3 Reasons Why Bitcoin Price Surged Over 40% in The Past 30 Days

It’s safe to say that 2019 is so far shaping up to be a lot better year for Bitcoin compared to 2018. Since January, Year to date, the cryptocurrency is up by almost 60 percent.

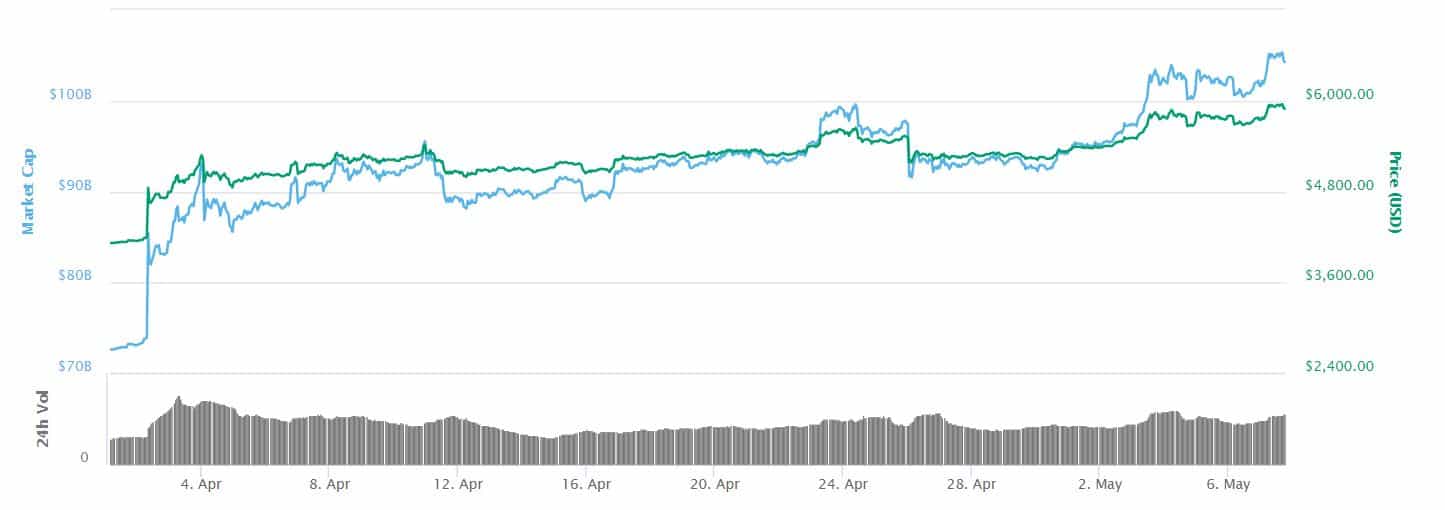

Most of these gains, however, were made in the last month. April has turned out to be a very strong period for Bitcoin, as it managed to increase with more than 40 percent in about a month.

Most importantly, Bitcoin managed to retain the gains and it is continuing to climb higher. The cryptocurrency hit $6,000 earlier this week, which is something we hadn’t seen for the past 6 months.

So, what’s causing the strong performance of Bitcoin? While it’s challenging to identify the exact reason, there are at least a few factors which could be propelling the upward trajectory of Bitcoin. Let’s have a look.

Fidelity to Offer Crypto Trading in a Few Weeks

Fidelity Investments is a Boston-based asset manager which has over $2.4 trillion in assets under management (AUM). While the company has been known for its interest in the cryptocurrency space for a while now, on May 6th, Bloomberg reported that sources familiar with the matter have said that the company will be buying and selling Bitcoin for its institutional customers “within a few weeks.”

Institutional interest in Bitcoin is undoubtedly one of the more serious things to be considered when speaking about its price. The cryptocurrency market, in general, is currently sitting on a market capitalization of a bit more than $186 billion, which is incomparable to traditional markets. Hence, even a relatively small interest from large institutional investors is capable of causing serious shifts in its current position.

Following the news of Fidelity, Bitcoin spiked with about 5 percent in a few hours.

Technicals and Fundamentals Looking Better

One of the recognized Bitcoin proponents, Thomas Lee, the head analyst at Fundstrat Global Advisors, has once again come out strong, saying that Bitcoin will see a major improvement in its price somewhere in 2020. He also outlined that there is a number of catalysts which are “likely” to propel it to a new all-time high (ATH).

