A Financial Professional’s Guide to Consensus 2024

Curious about how crypto is already disrupting the world of finance? Here is a schedule of the events every financial professional will want to attend at this year’s Consensus 2024 conference to get you up to speed.

Wednesday, May 29

OFAC Sanctions Compliance: The Good, the Bad, and the Ugly (10:30 AM CDT • 11:30 AM EDT)

In recent years, crypto has come under the watchful eye of international regulators concerned that borderless and censorship-resistant financial platforms could be used to bust sanctions. Former Central Bank of Ecuador Director General Andres Arauz is joined by three expert crypto lawyers, privacy advocates and founders to discuss how crypto startups can comply with sanctions lists without sacrificing their credible neutrality.

Cathie Wood on Bitcoin’s Rubicon Moment (10:45 AM CDT • 11:45 AM EDT)

Cathie Wood, CEO of ARK Invest and legendary Wall Street investor, is joined by influential Bitcoin podcaster Peter McCormack to discuss the world’s first decentralized money’s current and future value proposition — and why she thinks bitcoin is likely to continue growing.

Tom Emmer: Congress’ Crypto Champion (11:15 AM CDT • 12:15 PM EDT)

Republican Congressman of Minnesota and Majority Whip Tom Emmer is one of crypto’s biggest advocates on the Hill. And as majority whip in the United States House of Representatives since 2023, what he says carries weight.

Open Money Summit: Time to Combine? Mergers and Acquisitions in Digital Assets (3:30 PM CDT • 4:30 PM EDT)

A wave of consolidations swept the industry in the wake of 2022’s contagion event and will likely happen again during the market upswing, as growing companies look to invest. Attorneys and investments bankers including DLx Law’s Sarah Chen, KBW’s Paul McCaffery and Imperii Partners’ Tony Scuderi will discuss how the tone and tenor of M&A deals change during boom and bust market cycles.

The OG of Fast Payments (4:05 PM CDT • 5:05 PM EDT)

Brad Garlinghouse, CEO of Ripple, is set to discuss the evolving world of enterprise-focused blockchain tools, including the company’s plans to launch a stablecoin, and how traditional finance operations could move on-chain.

Thursday, May 30

Crypto, the U.S. Elections, and the Next Administration (10:00 AM CDT • 11:00 AM EDT)

Tim Draper, one of the first major VCs to buy bitcoin, is joined on the mainstage Polygon Labs Chief Legal Officer Rebecca Rettig and Messari CEO Ryan Selkis to discuss how politics affects crypto policy. About 15% of Americans — including about a quarter of Millennial voters — own, trade or use crypto: Can they become a unified voting block?

State of Crypto Policy Summit: SEC and CFTC Commissioners Speak (11:00 AM CDT • 12:00 PM EDT)

Hester Pierce and Summer Mersinger, commissioners of the U.S. Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC), respectively, will discuss where the U.S. is going wrong with crypto regulation and how to get the world’s largest economy back on track.

Digital Asset ETFs: A New Frontier, 10 Years in the Making (12:00 PM CDT • 1:00 PM EDT)

It took over a decade to launch the first spot bitcoin ETF in the U.S. but only weeks to establish themselves as some of the hottest investment vehicles this year. Asset managers from BNY Mellon, BlackRock, Bitwise and Fidelity will discuss where the market goes from here, and the prospects for launching a spot Ethereum ETF this year.

Prometheum’s Perspective (4:10 PM CDT • 5:10 PM EDT)

In an industry as contentious as crypto, perhaps no startup is more controversial than Prometheum, the special purpose broker dealer that wants to list “crypto asset securities” — including Ethereum. Co-CEO Aaron Kaplan will give his perspective about why crypto needs regulated entities to run the show.

Friday, May 31

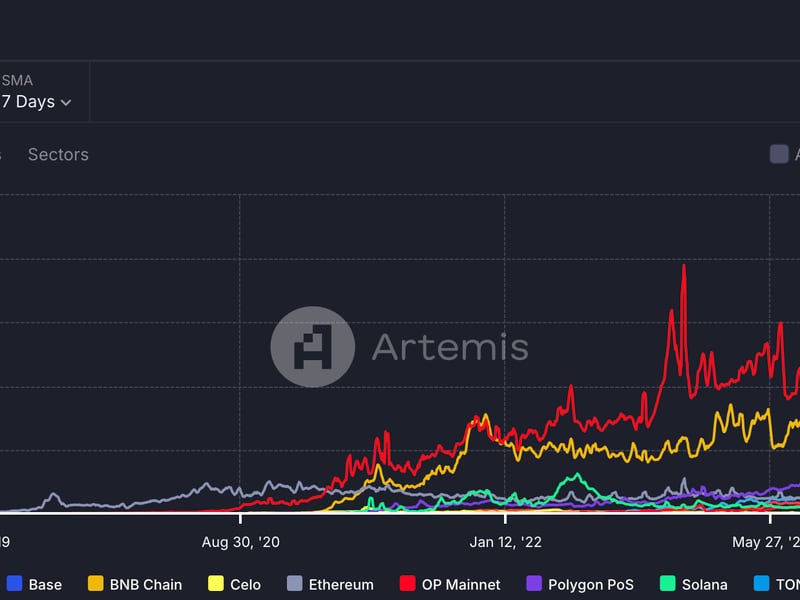

Can DeFi Scale? (10:10 AM CDT • 11:10 AM EDT)

MakerDAO founder Rune Christensen and decentralize finance expert at The Defiant Camila Russo will discuss whether decentralized finance is living up to its promise of empowerment and how it can maintain its ideals as it continues to scale to a global level.

Bringing the Next Trillion Dollars of Assets On-Chain (12:45 PM CDT • 1:45 PM EDT)

Real-world assets, i.e. traditional financial products that are brought on-chain, is one of the fastest growing sectors in the digital asset space, to such an extent that BlackRock CEO Larry Fink thinks tokenization will soon eat the world. Founders of three of the hottest RWA startups, Centrifuge, Superstate and Maple Finance, will discuss where this transformation is heading.

Memecoins: Shiny Objects or Serious Business? (3:30 PM CDT • 4:30 PM EDT)

Crypto projects that start as jokes sometimes evolve and pursue plausible use cases such as digital identity or tokenization, and even assets with no apparent utility can attract smart money.