A Wild Month for Treasuries Is Slow Going for Crypto: Crypto Long & Short

Welcome to the summer market lull.

Like the doldrums that wrap around the equator, late summer markets tend to be a quiet period partitioning the fresh optimism of a new year from the looming deadlines and targets brought forth by the passing of another calendar year.

And, similar to sailors in the doldrums (or intertropical convergence zone for all the atmospheric weather buffs reading), these periods of calm have a tendency to gnaw away at impatient traders trying to play catch-up from gains missed earlier in the year.

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

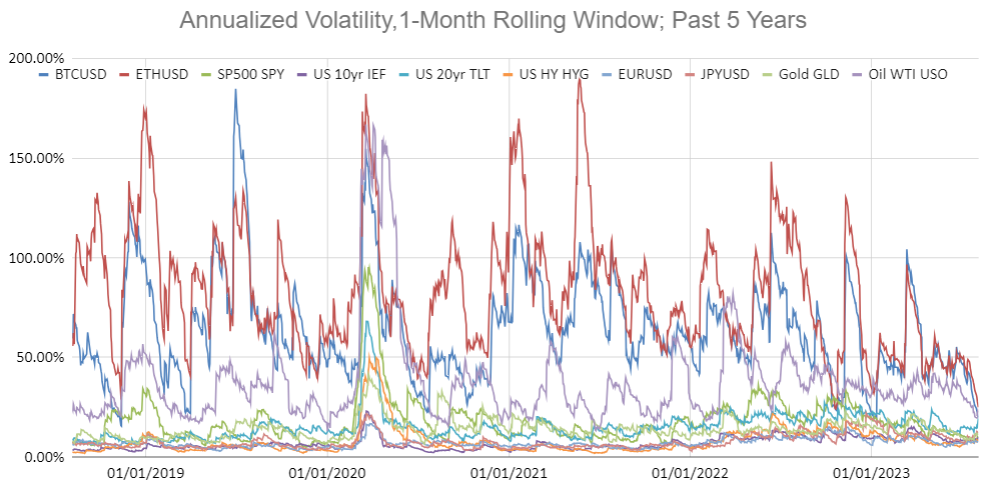

Over the past month of super-low market volatility, the U.S. equity market has been slowly moving higher, while we seem to be sliding backward in the crypto market. Realized volatility across markets has ticked meaningfully lower (see Figure 1), with bitcoin (BTC) seeing annualized realized volatility of about 20%, in line with exchange-traded funds tracking 20-year Treasuries (which counts as a wild period for U.S. debt!) and West Texas Intermediate crude oil. Ether’s (ETH) realized volume is at about 25%, similar to the equity volatility last year.

Figure 1: Rolling 22-day realized volatility; Source: CoinDesk Indices (CDI), Yahoo Finance

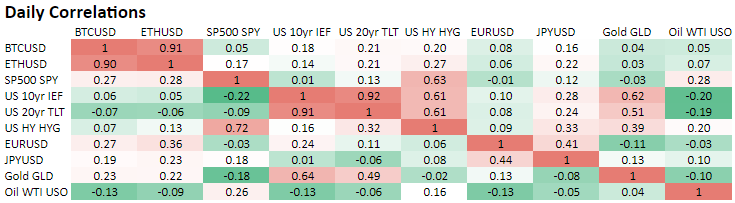

Checking in on correlations across digital assets and traditional markets (see Figure 2 below), we can see that over the past three months (upper right-hand side triangle of the matrix) BTC and ETH have generally decorrelated from equities, foreign exchange and commodities, when compared with the February-to-April period (lower left-hand side of matrix). The strongest correlation to traditional finance is now to fixed-income markets. As mentioned in previous “Crypto Long & Short” newsletters, it’s generally a good sign when digital assets move to the beat of their own drum, although at the moment the market pulse appears to be faint.

Figure 2: Upper right triangle: May 1 – Aug. 4; lower left triangle: Feb. 1 – April 30; Source: CDI Research, Yahoo! Finance

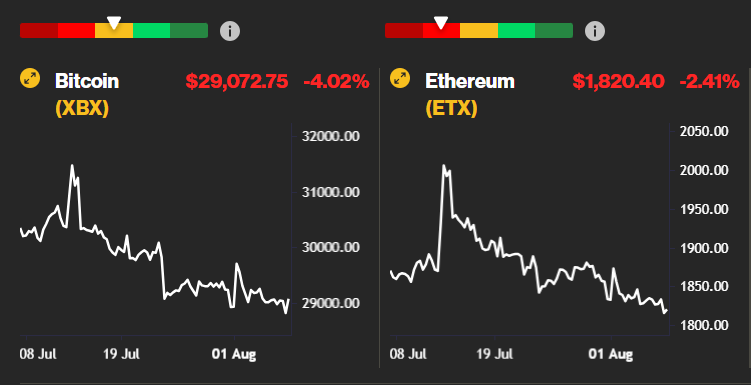

Even the CoinDesk Bitcoin and Ether Trend indicators, the telltales of trending market conditions, are now at neutral and slightly negative trend values respectively (see Figure 3 below) as we wait for the financial market winds to pick back up.

