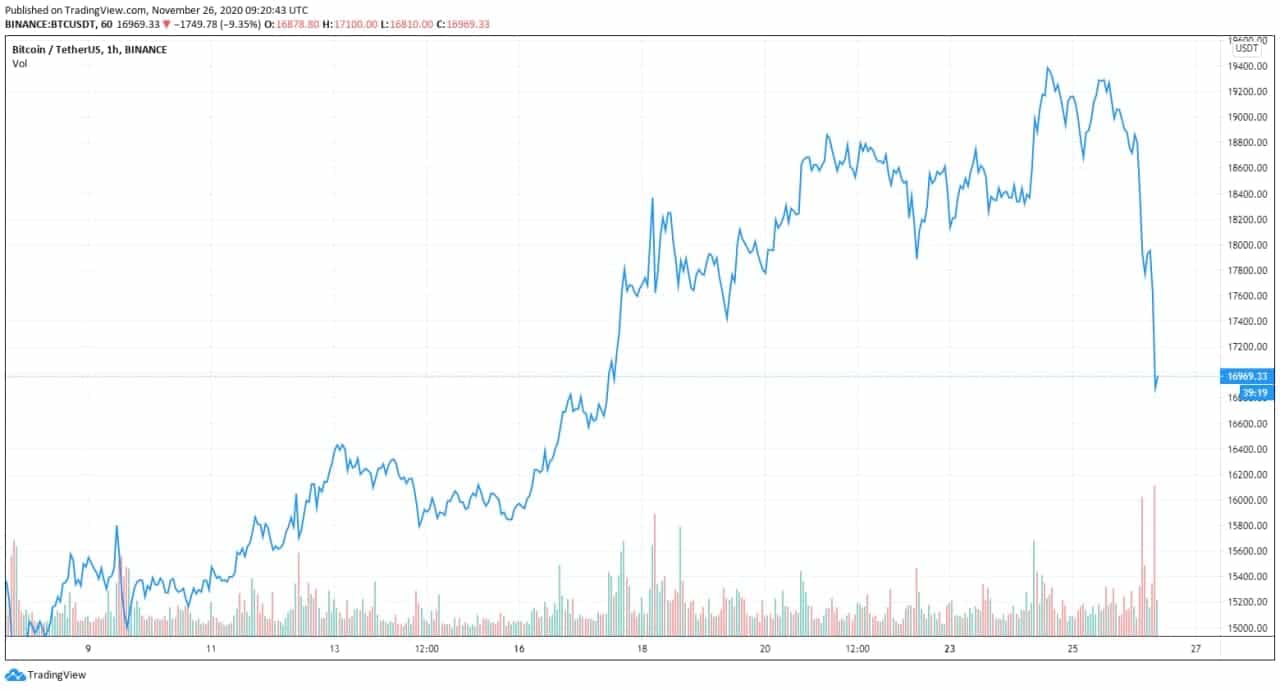

6 Possible Reasons For Bitcoin’s $3,000 Daily Price Crash

Bitcoin lost nearly $3,000 in a few hours, resulting in a price below $17,000. From OKEx opening withdrawals, the US supposedly eyeing additional restrictive regulations and increased exchange inflows, here are a few reasons for which this might have happened.

#1: OKEx Resumes Withdrawals: Chinese Traders Can Realize Mining Profits

OKEx is one of the leading cryptocurrency exchanges in the Asian markets. As CryptoPotato reported earlier in October, the founder of the exchange was reportedly arrested, and shortly after that, the venue halted withdrawals.

While the company reassured its customers that there’s nothing to worry about, OKEx wallets, at the time, had around 200,000 bitcoins on them, at the time worth around $2.3 billion. This means that it’s not out of the question for investors who reassumed control of their cryptocurrency to have sold it for profit.

It’s also possible that Chinese miners used the exchange to sell some of the mining profits that they gained. After all, it was reported that they had had issues paying their electricity bills because the Government had frozen their bank cards.

