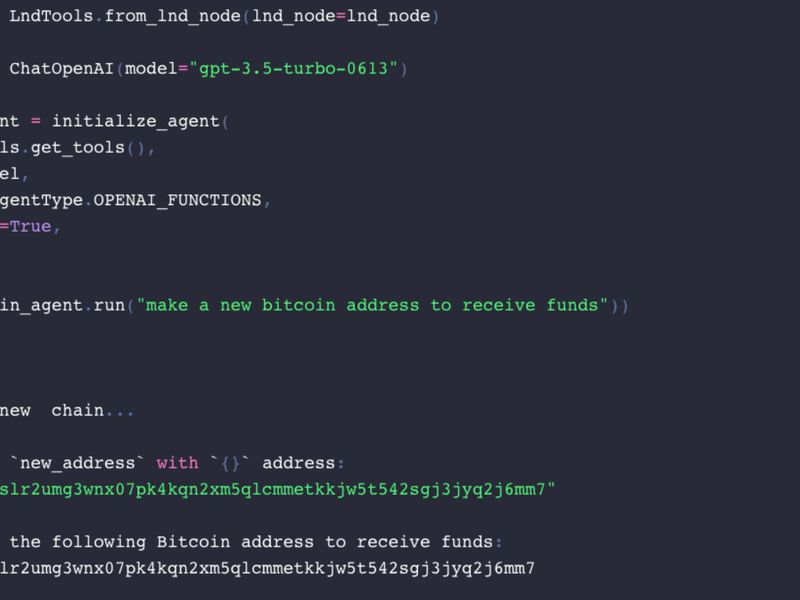

A Year After Bottoming Out at $3,100, Bitcoin is Up 127%

Bitcoin is currently reporting triple-digit gains since the 2018 bear market bottomed out exactly a year ago.

The largest cryptocurrency by market value is currently priced around $7,050, representing a 127 percent rise from the low of $3,122 registered in Dec. 15, 2018, according to CoinDesk’s Bitcoin Price Index.

Back then, while the selling ran out of steam near $3,100 in mid-December, buyers remained on the fence for at least 3.5 months, leaving bitcoin in the range of $3,300–$4,200, as seen below.

The narrative that bitcoin was repeating history by bottoming out almost 1.5 years ahead of the next mining reward halving started doing the rounds during that consolidation period. Bitcoin is set to undergo the scheduled halving in May 2020, following which the reward per block mined on the blockchain will drop from the current 12.5 BTC to 6.25 BTC.

The previous bear market ended at lows near $150 in January 2015, 18 months ahead of the supply-cutting event in July 2016.

The three-month consolidation period was breached to the higher side with a high-volume move from $4,130 to $5,100 on April 2 and the expectations for a pre-halving rally strengthened with the bullish breakout.

By the end of May, though, bitcoin was looking overbought at highs near $9,000. The resulting pullback to $7,500, however, was short-lived, as prices surged to $13,880 in the 16 days to June 26. The near 90-degree rally occurred as the bitcoin market was pushed into a state of frenzy by Facebook’s announcement of its proposed cryptocurrency Libra.

The Libra rally ran out of steam in early July after regulators across the globe voiced concerns regarding Facebook’s cryptocurrency project. Notably, President Donald Trump called for banking regulations for Libra.

As a result, many in the investor community began worrying that Facebook’s Libra project will end up fast-tracking regulations for the crypto market. That shift in the sentiment likely weighed over bitcoin’s price.

Bitcoin fell nearly 23 percent in the third quarter and has shed 15 percent so far in the October-December period.

The cryptocurrency declined to $7,300 on Oct. 23, erasing the entire Libra rally from $7,500 to $13,880.

Prices jumped from $7,300 to $10,350 in the two days to Oct. 26, reportedly due to Chinese President Xi’s encouraging comments on the blockchain. The move, however, failed to attract sustained buying and prices fell back to $6,515 on Nov. 25.

The decline was also possibly influenced by miners selling off their bitcoin, as noted by prominent analyst Willy Woo.

