4 Possible Reasons for Bitcoin’s $12K Correction After Reaching $42,000 All-Time High

The past couple of days have been very volatile for Bitcoin. Ultimately, though, the volatility played out in favor of the bears.

The price lost almost $12,000 of its value and tumbled to an intraday low of around $30,260 on Bitstamp. In fact, the past 6 out 9 four-hour candles are all painted in red. This is a decrease of about 27%.

All of this happened a couple of days after Bitcoin painted a fresh all-time high of around $42,000 on Friday, and it’s worth looking at some of the possible reasons for it.

Price Was Going Parabolic Without a Serious Correction

This is the first thing that anyone needs to consider when looking at the above chart. As seen there, the only major correction of above 10% happened on January 4th when the price dropped from $33,600 to about $27,700 – a 17% decline.

Apart from that, it has pretty much been “up only” for Bitcoin ever since it breached the coveted $20,000 mark back in December.

This has been recently touched upon by the well-known Bitcoin proponent Dan Held, who noted that “just like the last cycle, there will be several dips in this one.”

Just like the last cycle, there will be several dips in this one.

HODL and you will be rewarded for your conviction. pic.twitter.com/7KcM83E2PN

— Dan Held (@danheld) January 11, 2021

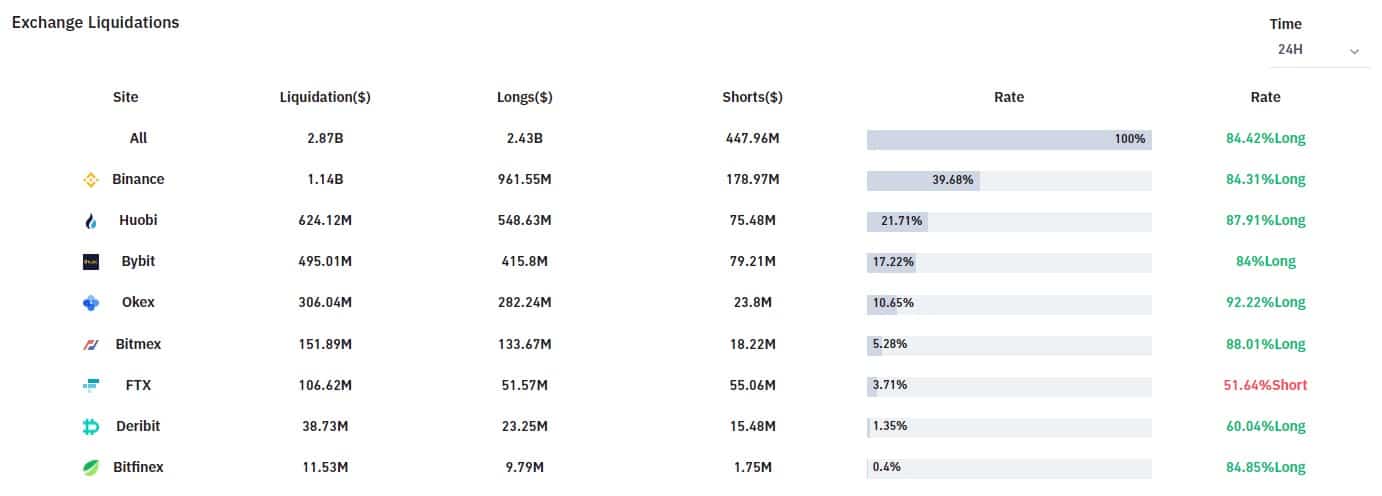

In addition, several analysts have pointed out that the Bitcoin market has been heavily overleveraged. This is perfectly indicated by the number of liquidations in the past 24 hours alone.

In less than a day, more than $2.87 billion worth of both short and long positions have been wiped off on major exchanges.

As it’s commonly the case, Binance is leading the way, followed by Huobi and Bybit. It’s also worth noting that today’s trading volume is also substantial, sitting at about $235 billion at the time of this writing.

In any case, going forward, if the trend remains intact, it’s important to keep in mind that Bitcoin is traditionally volatile, and sudden spikes of this kind are somewhat commonplace.

Profit Taking

The main narrative in the past year is that this rally isn’t driven by retail – it’s driven by institutions. And we can see why this idea has been so prevalent.

Plenty of high net-worth individuals, prominent hedge funds, and publicly-traded companies have jumped on the Bitcoin train. And while a lot of them have outlined Bitcoin’s inherent qualities as reasons for their involvement, pushing the “digital store of value” narrative to new heights, profit-taking is obviously not out of the equation.

Just today, amid the ongoing crash, the CIO of Guggenheim, Scott Minerd, said:

“Bitcoin’s parabolic rise is unsustainable in the near term. Vulnerable to a setback. The target technical upside of $35,000 has been exceeded. Time to take some money off the table.”

As CryptoPotato reported back in November, Guggenheim filed with the SEC to seek approval to allocate millions of dollars in BTC. This goes to show that while institutions might bring further attention and capital to the market, realizing profits is paramount for everyone involved.

