$1000 Bitcoin Price Fluctuations Following the Latest Fed Interest Rates Hike: Market Watch

The latest Federal Reserve interest rate hike brought more volatility for bitcoin as the asset dipped to $20,000.

Several altcoins, including MATIC, Flow, and Filecoin, have skyrocketed by double digits in the past 24 hours.

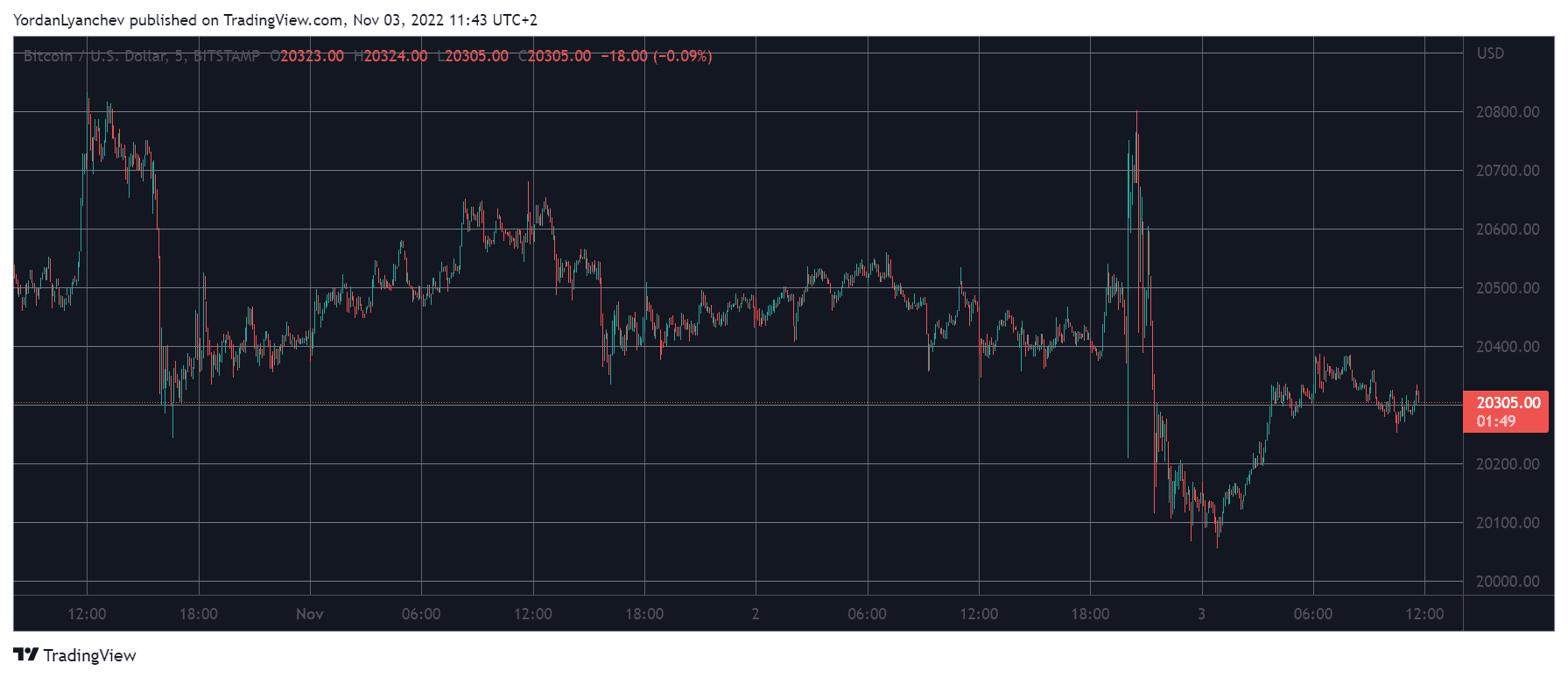

Bitcoin’s Latest Rollercoaster

After the positive last week in which bitcoin finally broke above $20,000 and jumped to a multi-week high at just over $21,000, the asset had calmed and traded in a tight range between the two round-numbered price levels.

However, there were rising expectations that the landscape is about to change in the first 10 days of November, following four notable events coming from the US.

The first was yesterday, in which the US Federal Reserve increased the interest rates by another 75 basis points. As with previous examples, this hike, even though it was in line with all expectations, brought enhanced volatility for BTC.

The cryptocurrency first shot up to $20,800 before it plummeted by almost $1,000 to $20,000. However, the bulls managed to defend that level once more, and BTC now trades a few hundred dollars above it.

Its market capitalization stands close to $390 billion, while its dominance over the alts is at 38.6%.

MATIC, FIL, FLOW Steal the Show

The altcoins went through similar rollercoasters, but most of the larger-cap ones have calmed now. Several are in the red now, including minor retracements from Ethereum, Ripple, Cardano, Solana, Shiba Inu, and Tron. Dogecoin has declined the most from the top 10 largest crypto assets, but it’s still the best performer on a weekly scale.

In contrast, Binance Coin and Avalanche are up by around 4% to $335 and $19, respectively.

Polygon’s native cryptocurrency has soared the most from the larger-cap alts, with a 12% daily surge to a six-week high of almost $1.

Similar gains are evident from Filecoin and Flow, both of which have skyrocketed by between 14% and 16%.

As such, the cumulative market cap of all crypto assets has managed to remain above the coveted $1 trillion mark.

The post $1000 Bitcoin Price Fluctuations Following the Latest Fed Interest Rates Hike: Market Watch appeared first on CryptoPotato.