Historically, bitcoin has put on a good show in the six months ahead of the reward halving.

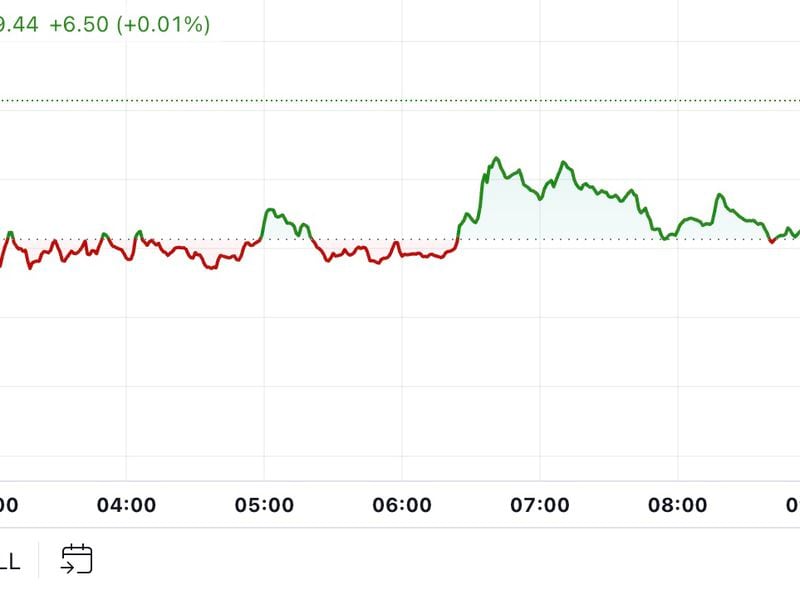

This time, however, the pre-halving period has begun on a negative note with the cryptocurrency falling by 17.5 percent in November. At press time, bitcoin is reporting a 6.5 percent month-to-date loss.

The analyst community is divided on whether the impending

supply cut is priced in or not.

Charles Hwang, managing member of the hedge fund Lightning Capital and an adjunct professor at Baruch College, expects the reward halving to power bitcoin to new highs above $20,000.

Meanwhile, pseudonymous trader Plan B has predicted a bitcoin price of almost $60,000 after the next halving.

However, Jason Williams, co-founder at digital asset fund Morgan Creek Digital, believes the halving will be a non-event for the markets. Mining giant Bitmain’s CEO Jihan Wu is also “pessimistic” about the prospect of a price surge after the halving.

The technical outlook is currently bearish with the cryptocurrency

trapped in a falling channel, as seen below.

A convincing move above the upper edge of the falling channel, currently at $8,500, is needed to confirm a bullish breakout. That would imply a resumption of the rally from lows near $4,100 seen on April 2.

The narrative of the pre-halving rally would gain credence if the breakout happens in the next few weeks.

Currently, the prospects look bleak for such a move. The 50- and 100-week averages produced a bullish cross last week, but that’s failed to attract buyers – a sign of bearish market sentiment.

Bitcoin is looking heavy, having closed (UTC) below key support at $7,087 on Saturday.

The MACD histogram is about to cross below zero in favor of the bears, while the 14-day relative strength index (RSI) is reporting bearish conditions, too, with a below-50 reading.

Bitcoin fell 2 percent in the three days to Dec. 14, validating a bearish “outside bar” candlestick pattern created in the preceding three days.

All in all, bitcoin risks revisiting recent lows near

$6,500.

A high-volume break above $7,870 (Nov. 29 high) is needed to invalidate the lower-highs setup on the daily and three-day charts and confirm a short-term bullish reversal.

Disclaimer Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

This article is intended as a news item to inform our readers of various events and developments that affect, or that might in the future affect, the value of the cryptocurrency described above. The information contained herein is not intended to provide, and it does not provide, sufficient information to form the basis for an investment decision, and you should not rely on this information for that purpose. The information presented herein is accurate only as of its date, and it was not prepared by a research analyst or other investment professional. You should seek additional information regarding the merits and risks of investing in any cryptocurrency before deciding to purchase or sell any such instruments.