2020 Established Bitcoin And Ethereum As Institutional Assets, Says Coinbase

The largest US-based crypto exchange Coinbase has classified bitcoin and several altcoins as institutional assets following the developments in 2020. In its yearly report, the company has confirmed the growing institutional interest, the maturing market, and, somewhat surprisingly, the expanding appetite from corporations towards ETH.

2020 Established Bitcoin As An Institutional Asset

The challenging last year saw the emergence of Bitcoin as an asset fit to serve the needs of institutional investors, reads Coinbase’s 2020 report. The popular exchange noted that larger investors, including corporations, view BTC as a “non-sovereign, digital commodity that is about scarcity, driven by growing demand and a predictable, inelastic supply.”

That last quality is what garnered their attention the most, explained the report. The worldwide initiatives by global superpowers, including the US, to commence into “aggressive” monetary policies, fiscal stimulus, and low interest rates have highlighted the total supply of 21 million bitcoins ever to exist.

“Specifically, many saw it as an increasingly attractive long-term store of value, treasury reserve asset, and inflation hedge. They looked to the largest crypto asset to protect their wealth in the “new normal.”

Some of the most prominent names that publicly admitted purchasing BTC include MicroStrategy, Square, One Asset River Management, Ruffer Investment, MassMutual, and more.

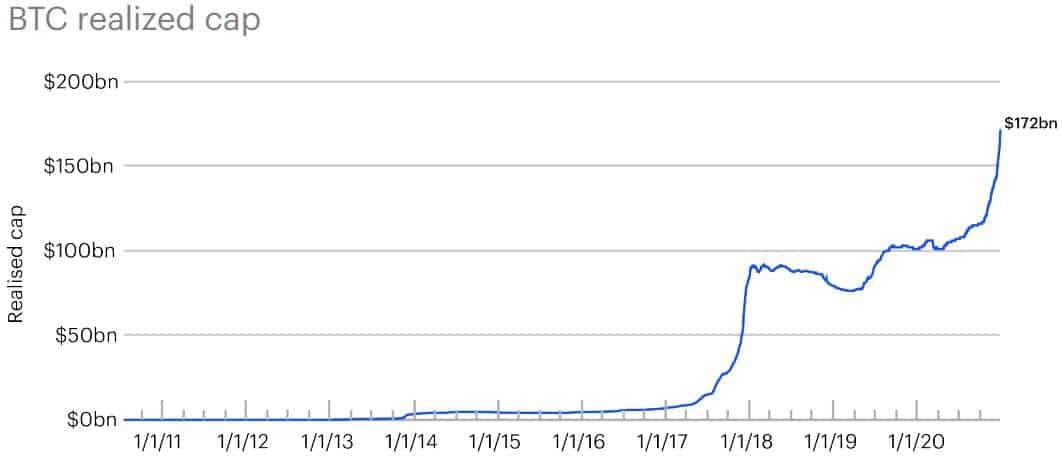

The paper breached BTC’s realized capitalization as a metric that helps determine “investors’ growing faith in Bitcoin’s status as a store of value.” It values “each unit of Bitcoin at the price it most recently moved on-chain, while also accounting for permanently lost Bitcoin.”

Despite the growing narrative of BTC serving as a store of value for some of these giants, Coinbase asserted that it’s still very early in the adoption cycle. BTC’s market cap as of the end of 2020 represented 20% of private-sector gold investments, 3% of the M2 money stock, and less than 1% of global institutional-grade real estate.

Ethereum’s (Un)Surprising Role

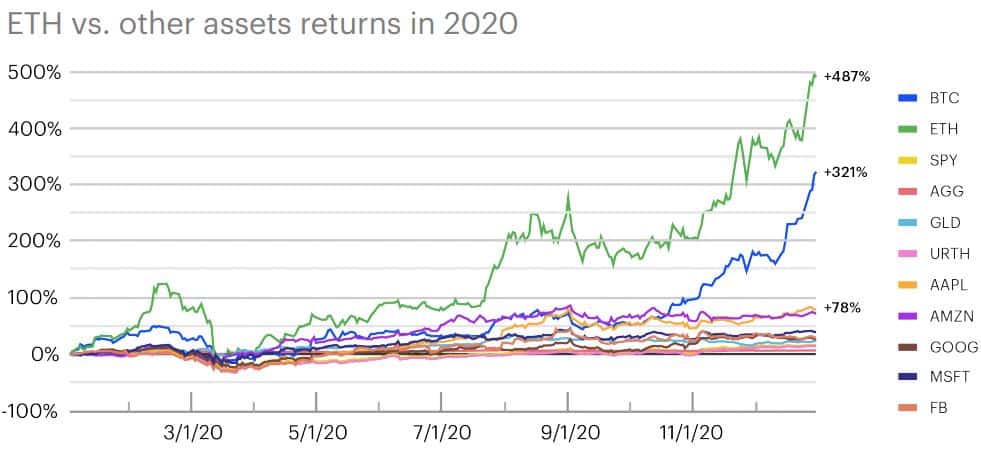

Although the paper admitted that most institutional clients had used Coinbase to allocate funds in BTC, a “growing number” also took large positions in the second-largest digital asset. As such, it helped the asset price to appreciate by nearly 500% in 2020 and become one of the best performers in and outside the crypto industry.

Coinbase clients view Ethereum as a “decentralized computing network that shares Bitcoin’s properties of trustless store and transmission of value, along with more flexible programmability via smart contracts.”

Despite several challenges and risks, including scaling friction and high transaction costs, the paper highlighted Ethereum’s “incredible potential” and upcoming ETH 2.0 upgrade as the key aspects of attracting fresh investors.