A Bitcoin Price Of $100k Could Come From A Testosterone-Fueled Frenzy

If seasonal levels of male testosterone correlate with winter price spikes, then a bull run might just be headed our way.

The price of bitcoin over its 12-year lifespan has been extraordinarily volatile. There have been five discernible price spikes followed by significant drawdowns in the price action. That many price spikes over such a short time frame is highly unusual in financial markets. However, given that bitcoin is traded 24/7, in any given week it trades for five times the number of hours that traditional markets are open. With five times more trading hours per week, bitcoin has effectively experienced 60 years’ worth of trading when measured in traditional market time. Bitcoin has already traded for more hours than the S&P 500 index, which launched in 1957.

However, the focus of this article is on the timing of these price spikes. It is well documented already that bitcoin bull runs have occurred in the 18 or so months that follow a mining reward halving event (a fixed and predictable event in bitcoin’s source code). This run-up in price is not surprising as a decrease in available supply in any commodity market often drives an increase in the price of that commodity. The primary question of this article is why do these price spikes seem to occur in the winter?

Three of these price spikes have occurred in the winter months of the northern hemisphere, while two have occurred in the summer months of the northern hemisphere. As bitcoin is an asset class dominated primarily by men residing in the United States, Europe, and Asia, this article explores a possible correlation between the seasonal variations in male testosterone levels and the timing of cycle peaks in the price of bitcoin. Although the price of bitcoin has also spiked in the summer months, these occurrences may be attributable to exogenous events, as their severity and duration were less significant than the winter spikes.

Testosterone Data

Testosterone levels in men vary both diurnally as well as seasonally, but the seasonal variation appears to hinge on day length and temperature disparities from summer to winter. The Tromsø Study in Norway measured testosterone levels of men residing in a northern city which experiences dramatic differences in day length and temperature from summer to winter. The men in this study exhibited a 31% difference in free testosterone levels between the summer and winter months, with the peak occurring in the winter. Another study of men in the southwest United States found that “there are significant circannual differences in the T/E ratio [testosterone to estrogen] in men. However, the magnitude of these differences was only statistically significant in the younger cohort of patients.” The study defined its younger cohort as being less than 60 years old, which is the age cohort that includes the vast majority of bitcoin investors. The southwest United States study diverged from the Norway study in that free testosterone levels did not vary nearly as much (10% in southwest U.S.A. vs. 31% in Norway) from peak to trough. However, even a 10 percent differential is significant enough to influence an acceleration in the rate of risk-taking as winter approaches.

Hormonal Influence On Investor Behavior And The Gender Disparity In Bitcoin

Fear and optimism drive short and medium-term price action in markets. Dopamine and cortisol are the most commonly referenced hormones that drive these emotional cycles in financial markets. Testosterone and estrogen levels, or a lack thereof, may be playing an especially potent role in bitcoin market cycles due to the gender disparity in bitcoin as an asset class. In American Economic Review, a study found that there is “a marked gender difference in producing speculative price bubbles. Mixed [gender] markets show intermediate values [in frequency and magnitude of price bubbles], and a meta-analysis of 35 markets from different studies confirms the inverse relationship between the magnitude of price bubbles and the frequency of female traders in the market. Women’s price forecasts also are significantly lower.” In markets dominated by men, price bubbles are more likely to occur. As more women invest in bitcoin, volatility in the price of bitcoin may dampen over time. The term bubble in reference to bitcoin is not meant pejoratively. I see these booms and busts as a natural and necessary phenomenon as the Bitcoin network proceeds up the Scurve of technology adoption.

Higher levels of testosterone are correlated with a higher propensity for risk-taking in general, but financial risk-taking in particular. In Frontiers in Behavioral Neuroscience, a study found that “giving testosterone to traders playing an economic game that resembled real-life resulted in increased price offers (i.e., mispricing) and over-optimism about future changes in asset values (Nadler et al., 2017) and non-professional subjects showed similar effects, together with increased appetite for risk (Cueva et al., 2015). Thus, testosterone appears to increase individual willingness to take financial risks because it biases estimates of outcome.” As free testosterone and the T/E ratio increase in the winter months, this biological phenomenon may have an influence on the collective optimism of bitcoin investors. Collective optimism is the primary driver of short-term price bubbles.

Future Outlook

The severity of these spikes in the price of bitcoin may dampen over time as adoption of the asset increases globally. Two populations in particular may have the most pronounced dampening effect over these winter price spikes. New female investors in both hemispheres, as well as new male investors in the southern hemisphere, may temper this trend of winter price spikes. As winter occurs in June, July, and August in the southern hemisphere, new participants down under may exert upwards pressure on the price of bitcoin during the northern hemisphere’s summer doldrum trading months. These summer doldrum months are the basis for the old trader’s adage of “sell in May and go away.” The adage might be partially attributable to low summer levels of testosterone, and not simply the distraction of summer BBQs and much-needed vacations.

Areas For Further Research

The data for bitcoin’s price history is continuous in nature, while the testosterone data in the referenced studies is only published with four seasonal values. Testosterone levels were measured daily, but these daily values are held internally by the Norwegian research team and were not published in the study. To ascertain the exact strength of statistical correlation between bitcoin price action and seasonal levels of male testosterone, the internal data from these studies must be requested and analyzed.

