2 On-Chain Metrics Suggest Bitcoin Bullish Bias Intact

Despite losing $6,000 in hours and $17,000 in several days, on-chain data suggests that the demand for bitcoin is still solid. The number of coins stored on exchanges and miners refusing to sell indicates that the cryptocurrency could resume its bull run shortly.

The Good News Following the Crash

It was roughly ten days ago when bitcoin was riding high and painted a new all-time at $65,000. This came amid the long-anticipated Coinbase public listing on Nasdaq. Ever since that peak, though, the situation has reversed.

On Sunday BTC slumped to a 3-week low at $51,500. Although it bounced off and recovered several thousand dollars in the following days, the bearish developments only intensified in the past 24 hours.

As always, the community speculated with the possible reasons with the most discussed theory links the market crash with the proposed new tax on capital gains from the US President Joe Biden.

These adverse market moves caused massive pain for investors once again as Bybt data shows $4 billion of liquidations on a 24-hour scale. Nevertheless, some community members found positive news.

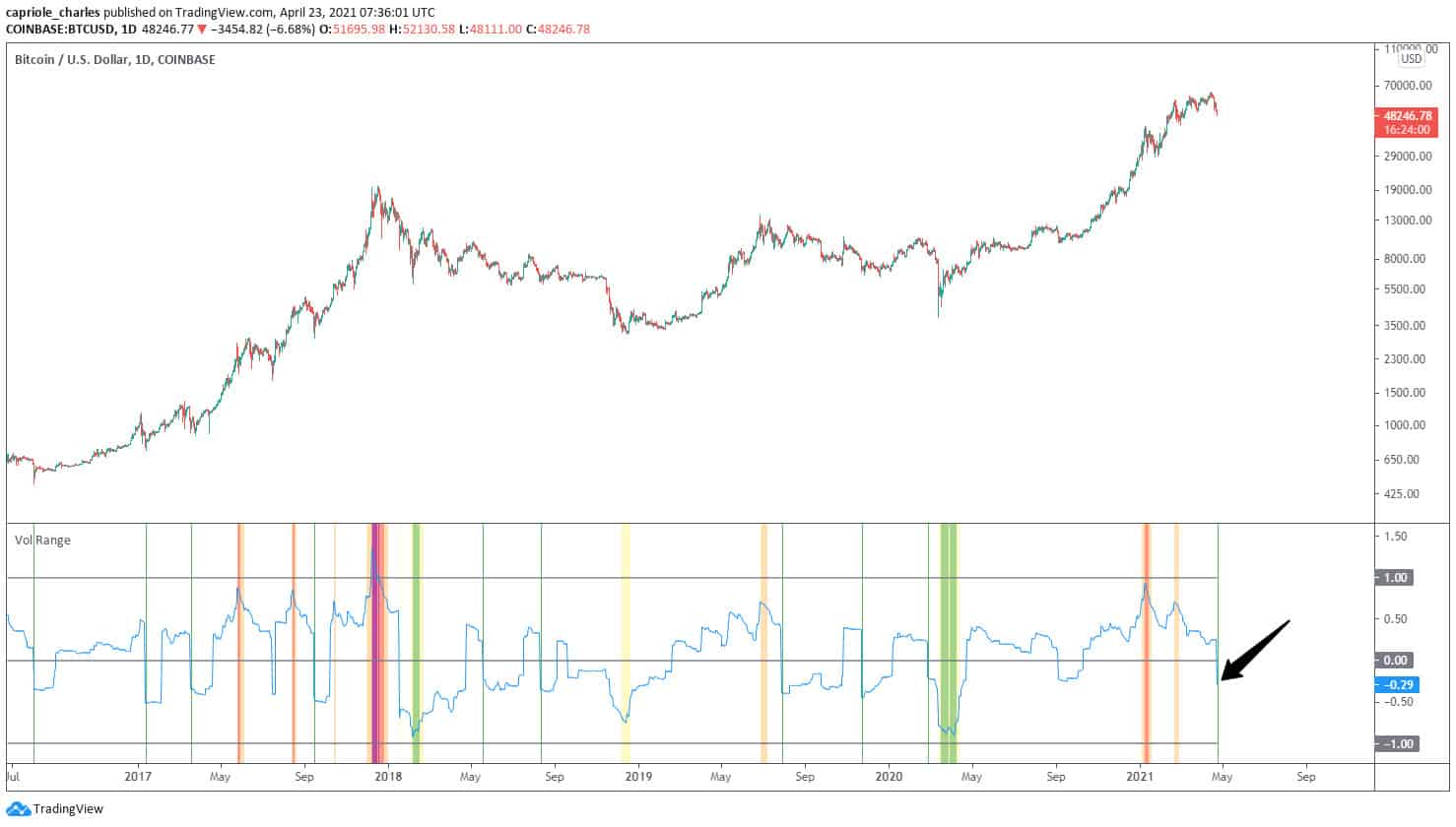

Charles Edwards, the founder of Capriole Investments, has repeatedly outlined the “overextended” state of the ongoing bitcoin bull cycle in the past. Now, he noted that the “volatility has finally reset,” and projected that the next run will be “in a much healthier position for continuation.”

