3 Catalysts That Suggest More Gains for Bitcoin After Price Broke $60K

Bitcoin surged above $61,000 on Wednesday, marking its highest level since November 2021. The rally seems fueled by significant inflows into US-based spot Bitcoin ETFs.

With bullish momentum building, all eyes are on the leading crypto asset’s trajectory, and data suggest that it might be able to break its previously established all-time high of $69,045.

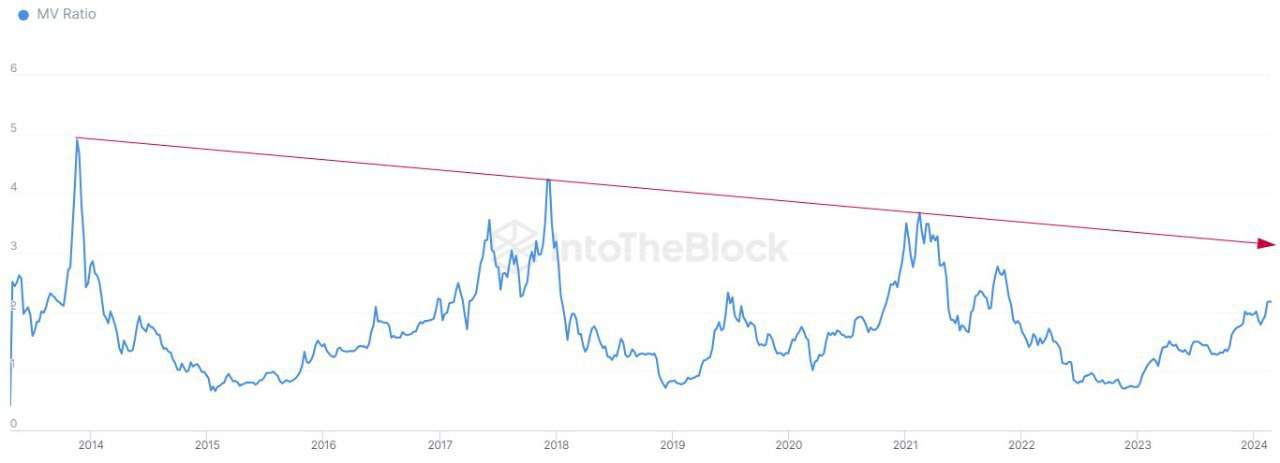

MVRV Ratio Signals Buying Opportunity

The MVRV Ratio, derived from dividing an asset’s market capitalization by its realized capitalization, serves as a pivotal metric in cryptocurrency trading. When below 1, it indicates most holders are at a loss, signaling a potential buying opportunity.

On the other hand, a rising ratio suggests increased profit-taking, potentially leading to selling pressure and market corrections.

Historically, an MVRV Ratio nearing 4 signaled market tops, though this threshold has decreased in each cycle. According to Intotheblock’s latest observation, the value stands at 2.22, essentially hinting at a bullish market that is not yet excessively overheated.

Subdued Retail Crowd

Despite Bitcoin’s remarkable price movement, current data suggests an absence of retail investors. While there has been a rise in the number of new addresses, Intotheblock said it is likely attributed to active market participants engaging with Ordinals.

However, new addresses have since declined and remain relatively consistent. The same pattern is observed with active addresses. Both Google trends and app store data show no significant surge in retail interest yet.

On-chain volume is gradually increasing, reminiscent of the early phases of the 2021 bull market, but it has not reached the frenzy levels seen during the peak.

This implies that institutional investors might be driving this phase, with attention focused on ETFs as potential accumulators.

Despite Bitcoin’s incredible price movement, current data indicates a quiet retail front

While there was a boost in new addresses, this was likely related to active market participants engaging with Ordinals. New addresses have dropped since and remain relatively stable. The… pic.twitter.com/uS1Gxd3Rg2

— IntoTheBlock (@intotheblock) February 28, 2024

Meanwhile, those monitoring altcoins are speculating on whether renewed retail interest will shift Bitcoin’s upward trend towards broader market movements. However, the upcoming halving could change this dynamic and push the crypto asset to a new peak.

Bitcoin Halving: A Major Catalyst

The analysis from ITB suggests that the upcoming Bitcoin halving in April typically triggers a surge in price according to historical patterns. However, in the current cycle, the price rally has occurred earlier than anticipated.

This deviation may imply that investors are aware of the potential impact of the halving and are adjusting their investments accordingly ahead of time. In short, these market players are anticipating and acting upon the expected price movement associated with the halving event well before it actually takes place.

The post 3 Catalysts That Suggest More Gains for Bitcoin After Price Broke $60K appeared first on CryptoPotato.