4 Possible Reasons for Bitcoin’s $5K Surge Above $41,000

The past 24 hours have been particularly turbulent throughout the cryptocurrency market, but this time it seems it’s all in favor of the bulls.

Bitcoin’s price surged above $41K for the first time since January 21st, and the whole market is in the green. Therefore, we’re taking a look at four possible reasons for which the positive move was triggered.

Reporting Season is Through

It’s worth noting that Bitcoin and the traditional stock market have been tightly correlated for quite some time. As such, what happens on Wall Street has been impacting the cryptocurrency market for a while, and it’s critical to be aware of macroeconomic factors that influence stocks.

The majority of the tech giants and other big names in the legacy markets are done filing their financial reports for the last quarter of 2021. These are important catalysts for considerable fluctuations in the markets.

For example, just a few days ago, CryptoPotato reported that Meta (formerly known as Facebook) filed their Q4 2021 report and revealed a loss of daily active users for the first time in history. In response, their stock price tumbled over 26% in the after-hours trading session following the filing.

Now that these reports are through, it’s perhaps safe to assume that the markets would be less volatile, devoid of massive catalysts of the kind, taking away some of the uncertainty off the table.

US Jobs Reports Exceeding Expectations

The recent figures revealed that the US added almost half a million new jobs in January alone, despite the spread of the Omicron variant that tends to lead businesses short-staffed.

This was reported by the US Labor Department’s Bureau of Labor Statistics on February 4th. The unemployment rate increased slightly from 3.9% to 4% over the same period.

The report surpassed the expectations of economists who predicted just 150K new jobs according to a Dow Jones survey. In addition, the length of time during which people remain unemployed also decreased:

“In January, the number of persons jobless less than 5 weeks increased to 2.4 million and accounted for 37.0 percent of the total unemployed,” reads the report. “The number of long-term unemployed (those jobless for 27 weeks or more) declined to 1.7 million.”

Now, it’s once again important to keep the bigger picture in mind as more jobs tend to translate to lower inflation – something that the wide publicity has been advocating for quite some time. Just for reference, the price of BTC dipped slightly after the report and then exploded to a high not seen in more than two weeks.

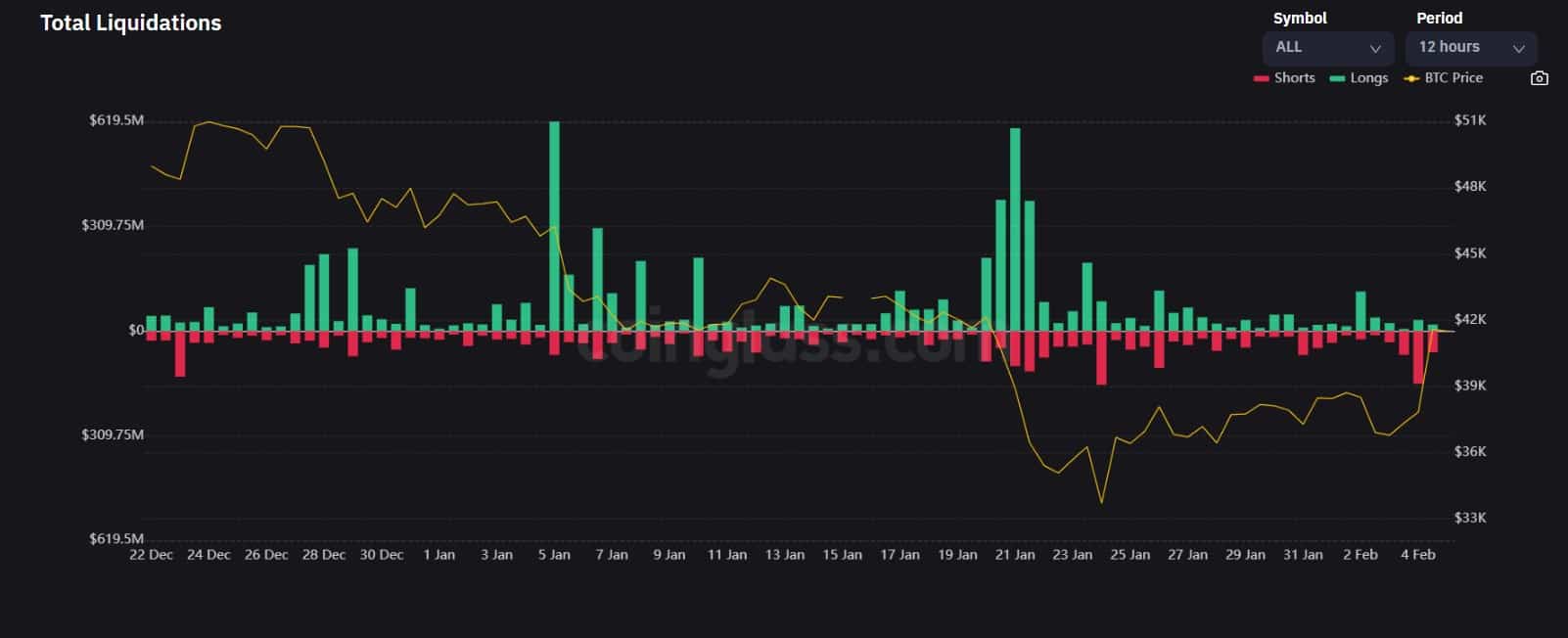

$220 Million in Short Liquidations

Data from CoinGlass reveals that over the past 24 hours, the market saw a whopping $220 million worth of liquidated short positions across major exchanges including Binance, OKEx, FTX, Bybit, Huobi, BitMEX, and so forth.

In total, over 80% of the liquidations in the past day were of short positions which triggered the so-called short squeeze – a market condition where the price is moving upwards, triggering more and more liquidations which in turn trigger further upward momentum.

A Correction Was Due

The price of Bitcoin has been on a massive downtrend in the past couple of months and there haven’t been any significant positive corrections for quite a while.

Yesterday’s daily candle market the largest green candle since the drop that took place on November 10th – the day BTC also marked its all-time high price.

It’s now interesting to see whether or not this will be a confirmed breakout of the downtrend and whether or not the market will start recovering. The upcoming weekly close tomorrow will be critical but it’s still particularly important to remain very careful in the upcoming days as volatility is likely to be enhanced.