2019 in Review: Nic Carter on Quadriga, Libra and Other Suspect Projects

This post is part of CoinDesk’s 2019 Year in Review, a collection of 100 op-eds, interviews and takes on the state of blockchain and the world.

It’s apt that Nic Carter’s favorite book is Candide, a satirical novella published during the age of enlightenment. It’s a story of a sheltered man coming to terms with the hardships of reality. Deeply critical of the optimism of the age, the philosopher Voltaire asks in Candide, “If this is the best of possible worlds, what then are the others?”

Not a satirist himself – though he’s given it a hand – Carter is one of crypto’s most dogged critics. His rise to prominence coincided with the gaining popularity of the phrase “blockchain, not bitcoin” — the idea that distributed ledgers are a solution to everything from world hunger to cancer. Carter isn’t convinced blockchain will usher in a utopia.

If this is the best of all possible ledgers, what’s with all the fraud?

But Carter does believe crypto – especially bitcoin – will change the world for the better. As founder of Castle Island Ventures, a venture capital operation, and CoinMetrics, an analytics startup, he’s actively investigating and investing in what he sees as the industry’s most promising projects.

We caught up with Carter in late October to discuss the industry’s recent scams, the dangers of fractional reserve banking, Libra, and the effects of spending too little time in “meat-space.”

Nic, crypto has come under attack from a lot of places this year, from state actors, the media to some extent, especially after Gerald Cotten died and people lost millions of dollars. I mean, why would anyone trust it?

Cotten was such a good case study. What people thought was the case was not the case as it was reported. I was super skeptical of the original story — that this guy just lost some keys. He basically operated a Ponzi exchange. It’s really a story about fractional reserve banking and how everything goes wrong when people think an exchange doesn’t have sufficient reserves. At that point, there’s gonna be a run on the bank. That’s why I really agitate for proofs of reserve. Exchanges should publish periodic attestations that they have X amount. Quadriga should be a catalyst for this. But nobody gave a shit. It was nothing to do with the security of bitcoin or custody. It collapsed because this guy was a fraudster. For whatever reason, people don’t demand proofs of the actual solvency, at least with the vigor they might question banks.

Do you think this represents a systemic risk for the industry? That exchanges could be potentially be operating when they’re actually insolvent?

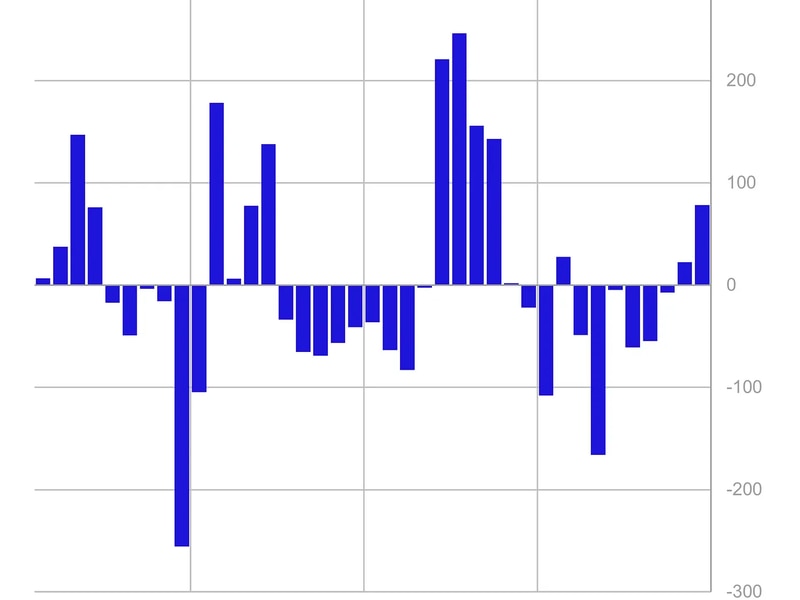

My guess is that none of the big high profile western exchanges are insolvent. Quadriga probably was the only one, because CoinMetrics has done some work evaluating trading volume versus bitcoins on the balance sheet [though an imperfect science, a ratio derived from exchange volumes and deposits acts as a “proof of reserves” to show that trading doesn’t exceed assets on chain]. We know deposit numbers generally seem to work, but some of them, like exchanges trying to get a leg up in the market, might have a big incentive to lie, cheat or play unfair. Some of them are undoubtedly insulting. There’s hundreds of exchanges worldwide, only a handful meet the BitLicense requirements in New York, which means they face real consequences if they screw up.

