A Mysterious Airdrop Called EIDOS Is Clogging EOS to Make a Point

EOS has been clogged up by a giant airdrop for a token called EIDOS – and it’s not clear the token is even good for anything.

In fact, it seems as though the people behind the token are trying to make a point. The token seizing up the network is called EIDOS. Its promoted by a Twitter account, @enumivo, whose website only describes the token generation, not its purpose. However, its tweets appear to express discontent with the block producers running the EOS blockchain today.

6 days into EIDOS airdrop and 20K users are joining it.

Your CPU, your freedom. You either give your EOS CPU to freeloaders or you convert your CPU to EIDOS. The choice is yours.https://t.co/Zls95jdhTR

— Enumivo (@enumivo) November 6, 2019

The smart contract for went live on Oct. 31 and is designed to encourage maximum transactions. The size doesn’t matter. This has caused EOS to go into congestion mode, which Coinbase described on its blog as limiting “the amount of transactions a user can broadcast to their pro-rata share of total staked CPU resources on the EOS network.”

In other words, EOS usually provides a little give when it has excess capacity (and it usually does), but that’s all been maxed out due to the demand spurred by the EIDOS smart contract.

CoinDesk has previously reported on dissatisfaction in segments of the EOS community with how the chain is being managed. That said, sources in the community say it’s unclear how clogging up the blockchain up will unseat the current power structure.

The Enumivo Twitter account has not replied to a request for comment from CoinDesk. On its blog, it describes vague plans for a decentralized market-maker system, of which EIDOS is said to be the beginning.

“It’s a token that is pretty sparse on information, but then again that’s nothing unusual in crypto,” Aaron Cox of Greymass, a block producer candidate, explained to CoinDesk over Telegram.

Sharif Boutkila, the CEO of EOS Dublin, a block producer candidate, argued that despite the technical hiccup and the mysterious intent, it may not be a bad thing for EOS. He said:

“This contract is a real contract. I might not understand it or agree with it or get why people want these tokens, but they want this token. And they are using the network in order to get them and I think that has to be seen as a positive thing.”

Coinbase staffers contend in their post that people want EIDOS because exchanges have listed trading pairs with USDT (tether), so it’s like getting free dollars. Yet the value of EIDOS has been tanking across the market since its debut, according to CoinGecko.

The #EIDOS token on #EOS is:

— Rob Finch (@finchify) November 5, 2019

The issue

Sources with knowledge of EOS told CoinDesk it will probably stay clogged for possibly another couple of weeks.

In the simplest terms, users are “mining” for new eidos tokens by moving eos back and forth on the network. To get eidos, users send tiny amounts of eos to the smart contract. The contract then sends back the exact same amount plus a tiny portion of the daily release of eidos.

Importantly, it doesn’t appear to actually matter how much eos gets sent. What matters is how many transactions the person can submit. EIDOS is designed to generate maximum transactions. It costs users time, but not money. It’s a spam-generating machine.

“What seems to be happening is people are sending these eos [coins] and sending them straight back again [after eidos returns their eos],” Bouktila explained.

By giving people profit motive to do more actions rather than spend more money, EIDOS seems to have been designed to test the capacity of EOS itself.

