A Technical Analyst’s Take on Crypto

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

:format(jpg)/www.coindesk.com/resizer/CabGUKozR1NyiBkjN56PYzuQ3RQ=/arc-photo-coindesk/arc2-prod/public/R5JVYM4XOFBPRLGHVGCYQXUAQM.png)

Glenn C Williams Jr, CMT is a Crypto Markets Analyst with an initial background in traditional finance. His experience includes research and analysis of individual cryptocurrencies, defi protocols, and crypto-based funds.

He owns BTC, ETH, UNI, DOT, MATIC, and AVAX

:format(jpg)/www.coindesk.com/resizer/8HPMRxDsJDJuWOBfhd410sC-cXU=/arc-photo-coindesk/arc2-prod/public/TY2E5BZWNVBLRGJ7KTDL66QAEM.png)

Nick Baker is CoinDesk’s deputy editor-in-chief. He owns small amounts of BTC and ETH.

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

To some, technical analysis (TA) represents a substantive technique rooted in an asset’s price. To others, it warrants no attention at all because it’s just lines on a screen and self-fulfilling prophecies.

During my stint in traditional finance (TradFi), oftentimes the response was the latter. Fundamental analysis took precedence given all the publicly available data on revenue, debt, managerial statements, etc. The underlying assumption was that if it was good enough for Warren Buffett, then it’s good enough for you.

I’m admittedly biased in the opposite direction. I completed the Chartered Market Technician (CMT) designation in 2018, while still covering traditional equities, no less. I find it useful every day. I don’t subscribe to the “random walk” theory of prices, which states that changes in an asset’s price are completely unpredictable; data, and the charts representing it, can have predictive power.

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

TA helps me answer this key question: What if I’m completely wrong? It lets you emotionlessly (well, mostly) decide whether it’s time to exit a position, for instance. If you buy something at $10 and it sinks to $5, you might do the contrarian move and buy more. “If you like it at $10, you love it at $5.” TA can act as a reality check. “I thought the price would rise to $15. I was wrong. Time to get out.”

What is TA? I view it as a graphical representation of investor behavior, with certain patterns and indicators providing a clue about what’s coming next. It has an important place in the three-legged stool of fundamental, technical and quantitative analysis.

While fundamental data is prevalent in TradFi, it doesn’t exist to the same extent in crypto. In fact, the allure of cryptocurrencies to many is the decentralized nature of many of the assets. There is no CEO of bitcoin (BTC), nor is there a balance sheet or statement of cash flows for it. So that’s one leg of the analysis stool that’s missing; it makes sense to pay attention to the other two.

TA encompasses a wide range of topics that goes well beyond looking at lines on a chart and subjective judgments. During my time preparing for the CMT, the emphasis on using hard numbers when making a decision stood out.

-

For every head-and-shoulders pattern you’ll find a chart showing the historic correlations between one asset and another.

-

For every falling-wedge pattern there’s a calculation of an asset’s proximity to its 200-day moving average.

-

For every benchmark within TA there are ways to look back historically to see how well or poorly they’ve performed historically.

For instance, I know very quickly that BTC has breached the upper range of its Bollinger Band three times over the past 25 days. When that happened in January, 30 days later BTC was up 11%. I also know that it’s been 24 days since BTC’s volume was at least twice as high as its 20-day moving average but, despite that, volume on that day doesn’t rank within BTC’s top 50 days since 2015.

From a risk-management perspective. I often use the Average True Range (ATR) metric, to measure an asset’s volatility.

