99.3% of Ethereum Addresses in Profit as ETH Price Came $150 Away From ATH

With Ethereum’s price jumping to nearly $1,300 and nearing the all-time high of $1,450, the number of ETH addresses in profit has reached a 2-year high of over 99%.

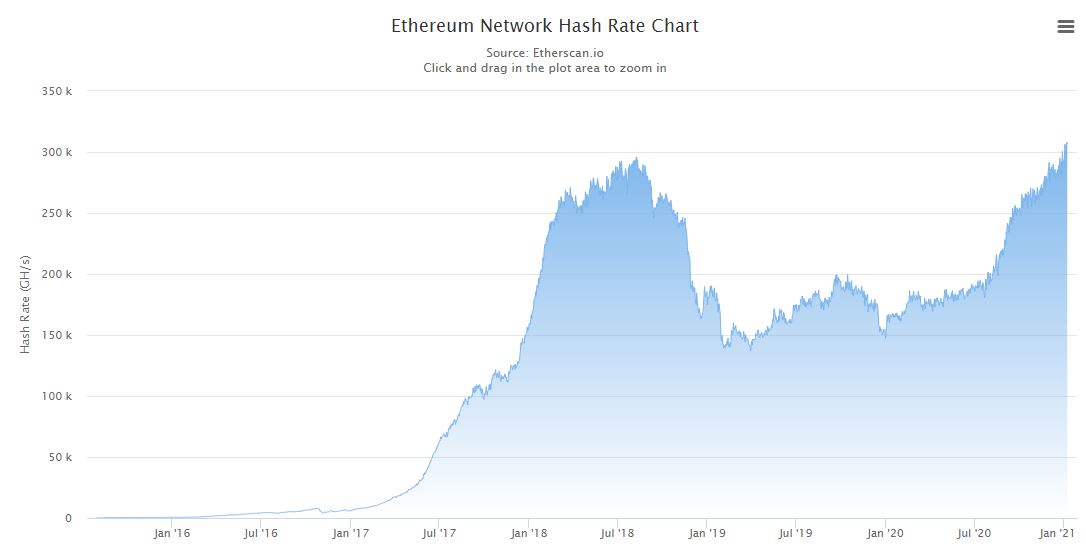

The Ethereum hash rate has also enjoyed the past several months with gradual increases and a new all-time high above 300,000.0000 GH/s.

ETH’s Price Leads To Nearly 100% Addresses In Profit

The second-largest cryptocurrency by market cap has led the recent altcoin rally with impressive gains. After becoming one of the best-performing assets in 2020, ETH entered the new year at about $740. This represented a 120% increase since October 2020 and 470% surge throughout 2020.

However, Ether doubled-down on its bull run and added over $550 in the first week of 2021 to reach a near 3-year high of almost $1,300. Thus, ETH came just inches away from following bitcoin’s example to register a new all-time high. CoinGecko data shows that Ether’s ATH came about three years ago at $1,450.

