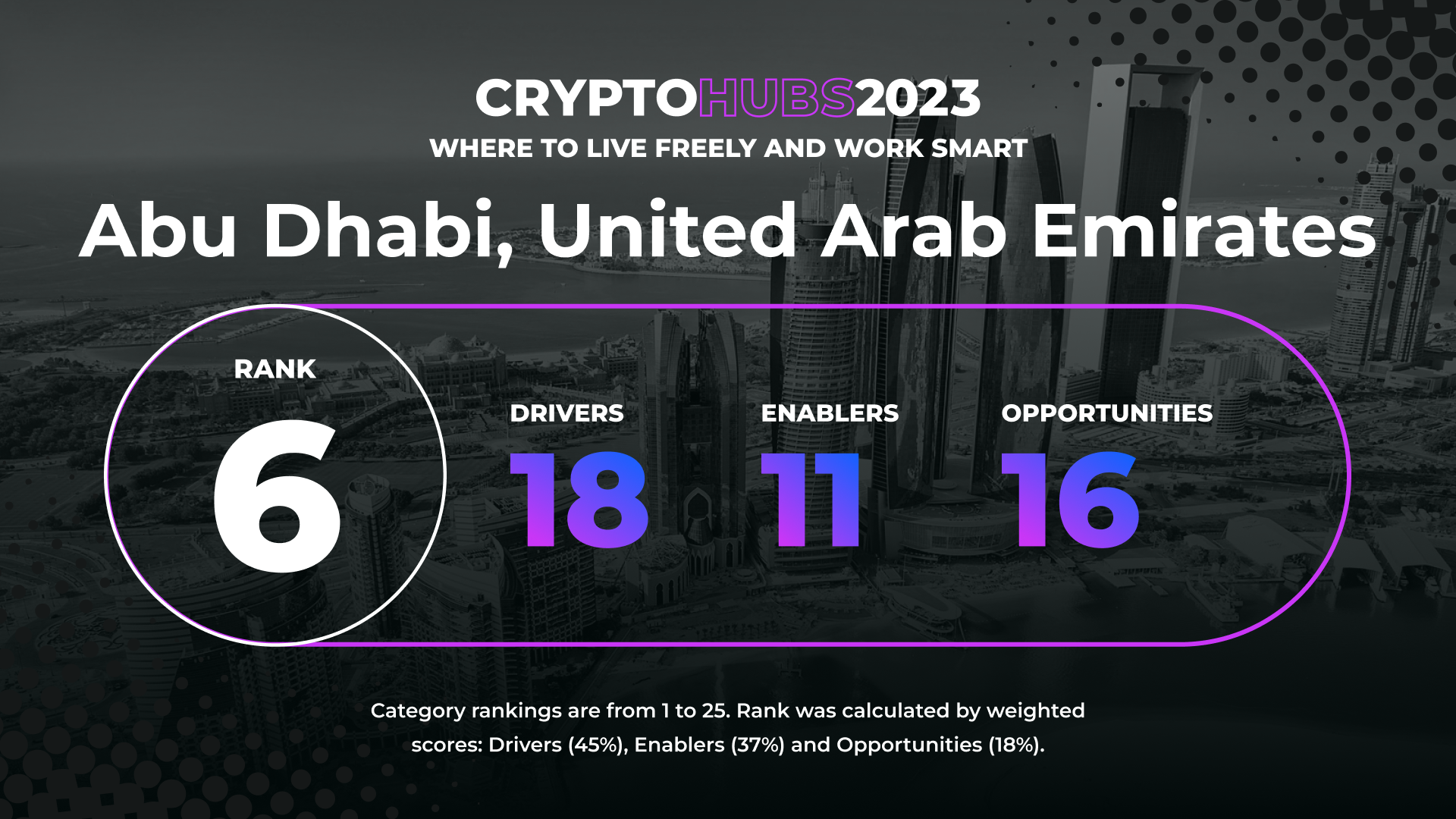

Abu Dhabi: A Wealthy Middle-East Capital Creating a Bridge From TradFi to Crypto

The United Arab Emirates’ hubs of Abu Dhabi and Dubai had identical scores for crypto regulatory structure and crypto adoption, two of the most heavily weighted criteria in the ranking overall. But while the UAE’s regulatory structure is top tier – and accounts for 35% of its total score – its crypto adoption score (measuring 10%) was in the bottom quintile. Arguably, the low score is a reflection of the greater Emirati population, rather than the behavior of the residents of Abu Dhabi and Dubai themselves. In nearly every other criteria we measured, the capital of the UAE trailed Dubai by a hair, including quality of life, ease of doing business and digital infrastructure (all criteria in the enablers category) and per-capita crypto jobs, companies and events (which comprise the opportunities category).

Abu Dhabi is the capital of the United Arab Emirates (UAE) and the quieter counterparty to the flare and bustle of Dubai. While Dubai is widely recognized as a crypto hub, Abu Dhabi remains under the radar.

“Abu Dhabi’s always been a bit more of an institutional-focused market, whereas Dubai has been more of a consumer-focused market,” said Basil Al Askari, co-founder and CEO of MidChains, an Abu Dhabi-based digital-asset trading exchange and custodian for global institutions. Therefore, if you’re looking for a crypto hub where blue-chip bank executives shake hands with players in the digital asset space, Abu Dhabi is the place for you.

The capital city’s financial services industry is centered in Abu Dhabi Global Markets (ADGM), an offshore, economic free zone with an agenda and regulatory framework that can be valuable to those looking to bridge the gap between institutions and crypto.

Read Crypto Hubs 2023: Where to Live Freely and Work Smart

ADGM aims to foster four areas of focus within finance, one being fintech. As a result, blockchain and cryptocurrencies are integrated into the ecosystem’s regulation.

“What Abu Dhabi is great at is creating clarity around digital assets for more institutional-type financial systems like prime brokerages, lending, asset management, etc.,” Pascal St-Jean, president of Canadian digital-asset manager 3iQ, told CoinDesk. 3iQ has recently been licensed in the ADGM.

