10% Daily Drop of ETH Stored on Exchanges Sees Bulls Regrouping for a New Push

Recent data indicates that the number of Ethereum coins stored on exchanges has been gradually decreasing in the past year and showcased a massive drop in the past 24 hours alone.

This causes speculations if the growing demand for ETH and decreasing liquid supply could skyrocket the asset price.

Ethereum Held On Exchanges Evaporates

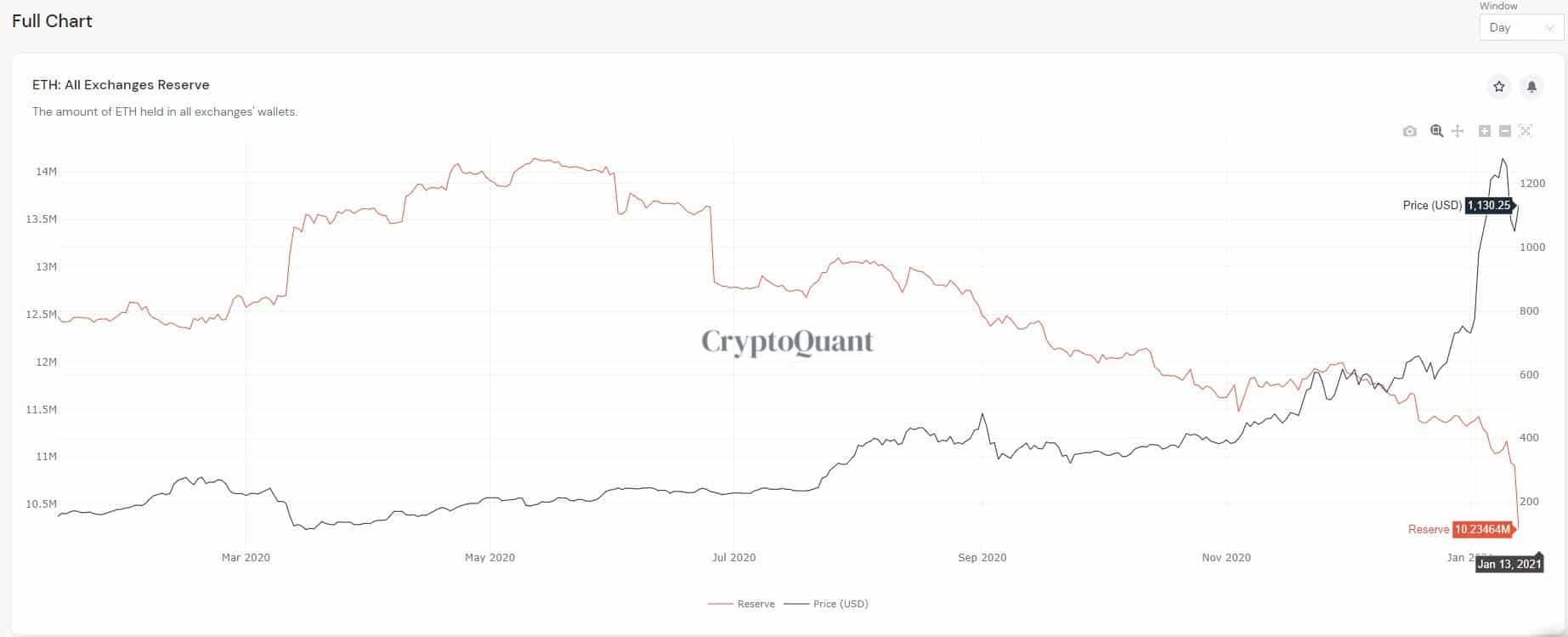

According to the cryptocurrency monitoring resource CryptoQuant, the number of ETH tokens stored on exchanges reached a 12-month high of over 14 million in the middle of 2020. Since then, though, the quantities have gradually started to decrease as Ethereum holders have withdrawn their assets to cold wallets or, more likely, used the coins in DeFi, NFT, or other endeavors.

After dropping to below 11.5 million in the following months, the liquid supply drastically decreased in the past 24 hours. As the graph above demonstrates, it fell sharply by about 10% to 10.2 million.

Popular cryptocurrency commentator Alex Sanders classified this development as “incredible” and breached a possible bullish scenario for the asset’s price. He referred to a similar situation with bitcoin.

Basic economic principles dictate that once the supply of an asset decreases, while the demand remains the same or increases, its price should rise, in theory.