I contacted Dr. Johan Svartberg, the lead Norwegian researcher for the Tromsø study and he instructed me to formally request the study’s internal data from the research board, which includes a fee between 26,000 NOK and 83,000 NOK (roughly $3,000 to $9,600), depending on the number of articles I intend to publish. Since I am not a bitcoin whale, I opted to publish this article as a work in progress, in hopes that the bitcoin community might be interested in crowdfunding my request for the Norwegian testosterone data (contact author for more information).

Perhaps a new technical analysis trading indicator could be developed based on the relative price action of bitcoin compared to a standardized seasonal testosterone level graph. When the bitcoin price is below the testosterone line, this would be a buy signal. When the bitcoin price is above the testosterone line, this would be a sell signal.

Another area for research would be bitcoin’s price action in relation to the daily variations in male testosterone levels, which tend to peak in the early morning. This data may be quite noisy as this daily peak in testosterone would only pertain to one time zone at a time. However, perhaps there is discernible daily price pressure upwards as the sun rises across time zones, similar to a wave in a sports stadium.

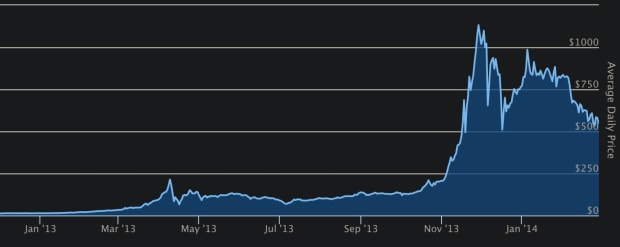

Historical Testosterone-Fueled Frenzies In The Price Of Bitcoin

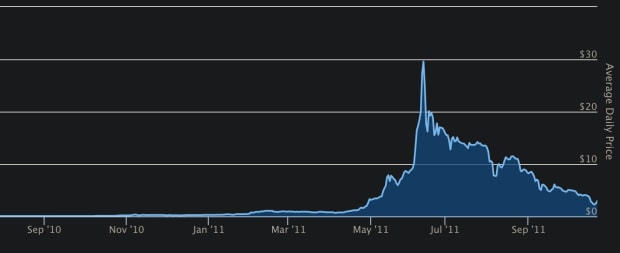

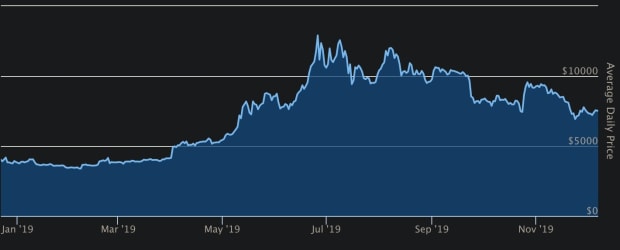

Exogenous Events Leading to Summer Price Spikes

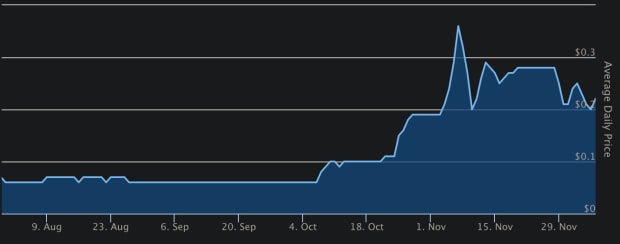

The price spike in the summer of 2011 is most likely attributable to Gawker shining the first mainstream light on The Silk Road marketplace as “a place to buy any drug imaginable anonymously.” The price ran up in the month after the article was published as people suddenly learned that they were able to buy drugs online easily for the first time.

The price spike in the summer of 2019 was largely due to billions of dollars of demand drummed up by the PlusToken Ponzi scheme in China. This Ponzi scheme was shut down by Chinese authorities in June of 2019, so the demand for bitcoin suddenly dropped off and the price fell.

References

Complete Bitcoin Price History Graph (2021, June 15). 100% complete bitcoin price history graph + related Events 2009 – 2021. 99 Bitcoins. https://99bitcoins.com/bitcoin/historical-price/

Eckel, C. C., & Füllbrunn, S. C. (2015). Thar she blows? Gender, competition, and bubbles in experimental asset markets. American Economic Review, 105(2), 906–920.

https://doi.org/10.1257/aer.20130683

Herbert, J. (2018). Testosterone, cortisol and financial risk-taking. Frontiers in Behavioral Neuroscience, 12. https://doi.org/10.3389/fnbeh.2018.00101

Moskovic, D. J., Eisenberg, M. L., & Lipshultz, L. I. (2012). Seasonal fluctuations in testosterone-estrogen ratio in men from the southwest united states. Journal of Andrology, 33(6), 1298–1304. https://doi.org/10.2164/jandrol.112.016386

Saat, D. (2020, October 23). Bitcoin is a mature asset. Bitcoin Magazine: Bitcoin News, Articles, Charts, and Guides. https://bitcoinmagazine.com/markets/bitcoin-is-a-mature-asset.

Svartberg, J., Jorde, R., Sundsfjord, J., Bønaa, K. H., & Barrett-Connor, E. (2003). Seasonal variation of testosterone and waist to hip ratio in men: The tromsø study. The Journal of Clinical Endocrinology & Metabolism, 88(7), 3099–3104. https://doi.org/10.1210/jc.2002-021878

This is a guest post by Jason Sonnefeldt. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.