A Bitcoin ETF Has Golden Parallels From History

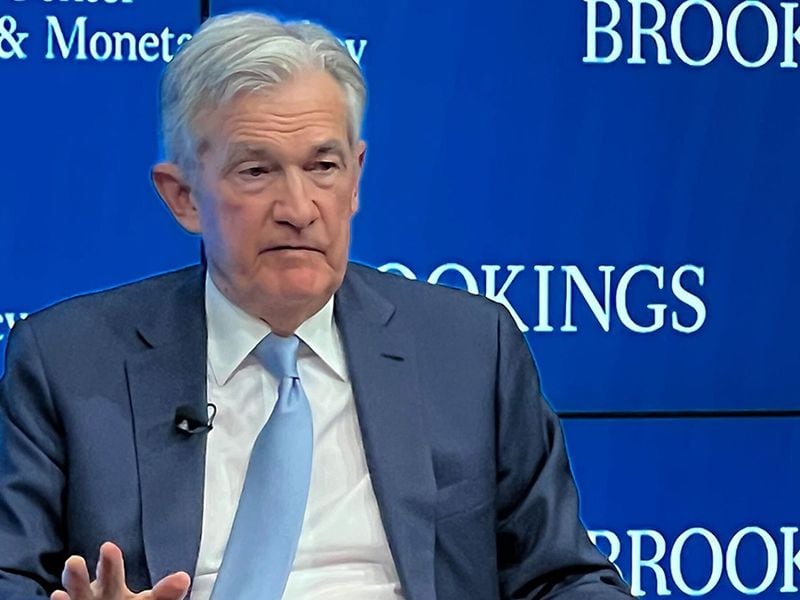

Back to the desk from a late summer break, it’s a good time for a quick year-to-date performance scan across the digital asset markets (see Figure 1 below). Overall, bitcoin (BTC) has clearly been setting the mood for 2023, as proxied by the CoinDesk Markets Index (CMI), and it feels like the majority of broad crypto market-moving headlines over the past few months can be placed within the bucket of the ongoing saga towards a bitcoin spot ETF.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/JB3SNMMDO5CLPKMFEWFFIY5AZQ.png)

Figure 1: Digital asset market performance in 2023. Source: coindeskmarkets.com.

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

To better understand the context behind the crypto market’s focus on a spot ETF, it’s useful to draw some useful historical parallels to the creation of gold ETFs and their impact on the gold market.

Like gold ETFs, a bitcoin ETF would make it significantly easier for a broader range of investors to gain exposure to bitcoin. It eliminates the need for investors to directly buy and store bitcoin. While this difficulty did not discourage early adopters, it can be a complex and daunting process for many (i.e., imagine walking a grandparent through the cold storage process). Fun fact: Before the first gold ETF was launched, investors could invest in clunkier closed-end funds, gold companies like miners or lug around the actual shiny metal. With an ETF, investor demand for gold increased. A bitcoin spot ETF could do likewise, leading to a surge in buying by retail investors who aren’t currently in the Grayscale Bitcoin Trust (GBTC) or one of the bitcoin futures ETFs like the one from ProShares (BITO).

Related to the increased accessibility would be an increase in liquidity and trading volume in the bitcoin market. Increased liquidity and further diversifying the asset’s investor base could help stabilize prices and reduce price volatility caused by illiquid market conditions. This could also shift the investor base from tech-savvy retail investors and crypto enthusiasts to more mainstream, longer-term real asset investors looking for diversification from fiat currencies.

The launch of a bitcoin ETF could catalyze further institutional adoption of bitcoin, as it would delegate the acquisition and storage of the digital asset to qualified custodians. An ETF structure also provides a more familiar and regulated investment vehicle that institutional investors are comfortable using, which could lead to more hedge funds, asset managers and pension funds allocating capital to bitcoin.

Just as the gold ETF made it easier for investors to add additional diversification to their portfolios, a bitcoin ETF could serve a similar purpose. Investors looking to diversify their portfolios may allocate some of their assets to bitcoin through the ETF, viewing it as a store of value or an uncorrelated asset class. This addition of bitcoin to a greater number of investor portfolios would likely be small in percentage terms due to the relatively young and volatile nature of the asset class, but it would still result in a meaningful flow of capital into the cryptocurrency asset class.

In summary, the introduction of a bitcoin ETF could be seen as a sign of the market’s maturation. It signals that bitcoin is evolving from a niche asset class to one accepted and regulated within the traditional financial system.

Takeaways

From CoinDesk Deputy Editor-in-Chief Nick Baker, here is some news worth reading:

-

SBF’S PARENTS: It’s no secret that Sam Bankman-Fried’s personal inner circle overlapped with this business inner circle. CoinDesk very much addressed that theme last year when it reported that SBF lived with some of his top executives, including ex-girlfriend Caroline Ellison, who ran his trading shop Alameda Research. And it’s been long-discussed how significant a role his parents played. The folks restructuring FTX just asserted they played a large role and sued them. Within the case is an eye-catching scene involving SBF’s dad acting exasperated with his son and saying he’s going to pull his mom into the situation. It wasn’t a normal family squabble over a curfew or whatever. It was Joe Bankman being angry that SBF was only paying his dad $200,000 a year, not $1 million. He wrote: “Gee, Sam I don’t know what to say here … Putting [your mom] on this.” Everyone who has parents feels this one. Relatedly, here’s CoinDesk’s Daniel Kuhn arguing SBF is blaming everyone but himself for FTX’s spectacular failure.

-

MORE TO COME: U.S. officials going after Coinbase and Binance earlier this year was scary enough for everybody in crypto. But CoinDesk’s Jesse Hamilton reported this week on foreboding new comments from the head of the Crypto Assets and Cyber Unit at the Securities and Exchange Commission. In Hamilton’s words, David Hirsch said the SEC “isn’t done chasing down crypto exchanges and decentralized finance (DeFi) projects it sees as violating securities laws in the same vein” as Coinbase and Binance. To state the obvious: This is not the sort of regulatory clarity crypto folks were hoping for.

-

SHARP DROP: As Binance continues to face scrutiny from regulators and maybe law enforcement officials, its business is shrinking. Its seven-day average trading volume has dwindled by 57% since the beginning of September. And this appears to be specific to Binance, as the data from K33 Research shows volumes on other exchanges have been mostly flat. “The ongoing [U.S. Department of Justice] and SEC cases versus Binance may have dissuaded market makers from trading on Binance, explaining parts of the decline,” K33 Research senior analyst Vetle Lunde said.

Edited by Nick Baker.