Figure 3: CoinDesk Trend Indicators, Aug. 7, 2023. Source: coindeskmarkets.com

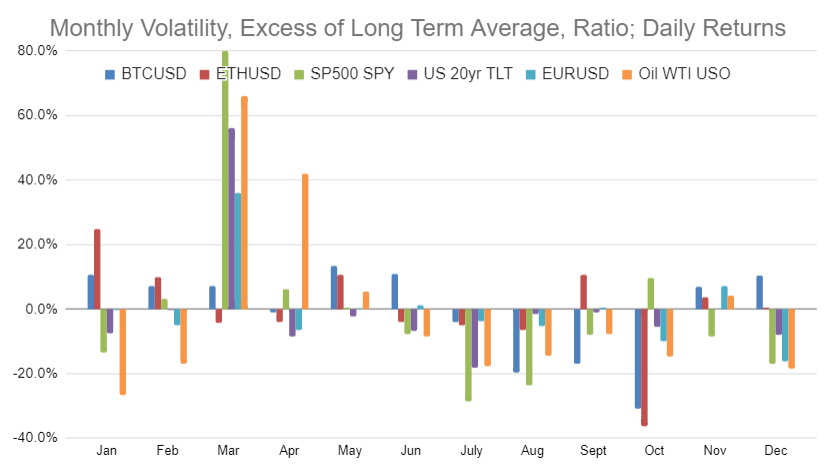

From an analysis of daily returns across asset classes, and comparing volatility of each month versus a five-year average volatility of the same period, we can confirm that both July and August have been particularly benign months for financial markets over the past five years (see Figure 4 below). We can also see that both BTC and ETH have different and distinct monthly seasonality volatility patterns from equity and fixed-income markets, as indicated by S&P 500 and U.S. Treasuries ETFs, although July and August lulls are shared across markets.

Figure 4: Monthly vs. past five-year average volatility, daily returns; Source: CDI

What drives the market calm during the later months of summer? While there is no definitive answer, there are a number of reasons why financial markets are often less volatile during August:

-

Summer Holidays: Many traders and investors take vacations during August, leading to reduced trading activity, which can result in decreased volatility. (And an increase in guest authorship of market newsletters. Enjoy the time off, Glenn Williams Jr.!)

-

Earnings Season Pause: The majority of companies have already reported their quarterly earnings by August, leading to a temporary lull in major market-moving news and announcements. For that reason, deals, announcements and headlines get pushed into a busier September.

-

Lower Trading Volumes: With fewer participants actively trading, there’s less liquidity in the markets, which can contribute to decreased price swings when there are few headlines or news releases to trigger market repricing events.

It’s important to note that while August typically experiences lower volatility, it’s not a hard-and-fast rule, as reduced trading activity and lower liquidity can magnify significant moves when they do occur. This seasonal illiquidity doesn’t afford market participants much in the way of market depth that can absorb news shocks or reprice major events. And in the rare event they do occur during the illiquid summer months, they can be meaningful (see the Quant Crisis of August 2007, the U.S. credit rating downgrade in August 2011, the Chinese yuan devaluation in August 2015), keeping traders glued to their laptops and Wi-Fi or forcing them to end their vacations prematurely.

So where to from here? Will market leadership and breadth expand in digital assets beyond bitcoin and ether and in equities beyond mega-cap artificial-intelligence technology? Are the majority of the year-to-date gains a result of bearish positioning into the most anticipated and consensus recession of modern financial history? Have inflationary pressures subsided? These are only a few of the many questions to consider during this August reprieve as we wait for the winds of the market to pick back up and propel us into another eventful second half of the year.

From CoinDesk Deputy Editor-in-Chief Nick Baker, here is some news worth reading:

-

GETTING FOCUSED: As discussed last week, Michael Saylor’s MicroStrategy is raising up to $750 million, probably to buy more bitcoin. So, we subsequently decided at CoinDesk to take a look at how the past year has gone since Saylor stepped down as CEO of the company to become executive chairman, leaving MicroStrategy’s original business (software) in the hands of someone else so that Saylor could just focus on laser eyes (buying BTC). He was down a billion dollars on his BTC a year ago and things got worse soon after following FTX’s collapse. But, today, MicroStrategy is nearly back in the black. Things aren’t so bleak anymore.

-

BETTER ODDS: One of the hot questions at the moment is whether a spot bitcoin ETF will get approved soon. Analysts at Bloomberg Intelligence believe the odds have gone up to about 65%. Meanwhile, the race is on to get an ether ETF listed. Crypto (Bitcoin specifically) was originally created, of course, partly in reaction to the Wall Street bailouts after the 2008 crisis. But Wall Street firms are increasingly running the narrative in crypto, and if these ETFs (from the likes of BlackRock) get approved, crypto OGs may be surprised how much money floods into the sector. Who knows how that shakes things up?

-

MORE STABLE: PayPal is a big deal in payments. Now it’s angling to be a big deal in stablecoins by issuing its own: PYUSD. Notably, PayPal reportedly put the project on hold early this year amid regulatory scrutiny. Given the pressure regulators have placed on crypto this year, does an apparent resolution signal easier days are ahead — or are upon us?

Edited by Nick Baker.