Whales Shaking Weaker Hands Out

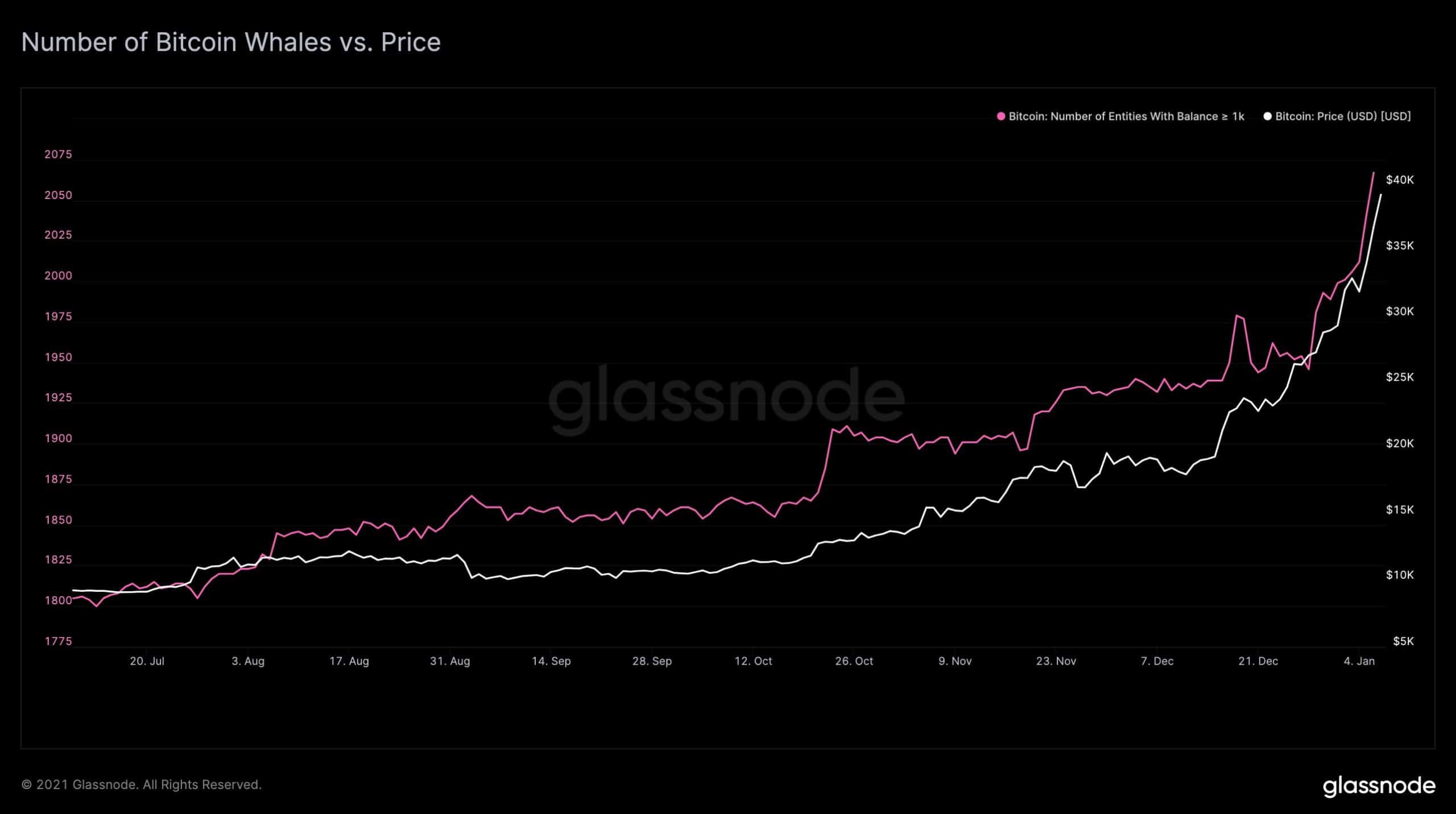

In our recent report, we highlighted that whale addresses continue to accumulate while bitcoins on exchanges are decreasing.

In general, retail investors are more likely to keep their BTC on an exchange because the amount isn’t that substantial. This is not a new phenomenon – it’s something that has been happening for nearly a year.

However, the CTO of crypto intelligence firm Glassnode highlighted the correlation between the price of bitcoin and the growing number of addresses holding at least 1,000 BTC. This shows that whales are expanding their holdings as the price is going up.

The net effect of all this is people with smaller holdings tend to sell to those with larger holdings – thus, the weaker hands getting shaken out.

HSBC Blocking Transactions from Crypto Exchanges

Last but not least, we have a piece of news from earlier today. HSBC has reportedly blocked transactions to or from cryptocurrency exchanges, and it has taken a heavy-handed approach to Bitcoin and other cryptos.

A number of UK banks have also made moves to prevent their customers from buying crypto assets using their credit or debit cards.

While this doesn’t seem like something that surprising, HSBC is a global banking giant, and the fact that its clients won’t be able to transfer funds from crypto exchanges could easily become a catalyst for a retail-driven selloff.