86% Quarterly Increase: Square Reports $1.63 Bitcoin Sales In Q3

Twitter founder Jack Dorsey’s payments firm Square is riding the Bitcoin wave like there’s no tomorrow. The company’s Q3 investors’ letter has just come out.

And if numbers are anything to go by, Square has registered a humongous $1.3 billion revenue in the third quarter through Bitcoin sales. This comes amid the company clocking a $3.03 billion net revenue and nearly $800 million in net profits.

Bitcoin’s Headed For The Stars Along With Square’s Q3 Earnings

While bitcoin’s busy bringing back 2017 vibes, Square’s cash registers are not staying behind either. The company’s quarterly earnings report for Q3 2020 has growth written all over it. And not just petty linear growth, the exponential kind.

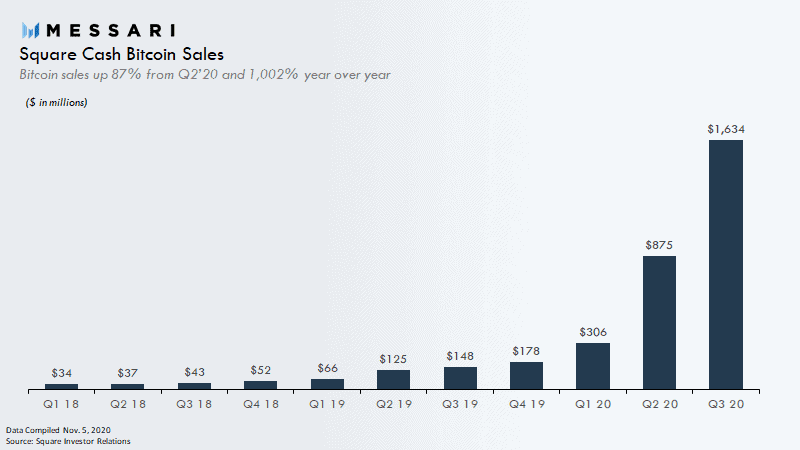

For starters, the Jack Dorsey led payments firm has raked in an astronomic revenue of $1.3 billion from bitcoin sales alone. Through its Cash App. Messari researcher Ryan Watkins was quick to lay down the growth comparison from the last quarter and the last year.

Square Cash #Bitcoin sales going 📈.

$1.6 billion in Q3’2020. Up 86% from Q2’2020 and 1,002% over the past year.

Square is blazing the trail for large scale financial institutions offering cryptocurrency products. pic.twitter.com/RoRPm8fQQF

— Ryan Watkins (@RyanWatkins_) November 5, 2020

According to Watkins, Square is setting an example for bigshot financial institutions to start offering bitcoin and cryptocurrency products for their customers. Square attributed the towering rise in BTC volumes to the surge in its bitcoin sales.

Bitcoin revenue and gross profit benefited from an increase in bitcoin actives and volume per customer.

It is also important to note that the firm physically holds $50 million worth of Bitcoin from its dedicated BTC purchase last month. Square, while talking about the same in the earnings report, commented that:

In October 2020, we invested $50 million in bitcoin as we believe cryptocurrencies are an instrument of economic empowerment and aligns with the company’s purpose. We expect to hold this investment for the long term. The accounting rules for bitcoin will require us to recognize any decreases in market price below cost as an impairment charge, with no upward revisions when the market price increases until a sale.

Diving Deep Into The Numbers

As per Square’s official statements from its investment letter:

Cash App generated $1.63 billion of bitcoin revenue and $32 million of bitcoin gross profit during the third quarter of 2020, up approximately 11x and 15x year over year, respectively.

The firm made $875 million through bitcoin sales in Q1 2020 and $306 million in the quarter before that. As can be seen from Messari’s graphical representation above, BTC revenue has followed a restricted since Q4 2019.

Square earned $32 million (profits) from its BTC sales in Q3, representing 4 percent of the company’s net profits and $17 million in Q2 2020, which accounted for a mere 2.84 percent of the total profits.

Overall the company clocked a revenue of $3.03 billion in the third quarter compared to $1.92 billion in the second and $1.3 billion in the first.