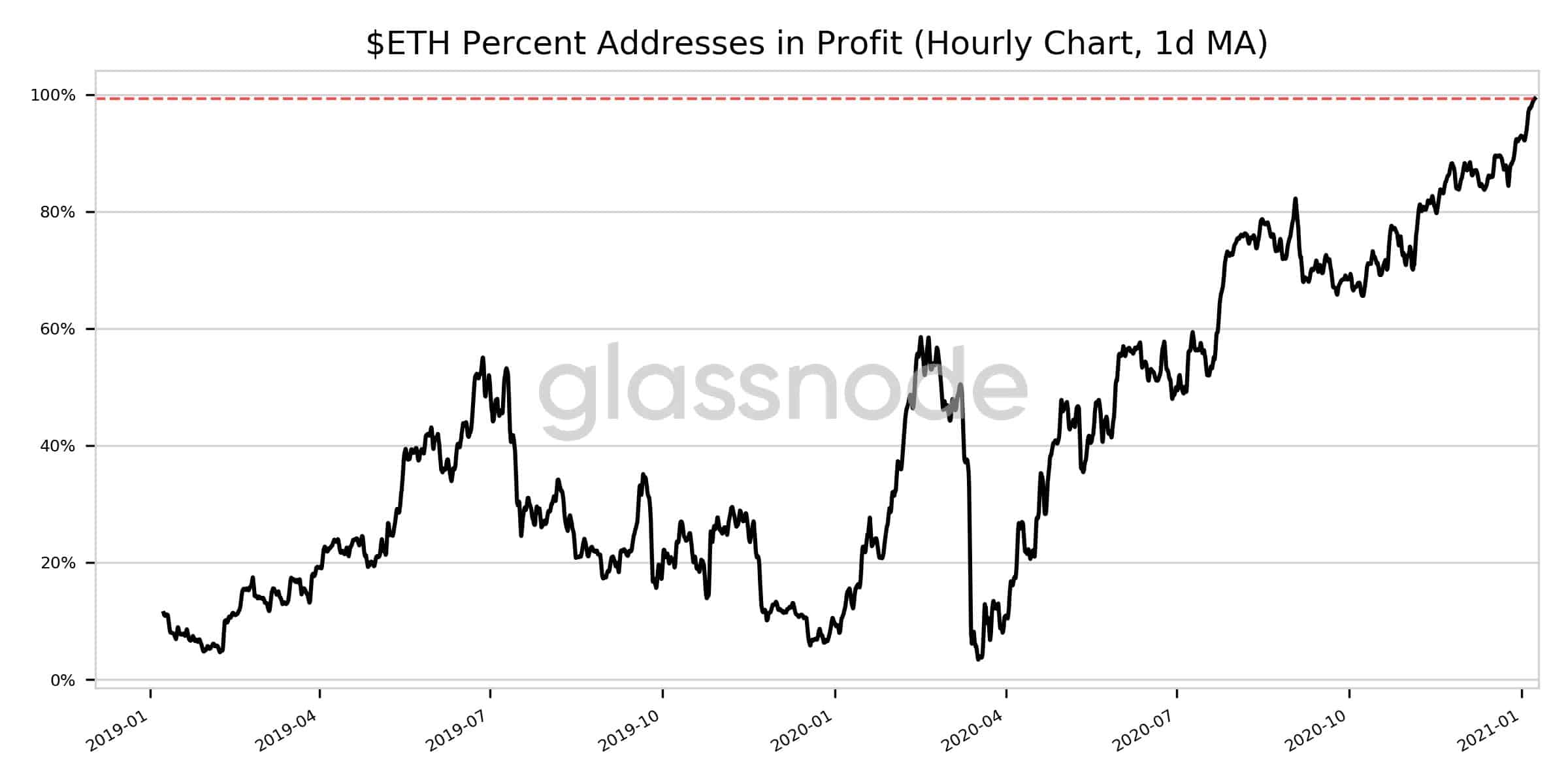

Nevertheless, ETH holders reaped the benefits of these price developments with another multi-year record. The analytics company Glassnode said that the percentage of Ethereum addresses in profit (1-Day Moving Average) had charted a 2-year high of 99.293%.

This is a massive increase since mid-March 2020. During the liquidity crisis when ETH plummeted below $100, the percentage of addresses in profit had dropped to slightly above 0%.

