90% Of Large Bitcoin Trades Comes From China: Report

Although Bitcoin is still officially banned in China, the country portrays the most significant chunk of BTC trading volume, new research says. Additionally, the world’s most populated continent, Asia, occupies the largest market share, whale activity, and larger trades.

China Dominates The Crypto Field

China’s government has repeatedly outlined that BTC is officially banned within the nation’s borders. Nevertheless, the country has remained one of the largest and most crucial players in the primary cryptocurrency’s development.

As previously reported, China is responsible for over 60% of the BTC hash rate – meaning that the majority of miners are situated within the country.

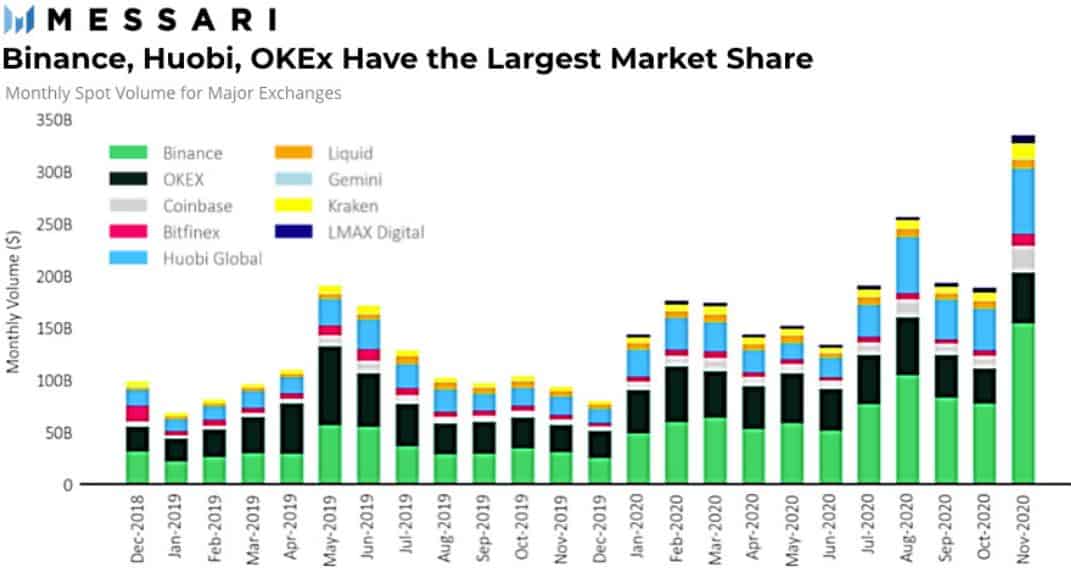

The analytics company Messari has compiled a report to put the country’s dominance in numbers. Apart from the most substantial pool of miners, the world’s most populated nation has massive crypto development communities and is home to “three of the world’s largest exchanges.”

However, the paper admitted that the government’s “hostile narrative” against the digital asset field has caused local investors to hold less BTC. Instead, they have focused on larger and more frequent trades.

“That has not stopped Chinese-based exchanges from having among the largest market share in the world” in terms of trading volume.

“East Asia (mostly China) is dominated by larger trades with 90% of all volumes above $10,000. East Asia engages in more short-term trades over a wider variety of assets, compared to North America where the focus is more on long-term holdings of bitcoin.”

It’s worth noting that the regulatory crackdowns on the industry and prominent individuals have continued. Reports emerged in 2020 that the China Merchant Bank had frozen bank accounts belonging to users engaged in cryptocurrency activities.

Furthermore, authorities reportedly took the founder of OKEx into police custody while investigating the popular exchange.

On the other hand, the Asian country has been significantly more accepting of blockchain – the underlying technology behind BTC.

President Xi urged the nation to enhance investment in the tech in 2019, which resulted in various new projects. Arguably the most well-known is the Blockchain Service Network (BSN). The paper outlined that it works as a “standardized development environment within a government-approved technical network” and has already integrated 24 blockchains.

40% Of HQ-ed Market Cap Comes From Asia

Messari’s document also took a broader approach to examine the behavior of developers, investors, and users throughout the entire Asian continent. Aside from the aforementioned Chinese dominance, other countries in the region, such as India, Japan, Hong Kong, South Korea, and Singapore, have taken a substantial piece of the crypto pie.

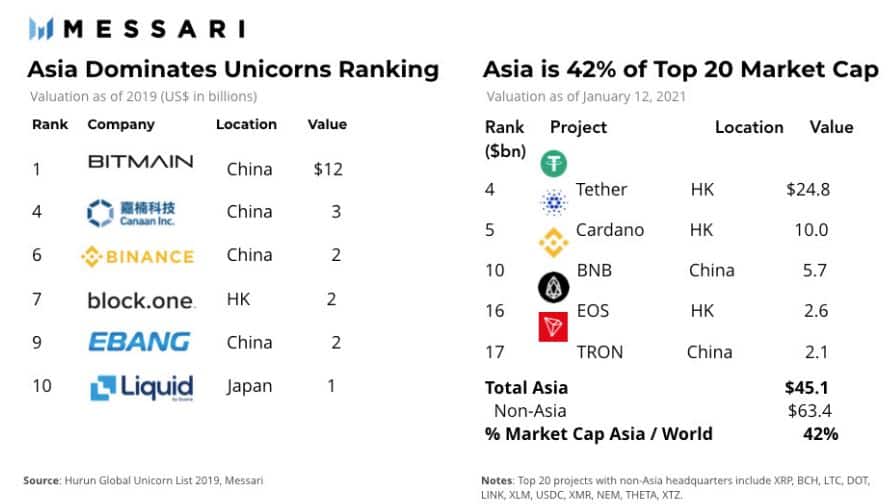

“With Asia accounting for 60% of the world population, infrastructure companies across the world are interested in tapping the growing market. By the end of last year, six of the top ten largest crypto unicorns in the world were located in Asia.”

The paper also said, “of the top 20 token projects with headquarters, 42% of the market capitalization is based in Asia,” per data as of mid-January 2021.

Asian companies also dominate the futures markets. The research concluded that such firms account for 98% of ETH and 94% of BTC futures trading volumes.