5 On-Chain Factors Suggest Bitcoin’s Bull Run Could Have Started: Analysis

With bitcoin’s price surging by over $5,000 since the start of the year and reclaiming $20,000, the number of analysts predicting that the asset is out of the woods continues to increase.

CryptoQuant is the latest analytics company to offer some insight into the key on-chain signals that could suggest the start of a bull run.

- Shortly after Santiment informed that the supply of bitcoin held on centralized exchanges had dropped to a multi-year low, CryptoQuant outlined the movements between different types of trading venues as the first positive sign for BTC.

- More precisely, the analysts believe the transfers of assets from spot to derivatives platforms show that traders have entered a “risk-on” mode, which suggests “the beginning of a new bull cycle.”

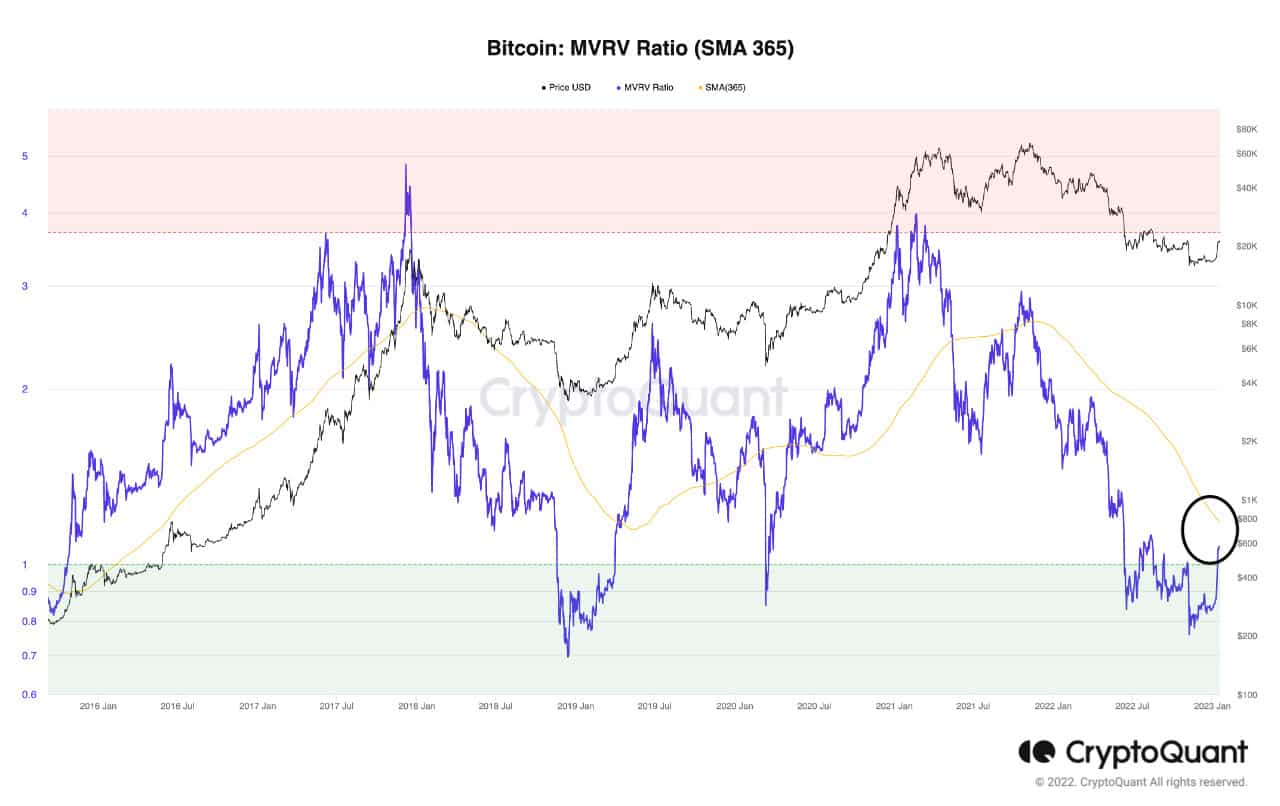

- The MVRV ratio is next, which shows whether BTC’s price is under or overvalued, comparing the actual market cap with the asset’s market price.

“MVRV is above 1 (1.07), and it is close to its 365-day moving average (orange line), which shows that bitcoin is about to start a new uptrend.”

- The Net Unrealized Profit/Loss (NUPL) is also close to the 365-day MA, which suggests the same as the MVRL.

- The Puell Multiple – showing the ratio of the daily dollar worth of newly issued BTC to their one-year MA – is the fourth signal. It displays positive signs as the asset’s price passed its 365-day MA for the first time in over two years.

- Lastly, CryptoQuant’s P&L index, which combines several indicators (the MVRV ratio, NUPL, and LTH/STH SOPR) into one, is “close to giving a buying signal for BTC.” Although the company said the Index still shows that bitcoin is expensive in the short term, it’s on the verge of changing its tides.

- Recall that Glassnode also said there are early signs of a starting bull market after a bear cycle that lasted for about a year.

The post 5 On-Chain Factors Suggest Bitcoin’s Bull Run Could Have Started: Analysis appeared first on CryptoPotato.