Additionally, the economic sandbox fosters open dialogue between those in the fintech/crypto industries and the free zone’s authorities. Al Askari recounted approaching ADGM on behalf of MidChains in 2018 before there was an established regulatory framework for crypto: “We pitched our idea and said, well, can you regulate us, and initially thought within 10 minutes of the meeting they were gonna kick us out […] But to our surprise, it was a really productive meeting and they invited us to give commentary on the draft guidance, which eventually did come out later that year.”

Proximity to the sovereign wealth fund

Along with licenses and clear regulation, the inclusion of digital assets in the ADGM’s growth ambitions has led to substantial investment, making it a hotspot for entrepreneurs seeking to raise capital in the region. ADGM is a backer of Hub 71, a physical center on Abu Dhabi’s Al Maryah Island that houses tech startups, investors and incentive programs to boost innovation. Earlier this year, the Hub 71+ Digital Assets initiative was announced, where a $2 billion fund will be dedicated to supporting Web3 projects. Abu Dhabi is also the home of Mubadala Investment Company, the country’s sovereign wealth fund.

Venom Blockchain Foundation, a layer 0 blockchain project focused on empowering Web 3 developers in the Middle East and North Africa region became the first protocol to be fully licensed by ADGM in July of 2022, highlighting the free zone’s commitment to harboring innovation in the digital economy.

Abu Dhabi has not been immune to the effects of the crypto winter, however. In February, crypto exchange Kraken announced it was pulling up stakes less than one year after receiving a license to open in Abu Dhabi. But new entrants in Abu Dhabi like 3iQ are finding community alongside familiar brands, St-Jean told CoinDesk, as some of the industry’s biggest players like Coinbase are reportedly engaging with the ADGM to make a regional base in the capital city.

“The next five years are going to be explosive” for crypto in Abu Dhabi, St-Jean declared.

Edited by Jeanhee Kim and Daniel Kuhn.