6X Bitcoin: Ethereum Miners Made $166 Million from Gas Fees in September

It pays to be a miner and process cryptocurrency transactions on a proof-of-work blockchain. The Ethereum miners know this especially well as they made a record $166 million last month from transaction fees. Bitcoin miners, however, could barely manage to scoop up $26 million.

Ethereum Miners Made 6X More Money Than Bitcoin Miners in Sept

Data from on-chain insights provider Glassnode shows that miners operating on the second most popular blockchain platform made a hefty $166 million from processing ETH transactions in September. This, as pointed out by the crypto market data providing firm, is a 47 percent appreciation over August and is a new all-time high.

#Ethereum miners made a total of $166 million from transaction fees in September – a new ATH.

That’s an increase of 47% compared to the previous record high in August.

In comparison: #Bitcoin miners made $26M from fees – a difference of more than 6x!https://t.co/OkbOGhN4TT pic.twitter.com/f0NB94F9nd

— glassnode (@glassnode) October 1, 2020

Bitcoin miners, in comparison, made only $26 million from transaction fees in the last month. Quick napkin mathematics deduces that the Ethereum mining blokes raked in 6X more through gas fees than their BTC minting counterparts.

As reported by CryptoPotato, the revenue from Ethereum mining topped a 5-year high two times last month. The one-day moving average of earnings (1dMA) amounted to 2275.790 ETH on September 18 and 2273.540 ETH on September 2.

Surging transaction fees have also led to a rally in Ethereum’s mining hashrate. As of writing, the indicator has clocked 253.21 TH/s.

Increased DeFi Activity Causing Increased Fee Gains

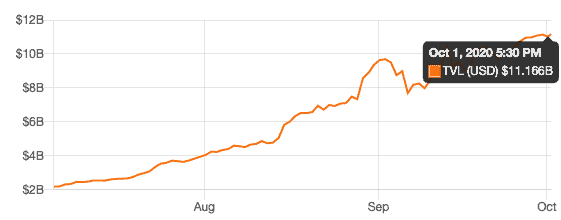

Ethereum’s decentralized finance ecosystem portrayed a wobbly performance in September. Nonetheless, the rising popularity of top DeFi protocols like Uniswap, Maker, Aave, WBTC has boosted total value locked numbers upwards of $11 billion.

And especially Uniswap‘s dominance in the ecosystem has generated more demand for Ethereum network usage. Traders are buying ETH and USDT en masse to participate in the liquidity gold rush on Uniswap. This can be seen from the DEX topping the $2 billion liquidity mark recently. As of writing, the number is nearing $2.5 billion.

ETH has the highest ‘total liquidity locked’ valuation of $1.13 billion. USDT follows next with $313 million. The increase in locking of Ethereum’s native cryptocurrency in Uniswap catalyzed an increased ETH buying activity leading to a price rise of 4 percent in the last 24 hours.

Also, the increased proliferation of WBTCs on Ethereum has led folks to use the Bitcoin network much less. Mostly, it’s just a one-sided transaction where buyers are just scooping up BTC to wrap them on Ethereum to out them to ‘good use’ other than HODLing.

Bitcoin has traded mostly sideways for the last 14 days. So miners apparently didn’t have much of an avenue left for making money through transaction fees.

The post 6X Bitcoin: Ethereum Miners Made $166 Million from Gas Fees in September appeared first on CryptoPotato.