3 Bullish Signals for Bitcoin’s Price as Uptober Approaches

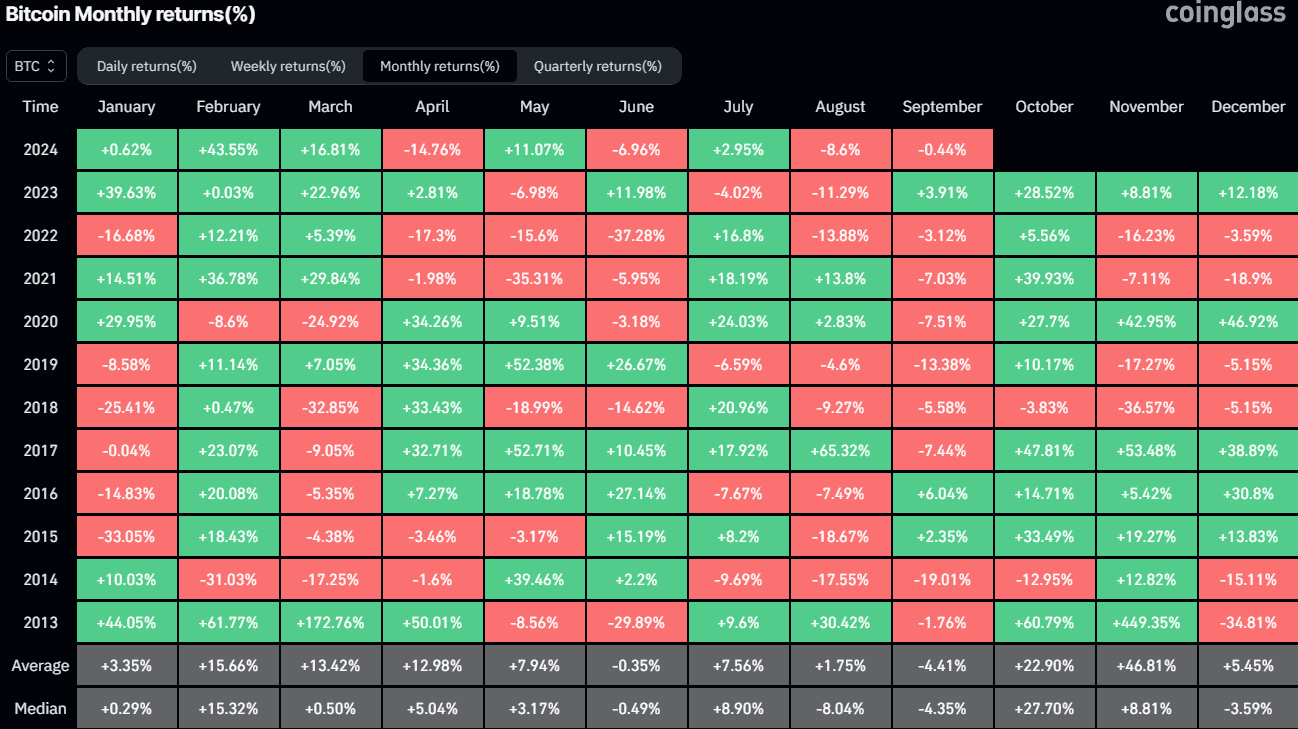

September is more than halfway through, and all eyes in the cryptocurrency community are on October, commonly referred to as Uptober, given the historical performances of BTC and the altcoins.

Here are three (and a bonus) signals that hint at an upcoming price surge for bitcoin by the end of 2024.

Whale Activity (x2)

CryptoQuant’s recent analysis reviewed two important aspects of whales’ activity. The first involves newer such market participants who have accumulated their BTC stash in the past 155 days. Their average base cost stands at $62,038, which means that they sit on minor unrealized losses of under 5%.

According to on-chain data, though, these newer whales refuse to sell at current prices: just the opposite. The report reads that they are “still accumulating, showing long-term confidence in bitcoin.”

Older whales, those who entered the ecosystem more than 155 days ago, stand in the opposite corner in terms of unrealized profits. Their base cost is $27,843, which means that their invested funds have more than doubled. However, the report outlined their HODLing behavior as they refrain from selling even with such impressive increases.

Miners Tend to HODL

Being the heart and soul of the Bitcoin network, miners have a highly important job in safeguarding the world’s largest blockchain. They are rewarded with 450 BTC daily (after the 2024 halving) for their efforts, and most larger mining companies have accumulated substantial stashes. What they do with those holdings frequently impacts BTC’s price, especially if they decide to sell in bulk.

However, that hasn’t been the case lately. CryptoQuant’s analysis determined that their average base cost is $43,179, which means that miners stand on (unrealized) profits of just under 40%.

“Though in profit, no signs of mass selling, suggesting they may hold or gradually sell.” – reads the report.

The only possible threat comes from Binance traders, as they seem more inclined to sell off quickly and realize profits. However, this is also questionable as the current trend shows that they are “actively buying.” Additionally, the BTC reserves on exchanges continue to decline, which reduces the immediate selling pressure.

“New whales and Binance traders are actively buying, while old whales continue to hold. This mix could signal market stability and potential price growth.” – concluded CryptoQuant’s analysis.

Bonus: Rate Cuts

Although many market participants believe the potential rate cuts by the US Fed have already been priced in, they are still worth mentioning due to the impact they could have on the entire industry. History shows that lower interest rates (meaning cheaper money available for borrowing) have resulted in rising prices in the crypto market and vice-versa.

With many global central banks, such as Canada, the UK, and the ECB, already reducing their local interest rates, Fed chair Jerome Powell said last month that the time has come for them to follow suit. The next FOMC meeting is taking place on September 18 and 19, and rate cut expectations vary from 25 to 75 basis points.

This could coincide perfectly with one of the most bullish months in BTC’s history, which is right around the corner – October (Uptober). CoinGlass data shows that only two out of the last 11 Octobers have been in the red, while the average returns stand at 22.9%.

The post 3 Bullish Signals for Bitcoin’s Price as Uptober Approaches appeared first on CryptoPotato.