5 Reasons Why The Bitcoin Bull Run Has Started

Popular cryptocurrency YouTube content creator DataDash believes that Bitcoin has entered a long-term bull cycle. He based his opinion on several factors, including the famous stock-to-flow model, the increasing hodling mentality from investors, and the issuance of new coins.

Weekly And Monthly Bullish Patterns

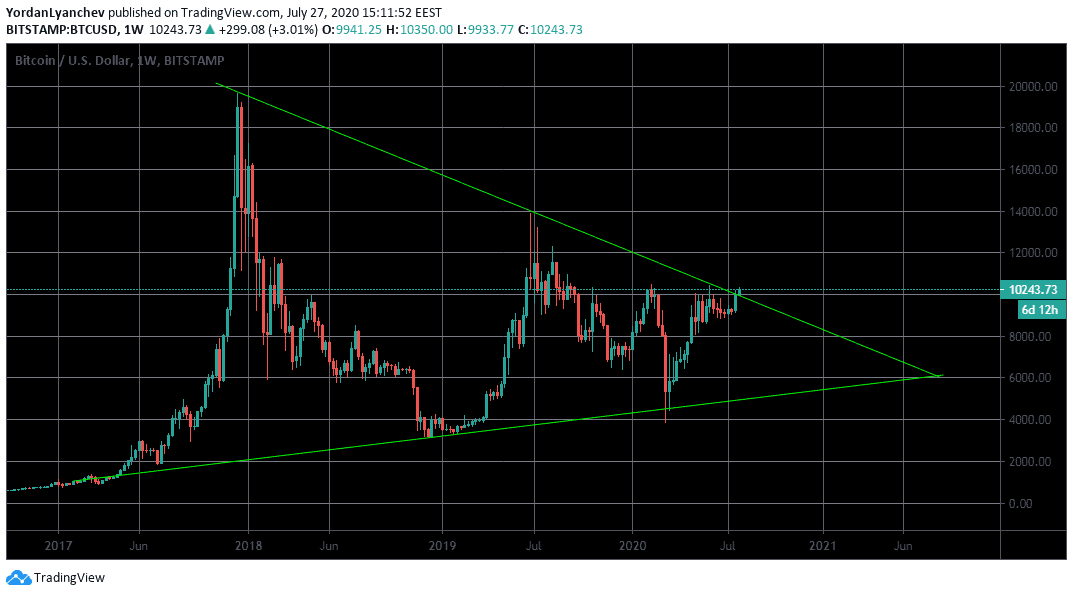

According to Nicholas Merten, the person behind the popular DataDash YouTube channel, Bitcoin’s recent performance solidifies an upcoming bull run. He began by examining a nearly three-year-old resistance level that started from the all-time highs in December 2017.

BTC was incapable of closing above it on the weekly chart since then but managed to do so this week. Merten classified it as a “massive moment for Bitcoin. Even on a weekly timeframe, we are flipping on a bullish pattern.”

Merten also observed an even higher timeframe – the monthly chart. He argued that Bitcoin doesn’t move in four-year cycles between each halving as the majority believe. Instead, the asset’s price follows expanding cycles.

The first such cycle took place around 2010 when “we started to get actual price data, actual volume, and the first major exchanges started to list Bitcoin.” It was eleven-month long. However, each cycle that follows adds about a year (11-13 months), making it larger, hence the name – expanding cycles.

The second one began in October 2011 and finished in November 2013, and the third completed one – ended in December 2017 when BTC reached its all-time high of nearly $20,000. The cycle that Bitcoin is currently in right now started at the end of the bear market in 2019. Its estimated time of completion is “somewhere around November 2022.”

“If we take a look at the logarithmic chart when we have the line resistance that’s curving over time, it’s roughly around a big even of $100,000.” – noted Merten.