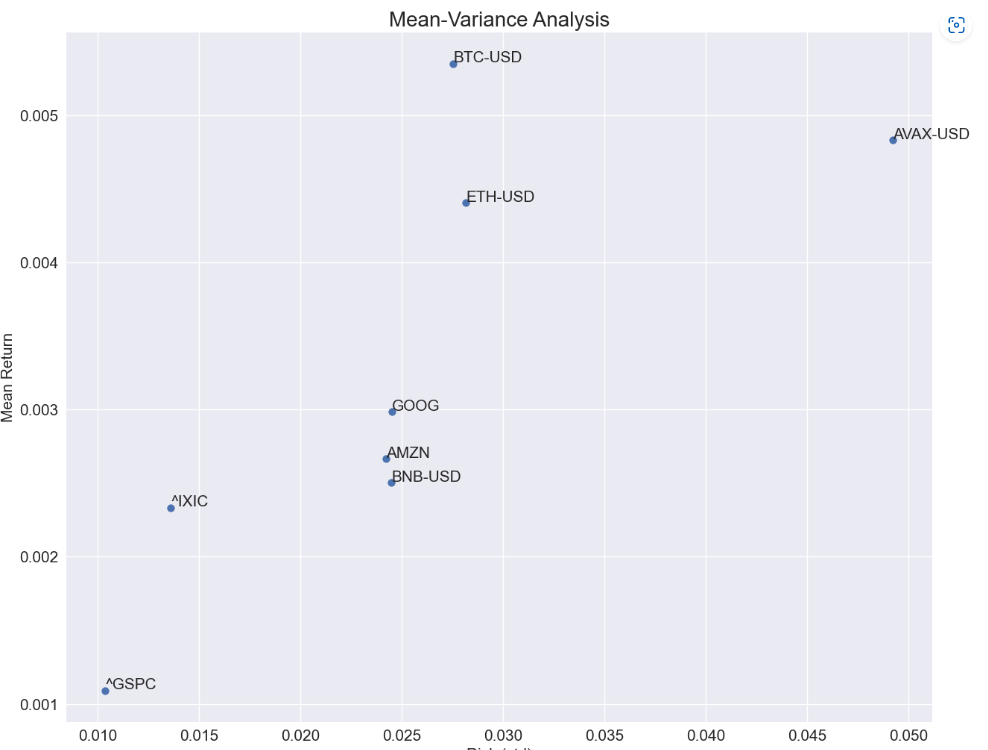

Taking things a step further, I like to look at an asset’s returns, as well as its standard deviation of returns, in comparing one asset to another – essentially distilling what’s seen on a chart into a different format.

Doing so in the following chart shows the risk versus return relationship since January for BTC, ether (ETH), Avalanche’s AVAX, and Binance’s BNB. The S&P 500 (GSPC), Nasdaq (IXIC), Google (GOOG) and Amazon (AMZN) were added as well just out of curiosity.

This chart highlights BTC’s outperformance while having a slightly lower standard deviation (risk) than ETH. Also displayed is AVAX’s high level of performance, but with significantly more risk.

This should be kept in mind when looking at other technical indicators, specifically momentum and volume. I would also be inclined to perform the same exercise over different time frames.

All told, TA represents an analysis of data, which starts with what you see specific to price. In many ways, it allows you to ignore the noise or the verbal sales pitch that may come along with an asset. That’s possibly even more important as key crypto figures run into trouble this year.

Whether you believe in technical analysis or not, it’s difficult to ignore price. And it’s even more difficult to ignore the market’s overall reaction to it. In crypto markets, that will always be worth looking at.

From CoinDesk Deputy Editor-in-Chief Nick Baker, here’s some recent news worth reading:

-

ETHEREUM UPGRADE: Yet another big, potentially market-moving Ethereum software upgrade is going live Wednesday. CoinDesk has a nice guide to what’s changing and what’s ahead for development of the blockchain.

-

WALL OF WORRY: TradFi’s collection of colorful aphorisms includes the phrase that markets “climb a wall of worry.” In other words, the thinking goes, prices often rise in the face of bad news. Cryptocurrencies – especially the biggest one, bitcoin – are exemplifying that at the moment. Bitcoin has largely gone straight up this year, nearly doubling in price since New Year’s Eve, amid wave after wave of challenges: key industry figures being accused of wrongdoing, a clear intensification of crypto regulation, etc. This week was a perfect example of that. The New York Times published an exposé arguing that miners cause a huge amount of pollution (a story critiqued by CoinDesk’s David Z. Morris). Not long after, the price of BTC spiked and surpassed $30,000 for the first time since June. So it goes.

-

THE TWINS: Tyler and Cameron Winklevoss recently loaned Gemini, their crypto platform, $100 million, Bloomberg reported this week. Part of what stands out is that’s also how much Gemini pledged to give their Earn customers whose investments were frozen when Genesis stopped withdrawals late last year. It’s not clear, however, if that pledge is what led the brothers to make the loan.

-

APPLE’S BITCOIN SECRET: A weird thing about Apple’s computer operating system was a hot topic in recent days: Satoshi Nakamoto’s 2008 Bitcoin white paper is being distributed with every Mac sold, and that’s been true for several years. Is this an Apple endorsement of the crypto revolution? Is it just a conveniently small PDF file useful for testing? It’s totally unclear.

Edited by Nick Baker.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/CabGUKozR1NyiBkjN56PYzuQ3RQ=/arc-photo-coindesk/arc2-prod/public/R5JVYM4XOFBPRLGHVGCYQXUAQM.png)

Glenn C Williams Jr, CMT is a Crypto Markets Analyst with an initial background in traditional finance. His experience includes research and analysis of individual cryptocurrencies, defi protocols, and crypto-based funds.

He owns BTC, ETH, UNI, DOT, MATIC, and AVAX

:format(jpg)/www.coindesk.com/resizer/8HPMRxDsJDJuWOBfhd410sC-cXU=/arc-photo-coindesk/arc2-prod/public/TY2E5BZWNVBLRGJ7KTDL66QAEM.png)

Nick Baker is CoinDesk’s deputy editor-in-chief. He owns small amounts of BTC and ETH.