3 Companies Buying More BTC While Bitcoin Price Stays Below $30k – Will They Buy Bitcoin Minetrix Next?

Despite Bitcoin’s price struggling below $30,000, some major companies are continuing to accumulate the cryptocurrency.

These companies still believe in Bitcoin’s long-term future, seeing its low trading price as a buying opportunity.

In this article, we discuss three companies buying more BTC in 2023 before debating whether they might stock up on trending crypto Bitcoin Minetrix (BTCMTX) next.

1. MicroStrategy

First up is MicroStrategy, a business software company that has been one of the biggest buyers of BTC in recent years.

As of August 1, MicroStrategy held a whopping 152,800 BTC and had purchased 12,800 BTC in the previous quarter.

At the time of its Q2 2023 earnings report, MicroStrategy’s Bitcoin holdings were acquired at an average cost of $29,672 per BTC.

MicroStrategy’s CEO, Michael Saylor, often praises Bitcoin in the media and has said that he believes it’s superior to traditional FIAT currencies.

Under Saylor’s leadership, MicroStrategy has even issued convertible bonds and senior notes to raise cash in order to buy more Bitcoin.

Although this crypto-focused approach hasn’t sat well with all of MicroStrategy’s shareholders, the company’s share price is up over 245% since it started buying BTC, suggesting that it has found favor with some investors.

2. Galaxy Digital

Another company that has been buying more Bitcoin in 2023 is Galaxy Digital – an asset management company specializing in digital assets and blockchain technologies.

As of April 2023, Galaxy Digital reportedly had 8,100 BTC in its possession, with $2.5 billion in assets under management (AUM).

The firm’s Chief Investment Officer, Christopher Ferraro, has previously expressed his optimism about the future of Bitcoin, citing institutional interest and the potential approval of spot BTC ETFs as key catalysts going forward.

Alongside Bitcoin, Galaxy Digital has also been investing in other cryptocurrencies through its various funds, focusing on decentralized finance (DeFi) and Web3 infrastructure.

This diversified approach has allowed the firm to mitigate some risks associated with investing solely in BTC while exposing it to other high-growth areas in the crypto space.

3. Marathon Digital Holdings

Finally, Marathon Digital Holdings is another company accruing BTC in 2023, but not in the way that MicroStrategy and Galaxy Digital have.

Since Marathon Digital is a Bitcoin mining company, it mines enormous amounts of BTC each month, thanks to its colossal hash rate.

As of August 1, the company reported unrestricted holdings of 12,964 BTC, equating to approximately $379 million.

Additionally, Marathon Digital has been gradually expanding its operational capacity each month this year, even beginning a joint venture in Abu Dhabi to mine more BTC.

This continued growth in BTC production demonstrates its commitment to Bitcoin’s long-term future – and could prove fruitful if the coin’s price breaks above the crucial $30,000 level in the months ahead.

Bitcoin Minetrix’s Stake-to-Earn Model Draws Investor Interest as Presale Raises $180,000

While these three companies continue accumulating Bitcoin, a new cryptocurrency called Bitcoin Minetrix (BTCMTX) is gaining attention through its limited-time presale phase.

This project offers a “Stake-to-Mine” mechanism that allows investors to earn BTC without needing advanced mining hardware.

Bitcoin Minetrix’s developers aim to make BTC mining more accessible and efficient – especially for everyday crypto enthusiasts who typically face high barriers to entry when it comes to Bitcoin mining.

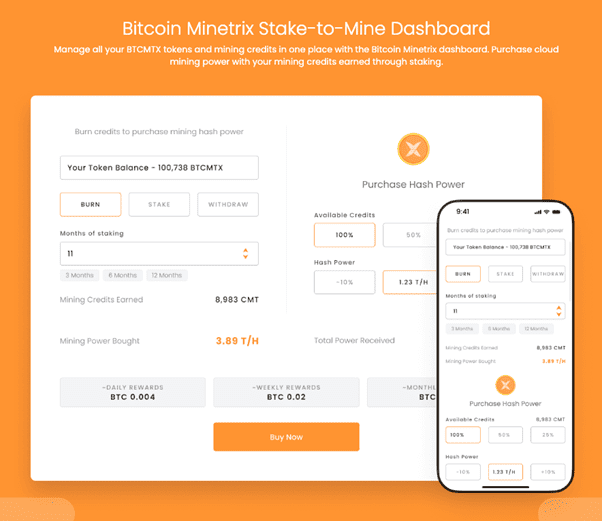

According to Bitcoin Minetrix’s whitepaper, the process works through BTCMTX, the platform’s native token.

Users can buy BTCMTX tokens, stake them to earn cloud mining credits, and then burn them to produce cloud mining power – which can be used to earn BTC passively.

This whole process is handled through Bitcoin Minetrix’s user-friendly dashboard, which will also be available to download on smartphone devices.

Although the platform is still in development, Bitcoin Minetrix’s team is hosting a limited-time presale for BTCMTX, allowing early investors to buy tokens for $0.011.

Over $180,000 has been raised since the presale went live, with the official Telegram community also seeing rapid membership growth.

YouTube influencer Michael Wrubel, who has over 310,000 subscribers, even endorsed BTCMTX in a recent video.

Although there have been no rumors about MicroStrategy, Galaxy Digital, or Marathon Digital Holdings buying BTCMTX, the growing attention and unique value proposition of the token could pique the interest of these firms in the future.

Visit Bitcoin Minetrix Presale

Disclaimer: The above article is sponsored content; it’s written by a third party. CryptoPotato doesn’t endorse or assume responsibility for the content, advertising, products, quality, accuracy, or other materials on this page. Nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully before engaging with any company mentioned and do their own research. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

Readers are also advised to read CryptoPotato’s full disclaimer.

The post 3 Companies Buying More BTC While Bitcoin Price Stays Below $30k – Will They Buy Bitcoin Minetrix Next? appeared first on CryptoPotato.