$600M Shorts Liquidated as Bitcoin Skyrockets to $21K

In one of its most impressive rallies in about a year, bitcoin skyrocketed by double digits, charting a two-month high above $21,000.

Most alternative coins have followed suit, resulting in over $650 million in liquidations on a 24-hour scale, the majority of which were from short positions.

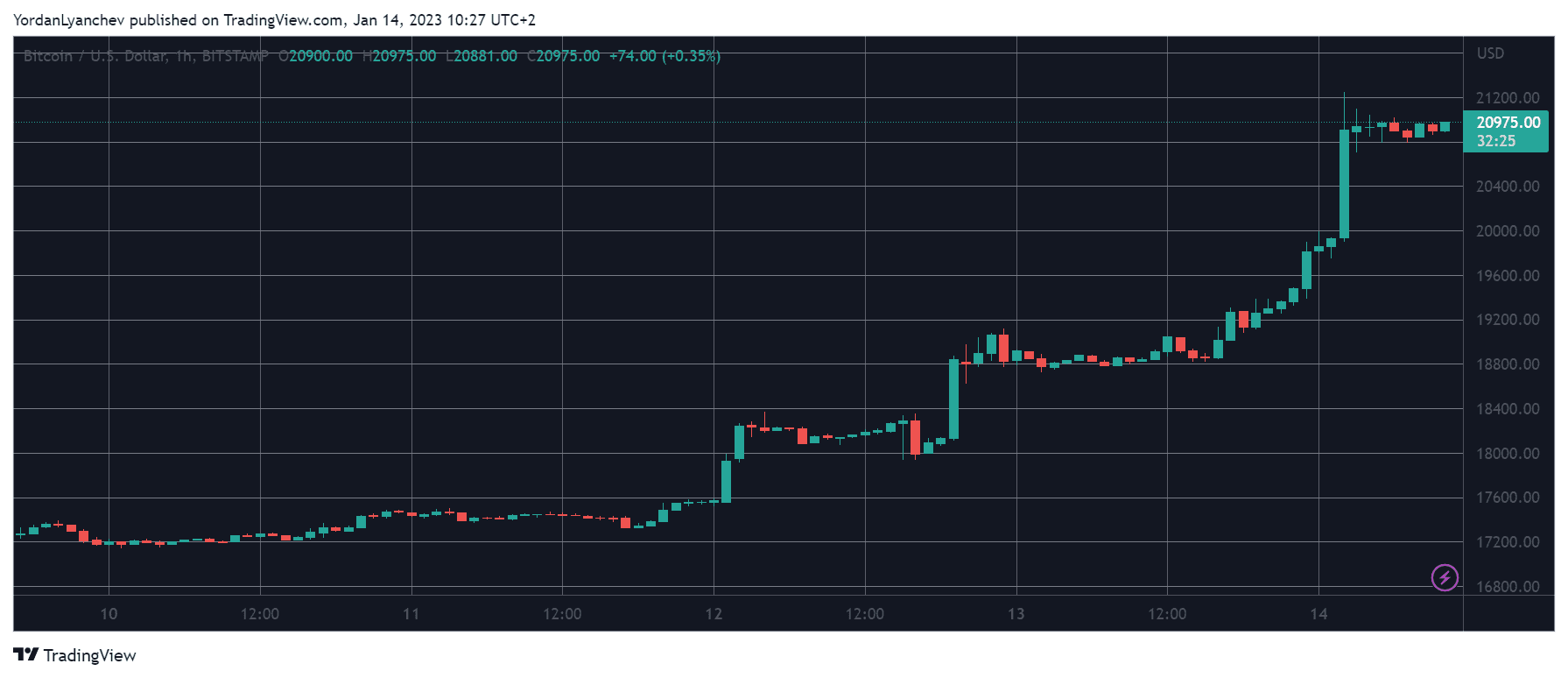

- It’s safe to say that the start of the year has been quite favorable for the cryptocurrency market. Bitcoin, for one, stood around $16,500 on January 1. After a quiet first few days, it began to add value and broke above $17,000 earlier this week.

- However, that was just the start, as the asset kept breaking into forgotten ground in the following days and finally reached $20,000 late last night.

- It continued climbing and jumped to $21,240 (on Bitstamp) for the first time since the FTX collapse unfolded at the beginning of November.

- Several altcoins have skyrocketed even more in the past 24 hours. Solana has stolen the show with a massive 40% rally, driving it to a multi-month high of its own at above $23.

- Polkadot (20%), Shiba Inu (14%), Ethereum (10.5%), Cardano (11%), Dogecoin (11%), Polygon (10%), and OKB (10%) are just some of the examples of double-digit price gainers.

- This has resulted in the overall crypto market cap nearing $1 trillion for the first time in months on CoinMarketCap.

- Short traders have felt the pain of this impressive rally, according to CoinGlass. The total value of liquidated positions in the past day stands at $650 million, but $590 million are from shorts.

- More than 110,000 traders have been wrecked in the same timeframe, with the largest single order happening on Huobi, which was worth over $6.5 million.

The post $600M Shorts Liquidated as Bitcoin Skyrockets to $21K appeared first on CryptoPotato.