Above $300: Ether Price Clocks 10-Month High

The price of ethereum’s native cryptocurrency ether (ETH) surpassed $300 today to hit ten-month highs.

The world’s second largest cryptocurrency by market capitalization climbed above the psychological hurdle at 01:10 UTC and extended gains further to $306 – a level last seen on August 19, 2018.

As of writing, ETH is changing hands at $304, representing 9.7 percent gains on a 24-hour basis and 129 percent gains on a year-to-date basis, according to data source CoinMarketCap.

Ether has more than doubled this year with the price currently reporting more than 260 percent gains on the low of $82.00 seen in December. The price, however, is still down 78 percent from the record high of $1,431 registered in January 2018.

Further, the cryptocurrency has retraced meager 16 percent of the sell-off from $1,431 to $82. On the other hand, BTC has retraced more than 40 percent of the bear market slide and is currently trading at a 15-month high of $10,800.

Looking forward, ether looks set to extend the ongoing rally, as technical charts are biased bullish.

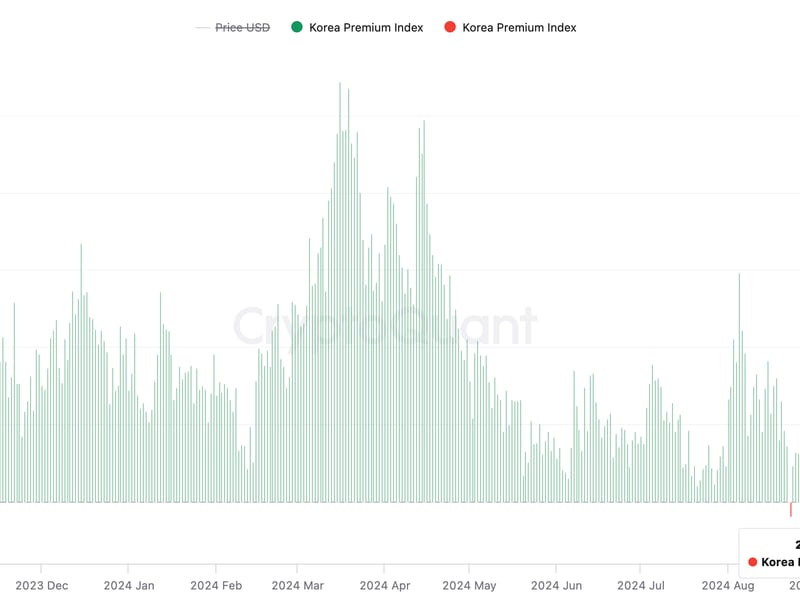

3-day chart

The 50- and 100-candle price averages on the three-day chart have produced a bullish crossover for the first time since in two years. It is worth noting that prices had rallied by more than 900 percent in three months following the confirmation of the bull cross in May 2017.

So, if history is a guide, then the cryptocurrency looks set to challenge the April 2018 low of $364 in the next couple of months. A break higher would expose resistance at $401 – 23.6 percent Fibonacci retracement of the bear market drop.

Supporting the bullish case is the solid rise in ether’s non-price or on-chain metrics in the last few months. For instance, ETH volumes on decentralized applications (DApps) registered record highs in April, according to crypto analytics firm Diar.

Meanwhile, network activity, as represented by daily gas usage, rose to lifetime highs in May. Gas is the fuel of the ethereum blockchain. The token is required to conduct a transaction on etherum’s network.

Disclosure: The author holds no cryptocurrency at the time of writing

Ether via Shutterstock; charts by TradingView