off the mark: the predictions ranged from 0.9-2.3%, while the actual inflation climbed up to 5% by the end of the year.

Following this embarrassing show of incompetency, the Fed finally retired the word “transitory” when addressing the inflation rate, and the ECB almost doubled its 2022 inflation forecast.

The Mandate Has Changed

“The monetary policy goals of the Federal Reserve are to foster economic conditions that achieve both stable prices and maximum sustainable employment.” – Fed

“The primary objective of the ECB’s monetary policy is to maintain price stability.” – ECB

The principal mandate of central banks has for decades been to “maintain price stability,” which usually meant keeping an inflation rate at around 2% annually. The Fed always had a “dual mandate” of price stability and maximum employment. Both the Fed and ECB seem to have unilaterally changed their mandates over the course of the past two years.

In summer 2020, the Fed redefined its inflation target as follows: “The Federal Reserve now intends to implement a strategy called flexible average inflation targeting (FAIT). Under this new strategy, the Federal Reserve will seek inflation that averages 2% over a time frame that is not formally defined.”

This means that the current inflation rate of 7% is well in line with the mandate, since there is no clear definition over what time period the inflation should average to 2%.

The ECB hasn’t changed the definition of their mandate, rather they chose to ignore it altogether. When addressing inflation, they simply “expect it to fall over the medium term.” But the ECB isn’t doing much to combat the inflation and instead keeps interest rates below zero percent, which of course leads to more money being injected into the economy, with rising inflation as the result.

Now the real question is, why are they doing this? Why do central banks just ignore decades-old mandates of keeping inflation low and not do everything to stop it from climbing even higher?

Because this emperor has always been naked; the price stability mandate is a lie. Debt serviceability and stock market performance were always the real captains of this ship. The low rate of consumer goods inflation has been a result of strong growth deflation, with technological developments driving costs down due to increases in productivity. Alas, the growth deflation effect may be depleted for the time being, with onerous regulations, trade barriers and ubiquitous capital misallocation among the main culprits. And when the technology-induced deflation is stripped away, all that remains is the ugly face of the Cantillon effect. The monetary policy is there to serve the state and the financial sector, savers be damned.

Any significant interest rate hikes that could slow down inflation would simply nuke stocks and make debtors insolvent, with governments among the first to fall. The US has a public debt-to-GDP ratio of 120% (debt levels unseen since World War II), while some European countries have debts of 150% (Italy) or even 200% (Greece).

Inflation is thus a conscious policy, preferred by the powers that be over a deflationary crash and widespread bankruptcies. Instead of outright crash and insolvency, the monetary policy aims for a soft default through currency debasement, meaning that it is the savers, the fixed-wage earners and pensioners who are getting wiped out.

Bitcoin, The Conservative Lifeboat

Bitcoin serves as a monetary lifeboat for people forced to transact and save in monetary media constantly debased by governments. – Saifedean Ammous, The Bitcoin Standard

Since it doesn’t look like central banks will save us from inflation any time soon (since they’re the very source of it), we need to look for solutions outside of official policy. The undoing of the effects of fiat monetary policy may be hard on the societal level, but it’s quite simple on the individual level. Bitcoin is accessible to everyone, 24/7, without any permission required — if you do your homework and steer clear of the KYC traps.

Bitcoin is sometimes described as an investment or a speculation, but it mostly resembles savings. Bitcoin has all the characteristics of sound money and can be securely held by an individual, thus eliminating counterparty risks and risks of dilution caused by changes in monetary policy.

When combined with the understanding that the road to hyperbitcoinization is bumpy and bear markets are a natural occurrence, bitcoin can actually be understood as the conservative choice in today’s world.

2022: More Of The Same

It’s hard to take the Fed’s recent hawkish pivot seriously. They may raise rates a little bit only to throw their hands in the air a few months later and proclaim “See? We tried, but the economy was going to crash!”

What will happen instead is more of the same. As Greg Foss brilliantly put it, you can’t taper a ponzi.

Bitcoin remains the only viable lifeboat for most people. But can Bitcoin accommodate everyone that needs it, right now in 2022? And most importantly, can billions of people own their bitcoin without reliance on trusted third parties? In the pre-Lightning era, this would have been impossible. Since Bitcoin on the base layer can process around 300,000 transactions daily, it would take almost 10 years to create a single UTXO for each of the first billion people alone. The Lightning Network and Taproot (which opens up doors to stuff like Eltoo, a much-improved Lightning Network protocol) bring the vision of a billion sovereign Bitcoiners much closer to reality.

2022 will probably not be a revolutionary year. Instead, the fiat monetary regime will keep on deteriorating, while Bitcoin will keep on improving. And the world will gradually learn to despise the former and appreciate the latter.

This is a guest post by Josef Tětek. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.