Would you say the licensing that Department of Finance is doing in New York state has been helpful?

It’s a substitute. A paradox. Because this will cripple and spur development. I’m not some sort of decentralization fetishist. You’re not meant to need to trust the government to trust that bitcoin is sound, for instance. Like if 80 percent of all bitcoins were held in exchanges which were regulated, like the end of being FDIC insured, that’s literally the same model that underscores the banking system. So if we are relying on exchanges which are guaranteed by the government in some way, you can still have bailouts. You could have covert inflation. You’re going to get the same banking system all over again. So it means you haven’t achieved much, which is why I’d prefer instead of regulation, super aggressive transparency. Proving to depositors that they are sound is an obvious thing they can do, instead of getting the hammer from the government eventually. What else happened this year?

Yeah, it seems that is the number one story of the year. What’s really interesting to me is that, Congress got so upset about it, I think mostly to score political points. But I think Facebook miscalculated, because they thought their messaging was about creating a global currency. We’re gonna have this reserve, and we’re gonna fill it with all these foreign currencies, and a little bit of dollars. Obviously, that’s going to offend Congress. Because the dollar is like 70 percent of all international trade. So they’re going to want the reserve full of dollars. Facebook could have gone the patriotic route, and said the Libra Reserve will be full of dollars and maybe 10 percent Swiss francs. So we’d basically export dollars abroad, which helps finance the government. It’d be good for the U.S., good for the treasury. It’d be a new vector for the dollar’s rise around the world. You could keep selling cheap Treasury bills and so on.

But they didn’t do that. So, there are consequences.

The other thing I find funny is that everybody in Congress, for some reason, woke up to the threat of cryptocurrency, or non-sovereign currency, right when Libra was announced. But bitcoin’s been around for 10 years, and they weren’t worried about it. They’re underestimating it. Mnuchin went on Squawk Box and talked about bitcoin in the context of Libra. I guess in their minds, they don’t even realize that something that is a non-corporate project can actually be viable for money. Or maybe they just surrendered some of the messaging from people like [Congressman] Warren Davidson [Representative, Ohio], who said bitcoin can’t really be controlled and should just be left aside from now.

The other thing that nobody’s bringing up is Ripple. Ripple and Ripple Labs are U.S. companies. They’re issuing their own currency, XRP. They’ve sold it by the bucket load for the last six years. And they’re being totally ignored. Why aren’t they getting letters saying: “stop doing this.” I think it’s because no one takes them seriously, but they take Facebook very seriously.

In 2018, you were bullish that the SEC would crack down on a bunch of different ICO projects.

Yeah, that’s my great shame, man. Yeah, they never did.

Yeah, and this year, we saw a bunch of new actions – Telegram just within the past few days – do you think that this phantom of the industry ended up being kind of toothless?

It was this looming specter. Our firm doesn’t invest in any tokens for that reason as well as a variety of ethical reasons – I don’t like the dirty secret of the industry: that venture firms get their exit from tokens by selling them to public retail investors. In some way or another, they get a discount. They structure it in a variety of ways, but the way they make money is by drumming up hype for these things and then selling them before it becomes clear that they’re obviously worthless. It’s perverse, because it’s an IPO for a firm that may have a patent, yet has nothing to offer. The whole thing is funded under expectation and hope, and it’s not clear that there’s any sustainable revenue or value accruing to any of these tokens. Period.

