Above $9.3K: Bitcoin’s Price Prints 13-Month High

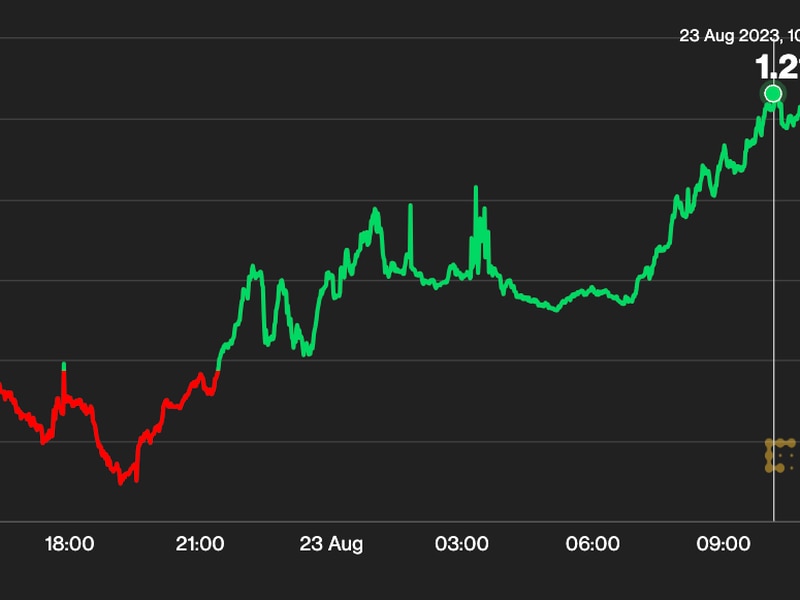

The price of bitcoin (BTC) hit a 13-month high above $9,300 on Sunday.

The leading cryptocurrency by market capitalization rose to $9,381 at 05:55 UTC – the highest price since May 10, 2018, according to CoinDesk’s Bitcoin Price Index.

BTC was last seen trading at $9,250 representing 6.4 percent gains on the day. On a month-to-date basis, the cryptocurrency is up 8 percent.

More than $19 billion worth of bitcoin has been traded across cryptocurrency exchanges in the last 24 hours, according to Messari data. Meanwhile, major exchanges included in the calculation of Bitwise’s “real” bitcoin trading volume are currently reporting the 24-hour volume figure at $867,697,751.

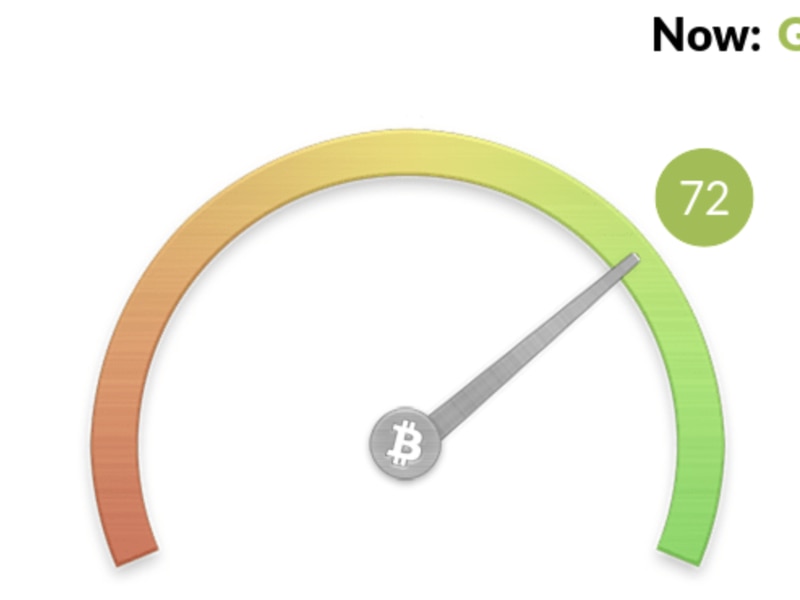

With the price rise, Bitcoin’s dominance rate, or its share of the total cryptocurrency market, has ticked higher to 57.1 percent from lows near 55 percent see on Friday.

The bitcoin price rally is boding well for the broader market. At press time, litecoin is up 2.3 percent on a 24-hour basis. Names like ethereum’s ether token, XRP and bitcoin cash are up 4 percent, according to CoinMarketCap.

Meanwhile, EOS is the best performing top 10 cryptocurrency of the past 24 hours with 7 .4 percent gains.

However, on a seven-day basis, litecoin is leading the top 10 cryptocurrencies with 18.29 percent gains followed by bitcoin, which has appreciated by 17.20 percent.

Looking forward, BTC may rise further toward the next major resistance at $10,000, as long-term technical studies are biased bullish. For instance, bitcoin’s 50- and 100-candle moving averages on the three-day chart look set to produce a bullish crossover – a sign of bull market momentum. Back in October 2015, the same cross marked the start of a long-term bull market.

Disclosure: The author holds no cryptocurrency assets at the time of writing.

Bitcoin image via CoinDesk archives; charts by Trading View