$2.4 Billion Liquidated in a Day Following Elon Musk Bitcoin Debacle (Market Watch)

Elon Musk continues to drive volatility in the crypto market as bitcoin fell by $7,000 in a day before it recovered $3,000. Most altcoins are also deep in the red, with ETH dipping below $3,500 and BNB beneath $500.

Bitcoin’s 24H Wild Ride

It’s safe to say that the primary cryptocurrency has seen better days. In fact, they weren’t that long ago as it traded above $58,000 on May 12th. However, Elon Musk’s statement that Tesla had stopped receiving BTC payments for its electric vehicles caused massive disruptions immediately.

In just a day, bitcoin nosedived by $12,000 to a two-month low. Despite attempting to recover quickly, the asset stood beneath $50,000 for a while before another engagement by Tesla’s CEO sent it south again.

As reported earlier, bitcoin plummeted to a three-month low this time at just over $42,000 (on Bitstamp). The high fluctuations continued as the billionaire clarified that Tesla hadn’t sold any of its BTC portions, and the cryptocurrency added $3,000 of value in a matter of minutes.

These developments caused pain for traders as the total liquidations in the past 24 hours are $2.4 billion.

As of writing these lines, bitcoin stands around $45,000. Its market capitalization is close to dropping below $800 billion, while its market dominance sits at 40%.

Blood on the Altcoin Street

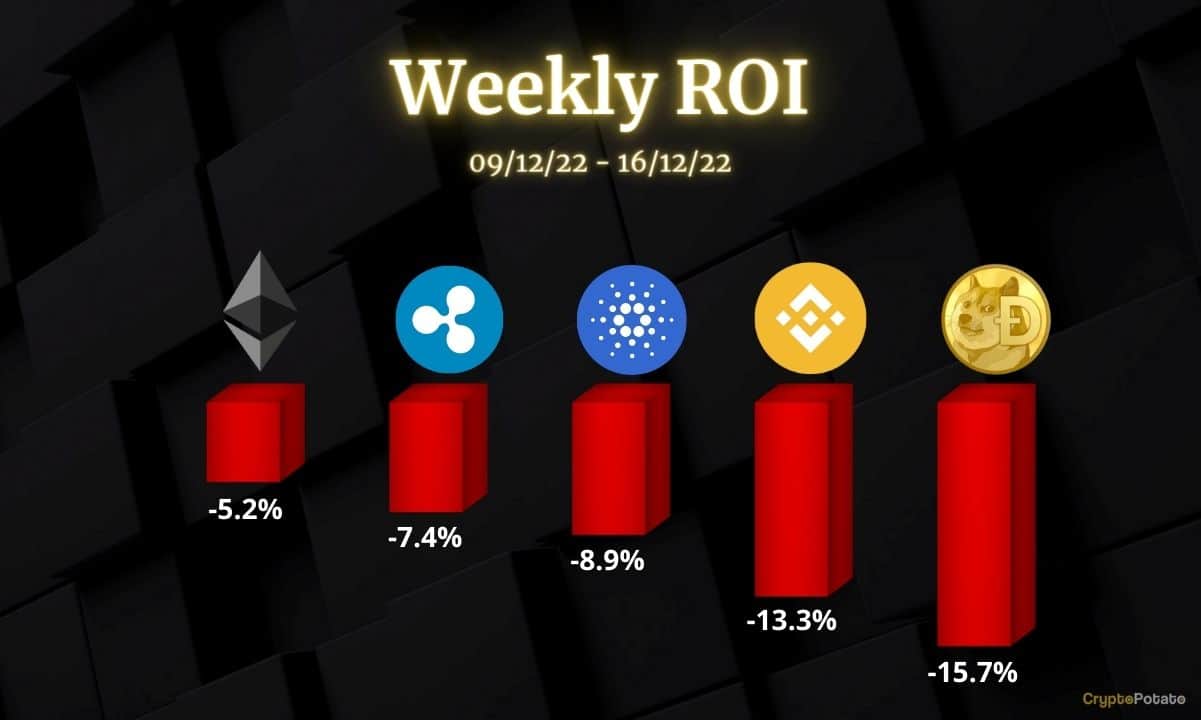

As it typically happens when there’s enhanced volatility with bitcoin, most alternative coins have followed suit. Ethereum led the adverse charge with a massive drop to $3,150 (on Bitstamp). Despite recovering some ground since then to $3,500, ETH is over $900 away from its most recent ATH registered earlier this month.

Binance Coin’s price drop brought it down to an intraday low of $485. Although BNB has bounced off, the asset is still 9% down on a 24-hour scale.

Cardano, which saw another record yesterday at $2,4, has declined by 8% and currently trades at $2.2. Ripple (7%), Dogecoin (-4%), Polkadot (-13%), Bitcoin Cash (-11%), Litecoin (-9%), Uniswap (-9%), and Chainlink (-10%) are also well in the red.

Further losses come from the lower- and mid-cap alts. Venus (-25%), Qtum (14%), Huobi Token (-12%), Stacks (-12%), Ontology (-11%), Stellar (-11%), Zcash (-11%), Bitcoin Gold (-11%), and OMG Network (-11%) are just a few of the double-digit losers.

The cumulative market capitalization of all crypto assets fell below $2 trillion for the first time in weeks. Despite recovering to $2.1 trillion as of now, the metric is over $400 billion down in five days.