As a main reason for this, Lee said that there are signs that fundamental, as well as technical characteristics are improving. He also noted that there is real activity by cryptocurrency holders. Moreover, his company, Fundstrat, has come up with 11 signs that pertain to a bull market, which is perhaps a sign that the prolonged bear market of 2018 is over.

On another note, the analyst also said that Bitcoin’s standard deviation from the S&P 500 index is about 2.5 this year and it could help drive the price even higher:

One thing to keep in mind is whenever the S&P has made a big move, … it’s almost always led to a big move in crypto later in the year. […] So I think … a 2.5 standard deviation move for bitcoin would take it to $14,000. I’m not saying that’s where it’s going to go, but that’s the magnitude of move that would be a catch-up.

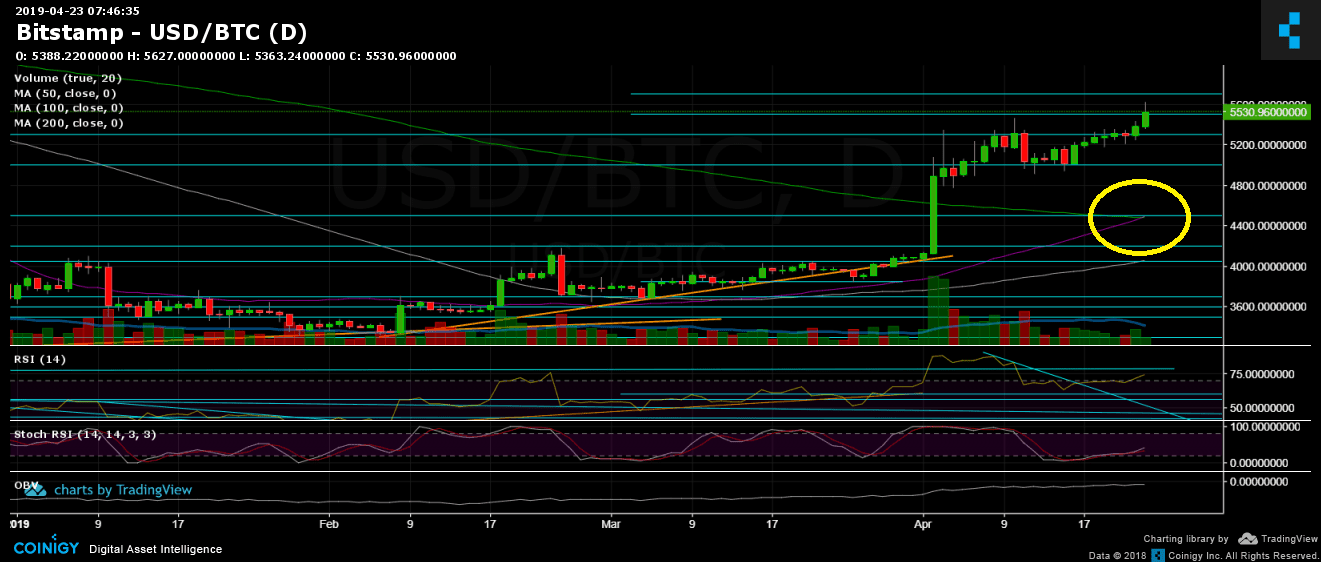

Add to the above, the anticipated Golden Cross which took place recently. A Golden Cross is when the 50-days moving average line crosses above the 200-days moving average line. Those who tend to compare 2014 market cycle to the current 2018 one, were anticipating this Golden Cross and might see it as a reason to return to buy Bitcoin.

Positive Community Sentiment Driven By Announcements

It’s also worth pointing out that the overall community sentiment is also seemingly shifting. And it also seems that there are quite a lot of reasons for this. Marquee traditional companies are continuing to venture into the field of blockchain.

The Wall Street Journal recently reported that the social media giant Facebook is seeking investments worth $1 billion for its rumored stable coin. Moreover, one of the world’s leading shoemakers, Nike, has also expressed intent to step into the field by creating its own cryptocurrency called Cryptokicks. In fact, the company has already filed an application seeking protection over the name.

In any case, there are obvious signs of recovery in the market. The price has been climbing steadily of late. Of course, there are still important levels to be breached on the way up and whether bulls will find the strength to do so is something that we have yet to see.

The post 3 Reasons Why Bitcoin Price Surged Over 40% in The Past 30 Days appeared first on CryptoPotato.