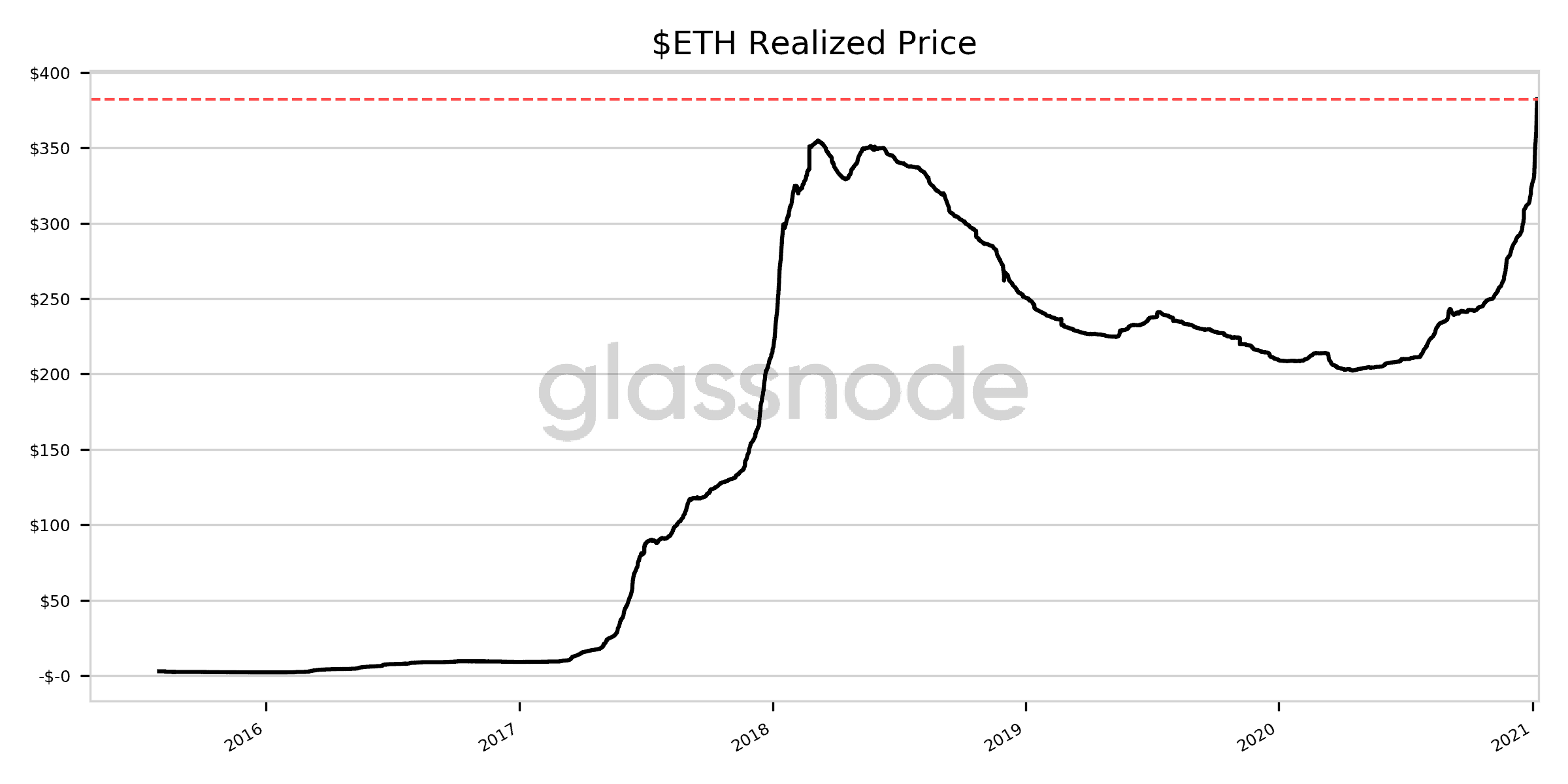

Furthermore, ETH’s realized price has painted a new all-time high of over $382, while the current price still falls short. Glassnode describes the realized price of an asset as the average price at which each token has moved the last time in the network.

ETH Enters The Top 100 Assets By Market Cap

CryptoPotato reported yesterday that bitcoin’s market capitalization had pushed the cryptocurrency in the top ten by this metric. BTC went even further and challenged Elon Musk’s Tesla for the 7th spot.

Ethereum has also registered an impressive milestone, even if not as high as bitcoin. By having its market capitalization grow to about $140 billion, the second-largest crypto has entered the top 100 by storm and currently occupies the 72nd spot.

Asset Dash data shows that on its way up, ETH surpassed the market capitalization of giants such as Jack Dorsey’s Square, HSBC Holdings, BlackRock, Starbucks, Royal Bank of Canada, Moran Stanley, Citigroup, and more.

Hash Rate Goes For A Record Too

Miners putting their computational power to work on the Ethereum network have also grown lately as the hash rate has surged to a new record of over 308,000.0000 GH/s. According to data from Etherscan, this is the first time ETH’s hash rate has expanded above 300,000.0000 GH/s.

As the graph above demonstrates, the hash rate has been increasing gradually for over a year. The higher the hash rate is, the more secure and healthier the network is as the chances for a 51% attack decrease.

It’s worth noting, though, that Ethereum is transitioning away from the current proof-of-work consensus algorithm to proof-of-stake. Upon completing the full integration of ETH 2.0, which could take up to a few years, the network won’t rely on miners anymore.