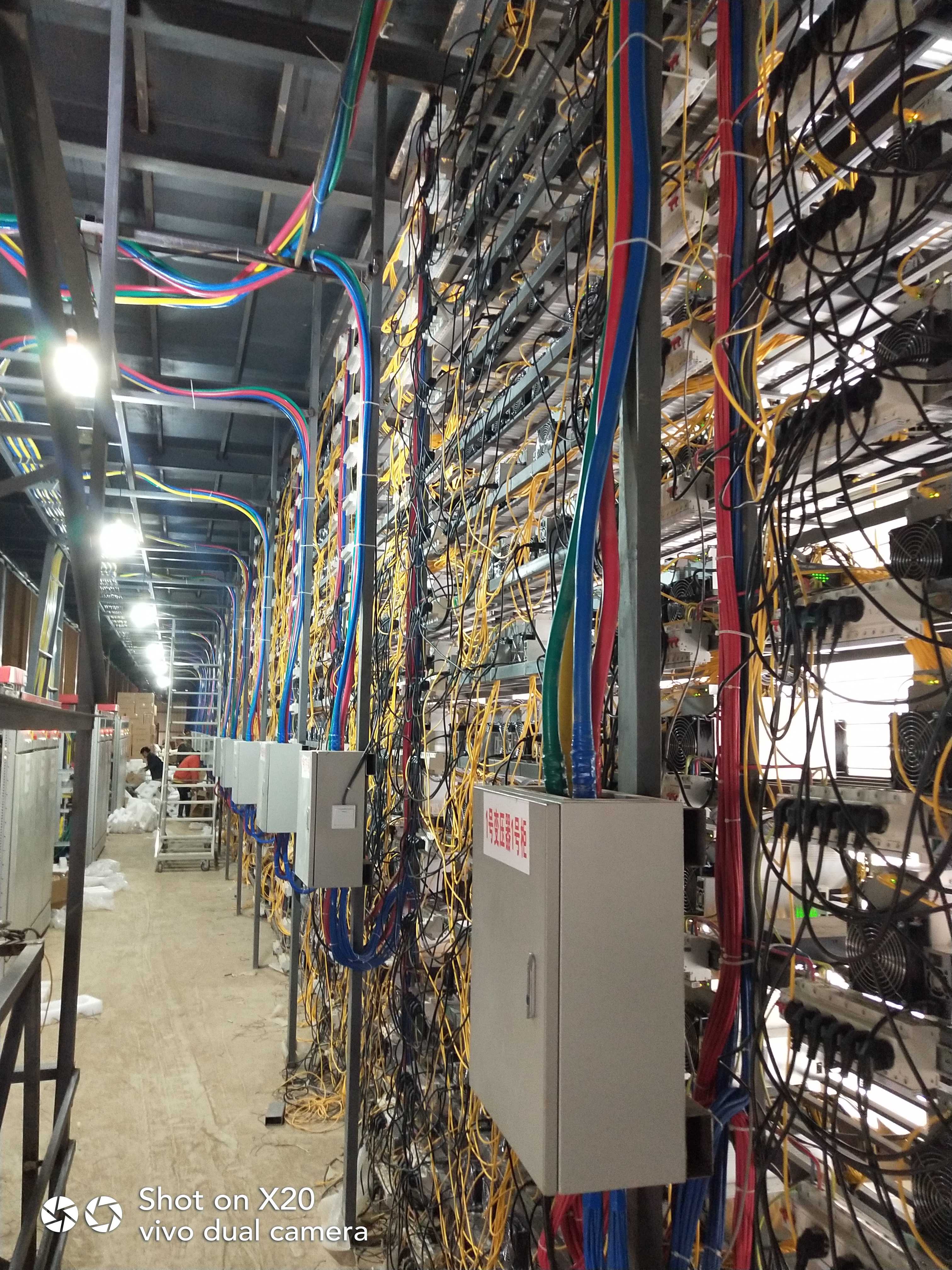

In order to do anything on EOS a user needs to stake a proportional amount of eos tokens, either to make computations (CPU), move data (NET) or store information (RAM). Early on, users directly staked for any of these things (an account could not even get registered without a little bit of eos).

On their own stake, a user can only run so many transactions per day. “They’ve exhausted their own resources,” Boutkila said. That’s usually OK, though, because then a user can turn to the Resource Exchange or REX, a smart contract built by Block.One that lets users stake eos for others to use.

“These rentals grant them network resources for a 30-day period, during which time the EOS Account can use those resources to perform smart contract actions,” Greymass’s Cox said. “These actions could be transferring tokens, playing games, etc. – basically any action on the network.”

Users of EOS have become accustomed to making free use of unused computing power on the world’s seventh most valuable blockchain, but the gravy train has been shut down by the EIDOS token. Usually, REX gives users some leeway. They can overshoot the amount they’ve rented a bit if it has unused capacity.

“The REX smart contract was set to never allow more than 80 percent of the tokens deposited into it to be rented out,” Cox said.

Once the demand for EIDOS started to speed up and lots and lots of people were making these tiny transactions, REX demand went from 10 percent to over 80 percent in less than three days.

“The supply hasn’t kept up with the demand,” Boutkila explained. The theory behind REX was that if it started to run out of space, the price to rent would rise high enough that more EOS users would move their stake to REX, but that hasn’t happened.

Currently, said Boutkila:

“Everyone can only use the amount of network resources that they have currently staked.”

What is to be done?

Critically, none of this means that EOS is inherently maxed out. It could handle much more if users would just move eos supply out of exchange accounts and onto the network, Boutkila said.

“The [REX rental] rates never really got to a point that they were too good to pass up,” Boutkila said. “To me, that’s something that can be improved in the future.”

There’s nothing stopping EOS users from buying tokens on the open market to make more transactions with, but the advantage of REX is that it’s less expensive than doing that.

On the other hand, if all the capacity were taken off REX, in theory, prices could rise as high as they needed to. As Boutkila explained, that means that it could cost eos to rent the same amount of computing capacity a user would get for just buying one eos. Obviously, at that point, people would just stop or buy more eos, but also HODLers would move more eos into REX long before that.

“It should get completely ridiculous,” Boutkila said. “The actual first fix that the block producer could do is just remove that [80 percent] cap” on REX.

The trouble is that fixing things hasn’t been a priority for the latest class of block producers running the network. He lamented:

“We have block producers who aren’t actively looking to see how can we fix things on a daily basis. They’re more passive, but that’s just the way it is.”

Gumball machine image via Shutterstock