As reported before, the liquid supply of BTC has been declining as well, while its price has surged to new all-time highs lately. Saunders highlighted this and added that “when demand outstripped the supply of BTC, it quadrupled in 90 days.”

Should ETH is to resemble bitcoin’s move and indeed quadruple in value, this would mean a price tag of north of $4,000 per coin.

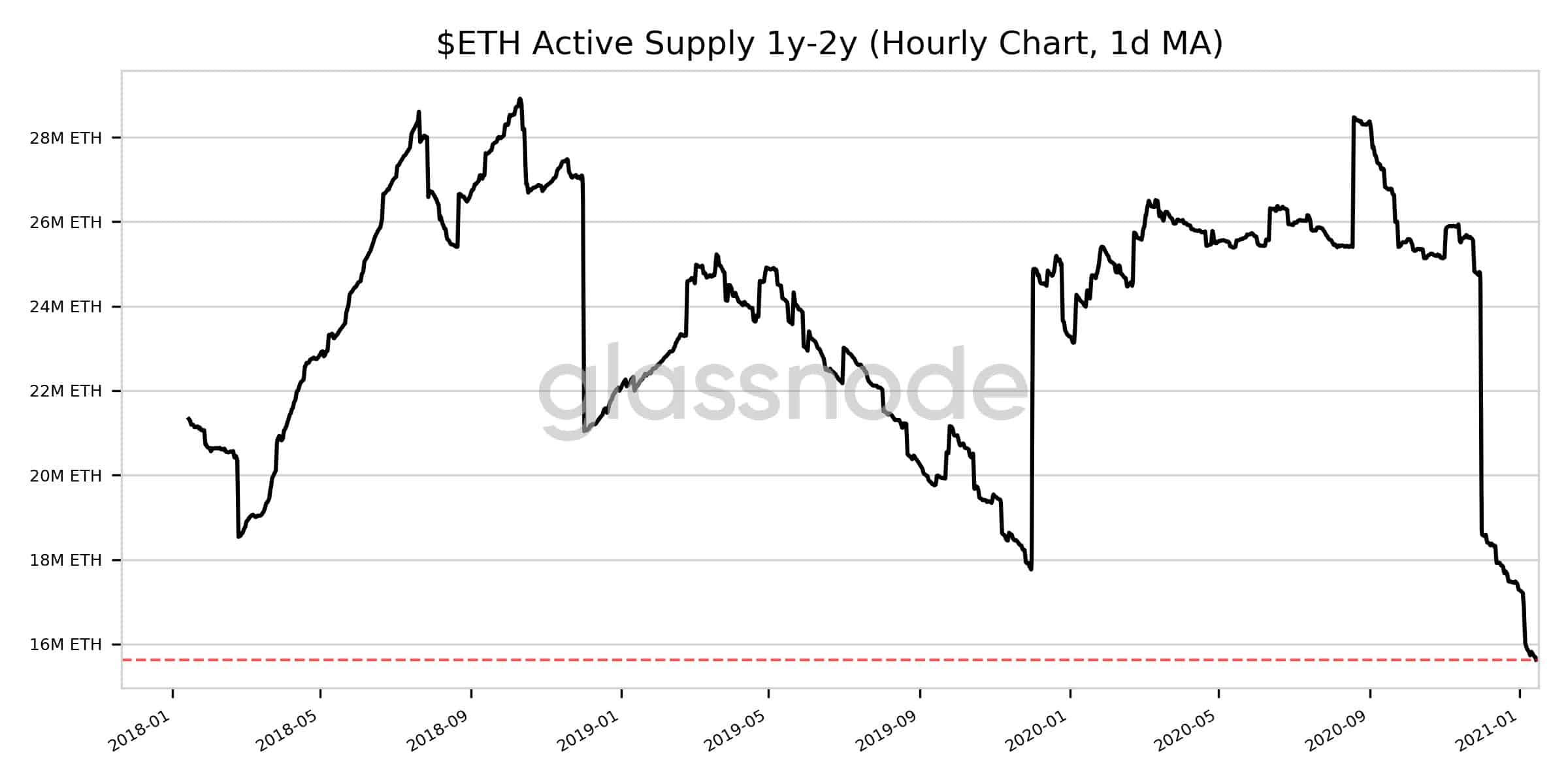

ETH Active Supply 3-Year Low

Data from Glassnode supports the aforementioned narrative that ETH’s supply is decreasing. More specifically, the company looked in the active supply – meaning the amount of circulating coins – last moved between one and two years ago.