It’s worth noting that OKEx initially said that they would open up withdrawals tomorrow, but they did it a day earlier and during the Asian trading times.

#2: Potentially Harmful Regulations Coming From Trump’s Administration

Earlier today, CryptoPotato reported that the CEO of the leading US-based cryptocurrency exchange, Coinbase, Brian Armstrong, fears rumored regulations proposed by the country’s Treasury Secretary.

The regulation relates to self-hosted cryptocurrency wallets. The high-ranking executive worries that if it’s implemented, it could harm users, as well as the overall role of the US in the cryptocurrency field.

The proposed set of rules would supposedly require exchanges to verify the identity of users who use self-hosted wallets (hard wallets) before completing a transaction. This is a direct interference with the privacy that cryptocurrency has to offer.

#3: Rally Had Seen No Major Correction So Far

What goes up, must come down. It’s a saying as old as time. So far in this rally, bitcoin had only gone up. On November 22nd, the cryptocurrency had a very volatile day of trading, reaching an intraday high of around $18,770 and an intraday low of $17,600 – a $1,100 difference. Ultimately, however, bitcoin settled at around $18,435, closing the day at an insignificant loss.

Today, the cryptocurrency lost around $3,000 on Binance. It had reached a high of around $19,500 yesterday and dropped to $16,400 today before recovering to $16,900, where it trades at the time of this writing.

This represents a drop of around 15%, and a lot of traders were calling for it. It’s interesting to see how the market will perform going forward.

#4: The All-Time High Around $20,000 is a Strong Technical and Psychological Resistance

Those who were around a few months ago surely remember what a hassle it was for BTC to conclusive claim the $10,000 resistance mark. This is because it was an important psychological resistance, apart from a strong technical level for the bears.

Now, the same thing is true for $20,000 but amplified. This is not only a strong technical resistance because it’s the all-time high, but it’s an even stronger psychological resistance. After all, never in its history has bitcoin traded above this level.

Once $20,000, the price goes into discovery, but until this happens, there’s a lot of work for the bulls.

#5: Increased Inflows to Exchanges Indicating Stronger Selling Pressure

The primary cryptocurrency almost doubled its value since early October. Bitcoin went from struggling around $10,000 to $19,500 in less than two months.

Such a remarkable increase in a relatively short time meant that many BTC investors saw their holdings surge in value. Naturally, it’s safe to assume that some of them have decided to take some profits.

According to Ki Young Ju, the CEO of the analytics company CryptoQuant, that’s precisely what transpired. The “all exchanges inflow mean” increased shortly before the massive price drop, which is an indication that whales deposited large amounts of BTC to cryptocurrency trading platforms.

Such sizeable quantities could instill selling pressure, leading to rapid, short-term nosedives. However, Young Ju asserted that the long-term on-chain indicators still “say the buying pressure prevails.”

All Exchanges Inflow Mean increased a few hours ago.

It indicates that whales, relatively speaking, deposited $BTC to exchanges.

But long-term on-chain indicators say the buying pressure prevails. I still think we can break 20k in a few days.

Chart 👉 https://t.co/mL1j2ZqVf8 pic.twitter.com/6ErmJHrS4v

— Ki Young Ju 주기영 (@ki_young_ju) November 26, 2020

#6: Overextended Fear and Greed Index: Traditionally a Bear Signal

Another reason behind Bitcoin’s plummet could be the increased FOMO (fear of missing out). As CryptoPotato reported recently, the “buy bitcoin” searches skyrocketed on Google Trends as the price was gradually rising.

The number of newly-created addresses on the BTC network also surged to highs last experienced during the parabolic price increase in late 2017 and early 2018.

Topping it up is the Crypto Fear & Greed Index, which is in a state of extreme greed. In the words of the legendary investor Warren Buffet – it’s important to be “fearful when others are greedy.”

In any case, a greed index of 93 is historically an indicator that the market is overextended and probably due for a correction.