BTC’s Supply Declines Demand Grows

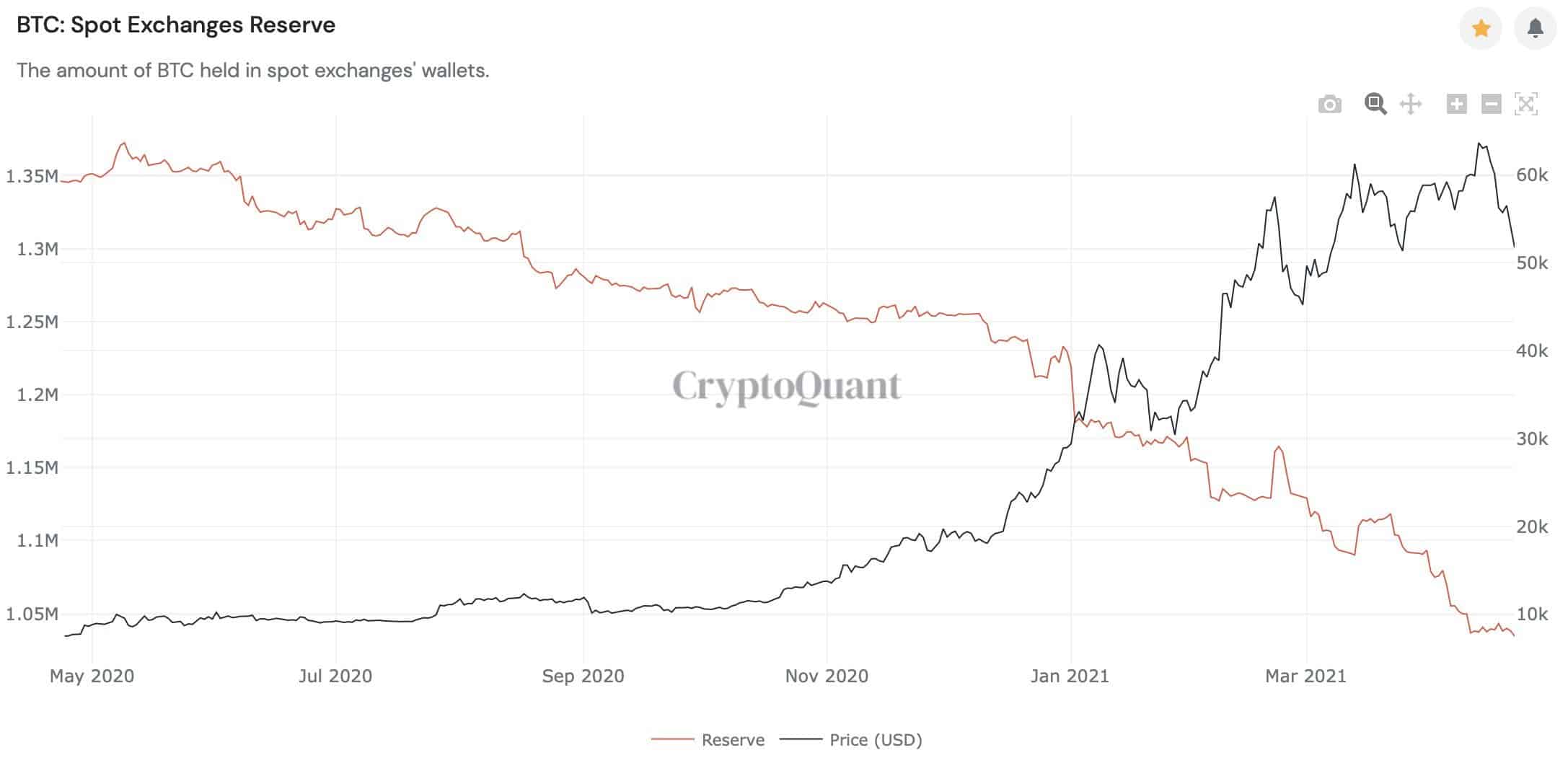

By referring to data from CryptoQuant, a popular crypto commentator going by the Twitter handle Dilution-proof breached valid reasons that could still support a bullish case for BTC.

The number of bitcoins held on cryptocurrency exchanges keeps declining. Meaning that the selling pressure decreases, while investors continue to accumulate and withdraw their assets from trading platforms.

Glassnode also supported this by indicating that the number of addresses receiving from exchanges (7D-MA) reached a 3-year high of nearly 3.4 million.

Additionally, miners have halted selling as well. As previously reported, BTC miners had started to dispose of their coins, which resulted in substantial price losses in a relatively short period. However, they have turned to HODLing since then.