This metric suggested a HODLing mentality from such investors as it has dropped to a 3-year low of 15.6 million coins.

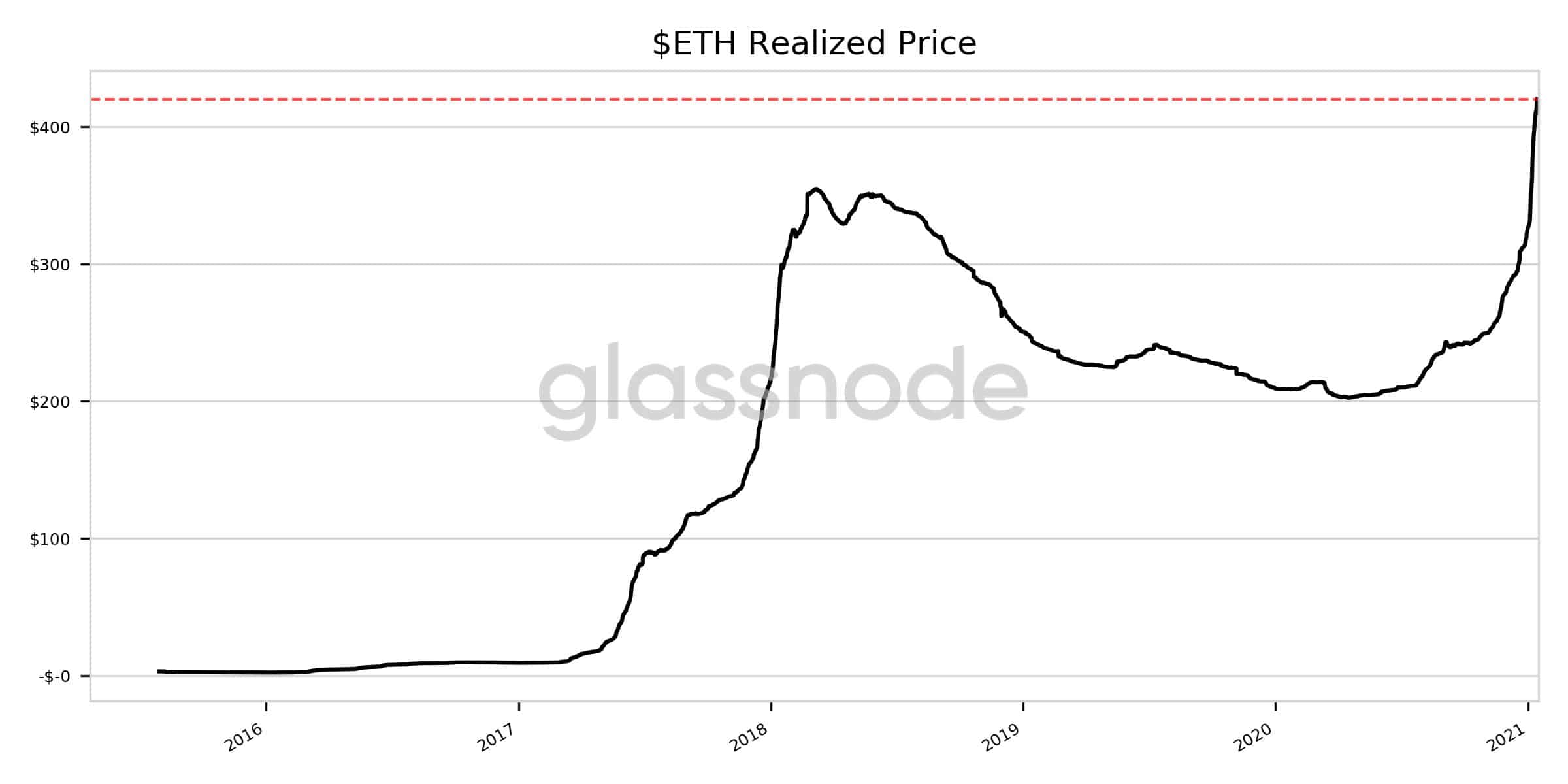

Separately, the firm indicated that unlike ETH’s actual price, which has failed to reach a new all-time high above $1,450, the token’s realized price had charted a new record.

The realized price of an asset considers the average price at which each coin has moved the last time in the network.

Glassnode said that ETH’s realized price has continued to paint new records, and the latest one has breached above $420.