Maybe Bitcoin just about works. But we don’t even know how to value it. Every other smart contract chain you’re talking about, how do you value those things? Nobody has a good answer. The fact that the investors in these things know their exit comes from retail, which still happens, makes it profoundly unethical. Like even Ripple which has these quarterly disclosure reports where they say how much extra XRP they sold? They can’t even get those numbers right. CoinMetrics looked in and found serious discrepancies between the on-chain stuff and what the disclosure of 100 million XRP. From the start of my serious involvement in this industry, I thought for sure there would be serious fines. And the perpetrators would be banned from the securities industry or from holding positions as directors of a company. And yeah, that hasn’t been the case. It makes me think that maybe we’re dealing with a S.E.C. that is super risk-averse and doesn’t want to get into costly litigation, unless they think they have a slam dunk. If I had to guess, I think there might be something more coming down from the SEC.

Are there any token projects you see as legitimate?

Professionally speaking, we are a venture fund. We absolutely could back startups building on other chains. There’s valid things being done on other blockchains. In terms of the monetary use case, I think bitcoin is gonna be the winner for the foreseeable future. But there will be a lot of smart contract chains fighting it out down there, and one of them will probably get meaningful usage at some point. We’re still figuring out the basics, man. Custody, key management, exchanges. They are corrupt. Merchant service is stuff like that. There’s still opportunity, sure. Ultimately, it’ll be nice to start seeing building on lightning. There are half a dozen startups that are targeting lightning.

I’m interested in Curtis Yarvin’s decentralized web project. It’s not just about money. It’s society. It’s not just owning your land. It’s laying claim to your identity. If you think about your Twitter handle as a plot of land, or the property that you improve upon and put work into…your social graph, then [you can say how it could valuable]. Ultimately, I think social media is not going to make it. And we’re gonna get something like Urbit or some other federated model like Mastodon to organize a virtual society. It allows you to control your own data in a home server. Someday, optimistically, I think that’s gonna happen in the real world. Like an exit from the state. We’ll have our own states.

Decentralized things, or at least bitcoin, represent something philosophical that’s an advancement in human thinking and in human society. Others have called it a truth machine that exists independently of the state.

I think bitcoin isn’t actually an end in itself. It’s a kind of truth proved to be true. It’s one of the most critical innovations that we’ve ever developed. The first being when people realized they could encode information by scrawling it down on clay cylinders in Mesopotamia and give information persistence. Blockchain is just a sophisticated version. I bristle a little bit at “truth machine” just because it’s, like “garbage in garbage out.” Also, it gets abused a lot in a non-bitcoin context. There’s not a lot of guarantees in blockchain. You need to attach a computational, real world cost to the job of including information on the ledger to make sure that the information is good.

There’s an argument that blockchains are really bad for human transactions — that the technology will only make sense after everything is automated for computers to speak with each other.

Yeah, it’s kind of hostile to humans. When humans interacted with blockchains they can mess up, make a typo. We kind of stumbled into this technology. We were progressively going more digital. If bitcoin didn’t exist, we’d have some other former virtual cash. Maybe someone would have rebooted like Chaum’s e-cash. I don’t exactly know how machines would benefit from machine-based currency. I haven’t really puzzled that out. People talk about electric cars paying to charge up. What’s the problem bitcoin solves? It lets people that mistrust each other transact online. Machines could be instructed to trust. Bitcoin is a very cold institution. It’s kind of like a machine, it’s unfeeling, and just follows set rules. All of our best institutions are kind of resistant to capture, resistant to malleability.

Will the U.S. create a digital dollar this year? Do you expect more sovereign nations to create coins?

The virtualization of currency is only going to continue because it’s like super pro to government objectives. They want to be able to surveil every transaction. Plus, you can’t impose negative interest rates on physical cash. Right? They really want total granular control of the economy through the money supply. But something like that would kill commercial banking, and they have a quasi-monopoly and pretty powerful lobbyists, so I doubt a digital dollar would happen anytime soon.

Either way, I don’t think it’s good or bad for bitcoin.

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.