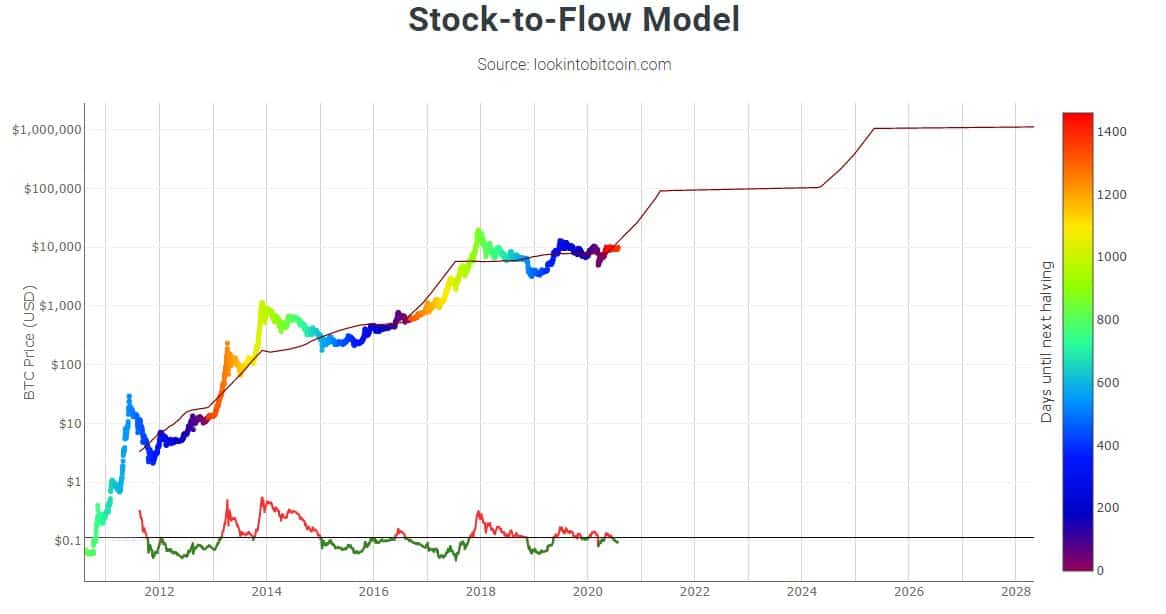

S2F Model

Merten also touched upon the famous stock-to-flow model. The stock represents the size of the existing stockpiles (or reserves), whereas the flow is the annual supply of BTC on the market. Since the halving occurring roughly every four years reduces the creation of new bitcoins by half, BTC’s stock-to-flow ratio predicts that the asset price could indeed surge to $100,000 per coin in a few years.

Following the third halving in May, many people began criticizing the model, as BTC’s price didn’t react immediately. However, Merten pointed out that historically, the asset has sometimes jumped months or even years after the event.

“As we look at the previous halving events, we can actually see that we get more and more of a delayed response here. During the previous cycle, it was after November 2017 – one month from the top – when the price finally went above the red line – the fair value of Bitcoin, according to the stock-to-flow model.

