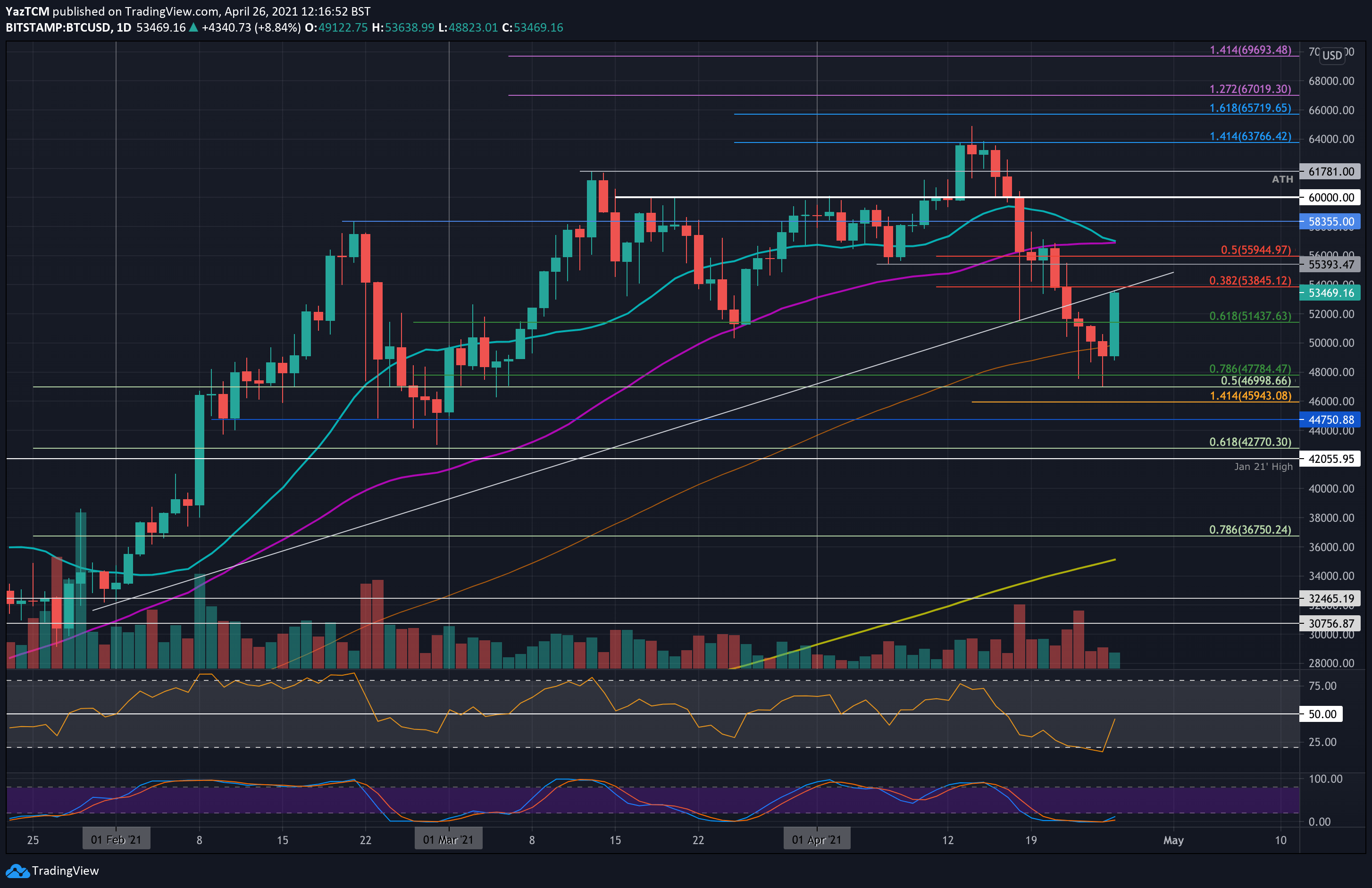

3.5 Million ETH Locked in Uniswap as Total Liquidity Approaches $3 Billion

Uniswap has been the top DeFi protocol for more than a month now. According to the latest statistics, users have locked almost 3.5 million Ether (ETH) tokens on the decentralized exchange. Along with this, the total USD liquidity on Uniswap is nearing the $3 billion mark.

Uniswap Now Holds $1.35 Billion Worth Of Ethereum (ETH)

It’s been a rollercoaster ride for the unicorn branded decentralized exchange since June this year. And with the DeFi train picking up steam with every passing day, Uniswap has stood to gain the most. It is the most popular protocol as per DeFi Pulse. And the latest statistics show that users have locked almost 3.5 million Ethereum (ETH) tokens worth $1.35 billion on Uniswap.

No doubt, Uniswap is getting most of its liquidity from ETH. Also, Ethereum on-chain data reveals that out of a daily transfer of $300 million (worth of ETH) to DeFi protocols, Uniswap is getting the lion’s share.

On the Flipside: Is it time to take #DeFi seriously? #Ethereum‘s on-chain data reveals that:

– $300MM is sent to DeFi apps & DEXes vs. $156MM to CEXes

– 70% of that ($211MM) is going to @UniswapProtocol specifically https://t.co/tF1O0KUyFI pic.twitter.com/puh4PQ8PCL

— Flipside Crypto (@flipsidecrypto) October 13, 2020

Due to this massive inflow of funds, the total USD liquidity on Uniswap is about to touch $3 billion.

Should these numbers make Bitcoin maximalists take Uniswap and the DeFi space seriously? Cryptocurrency usage analysis firm Flipside Crypto thinks so.

Bitcoin Maximalists Blasting Uniswap And DeFi Should Sit Up And Pay Attention

In the latest article on DeFi, Flipside Crypto observed that bitcoin maximalists had left no stone unturned in denigrating Uniswap and the entire decentralized finance ecosystem.

There are certain individuals in the blockchain space who believe that Bitcoin will inevitably become a monopoly due to network effects, and that building any other project or cryptocurrency is not only futile, but unethical. This line of thought is known as Bitcoin Maximalism, and its adherents are the only ones still denying the value of DeFi applications.

The firm referred to Anthony Pompliano and Tone Vayes’ recent comment on Uniswap, its founder Hayden Adams, and said that maximalists like them should take the DeFi space seriously. And why?

Because Bitcoin users and holders are slowly and gradually moving to the Ethereum blockchain to put their BTC stash to ‘better’ use. Data from Dune Analytics shows that around 137,000 tokenized bitcoins are now circulating on Ethereum. Going by the latest spot rates, this works out to be a supply worth $1.6 billion.

Also, the above data shows that traders/investors collectively transfer only $156 million in ETH to centralized crypto exchanges as opposed to a daily transfer of $300 million to DEXes and DeFi apps. Combining this with the rising ‘Bitcoin on Ethereum’ numbers, the firm suggests its time to take DeFi protocols like Uniswap seriously and not ‘stay glued to the Bitcoin blockchain.

The post 3.5 Million ETH Locked in Uniswap as Total Liquidity Approaches $3 Billion appeared first on CryptoPotato.