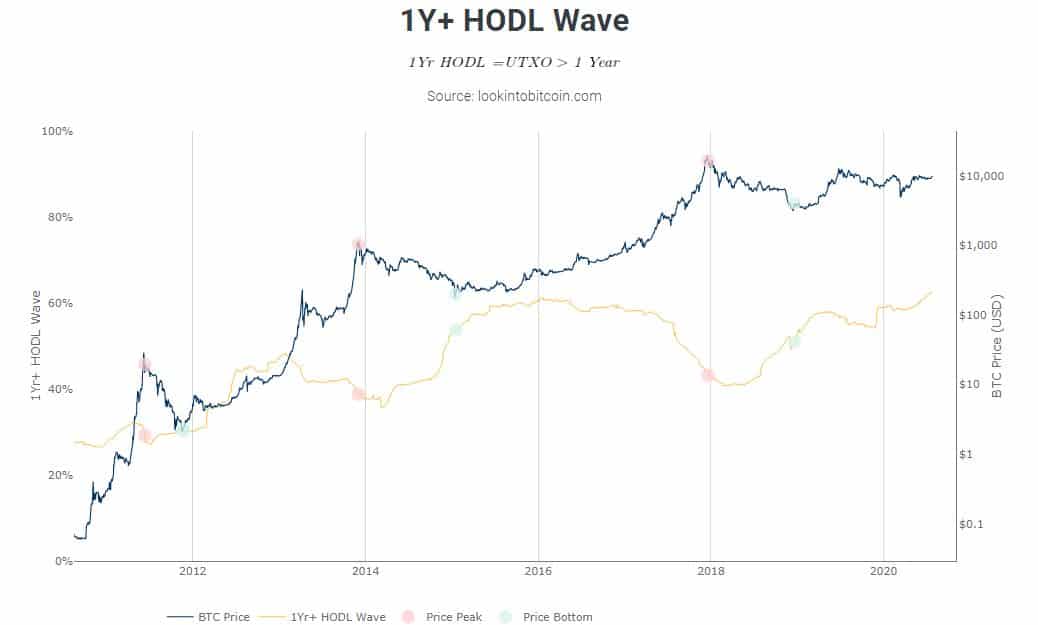

HODLing Helps

The increased HODLing mentality from Bitcoin investors is another indicator that could suggest a BTC price jump. The 1+ year HODL wave that tracks the number of bitcoins that have been stationary for at least one year is at a new all-time high, as the graph below illustrates.

More specifically, 62% of all bitcoins haven’t moved in one year or more. Merten highlighted the importance of this for the price, as it implies that people are more into holding their coins than actually spending or selling them.

“As we get more and more people, for example, players as Grayscale or other different institutional onramps, starting to get more bitcoins, it’s starting to get to the point where there is not much Bitcoin liquidity available on the market.”

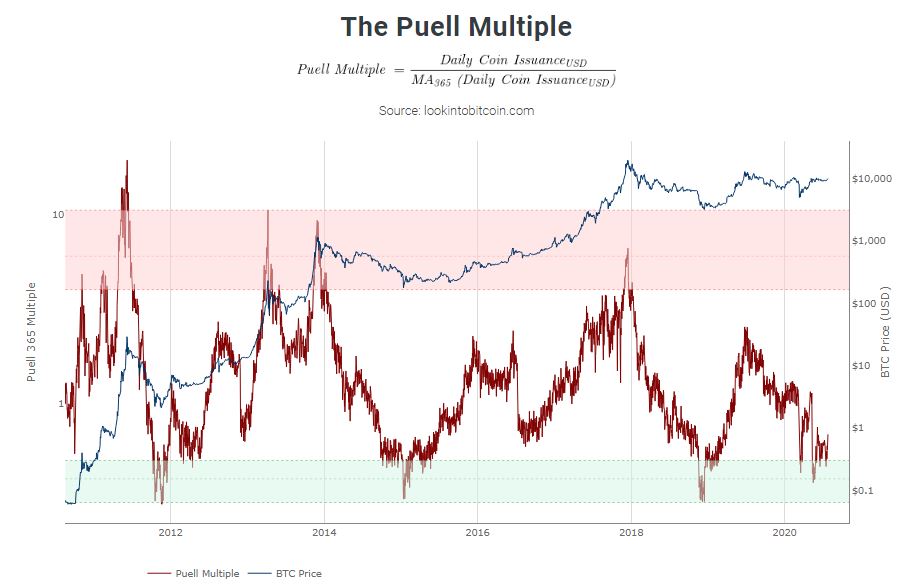

The Puell Multiple

The Puell Multiple metric divides BTC’s daily issuance value in USD (number of freshly minted coins added to the ecosystem by miners) and the 365-moving average of the daily issuance. According to Merten, it predicts price tops and bottoms quite accurately. And, since it’s currently situated in a relatively low position, it could solidify that BTC is undervalued now.

Ultimately, all of these factors support the narrative that Bitcoin is indeed heading towards a significant bull run, Merten explained.

“When you have a reduction in the available supply of Bitcoin due to the halving event, as well as a pick up in demand as its price continues to reach higher levels, and as more people start to hold on to Bitcoin, you get these very, very powerful cycles where you have massive multiples on BTC’s price.”

The post 5 Reasons Why The Bitcoin Bull Run Has Started appeared first on CryptoPotato.