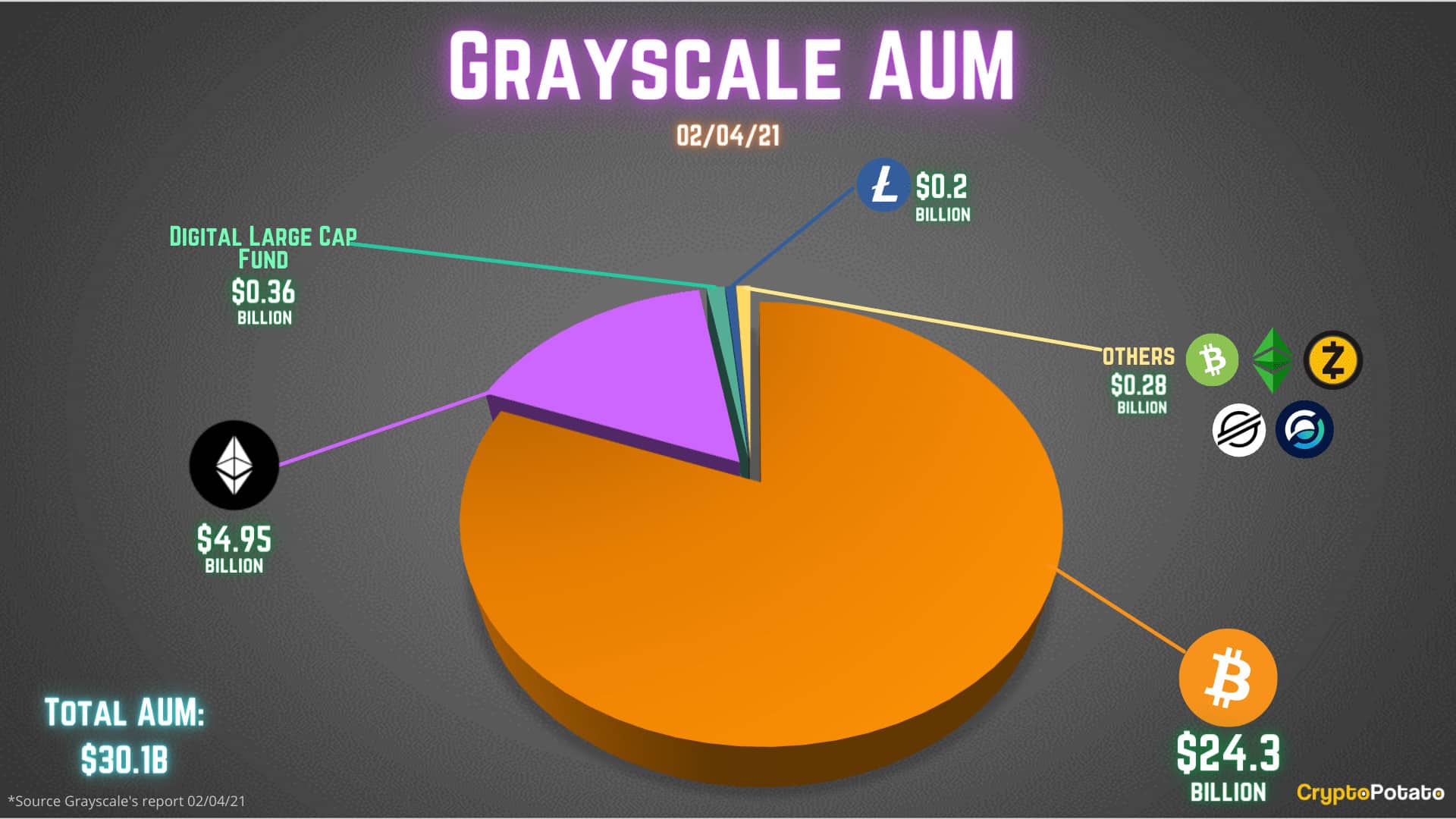

$10 Billion in a Month: Grayscale’s AUM Hits $30B Milestone

The world’s leading cryptocurrency asset manager, Grayscale Investments, continues with its rapid expansion by overcoming another AUM milestone at $30 billion. Somewhat expectedly, the Trusts dedicated to the two largest digital assets, namely Bitcoin and Ethereum, account for over 95% of all holdings.

Grayscale Tops $30B In AUM

Founded in 2013, Grayscale enables institutional investors to receive exposure to various cryptocurrencies without having to worry about storing or managing the assets. Until 2019, the company had attracted about $2 billion in assets under management.

However, 2020 became the firm’s most successful year as it witnessed the most substantial inflows from institutions. By the year’s end, Grayscale’s AUM had skyrocketed by a factor of ten to $20 billion.

The company hasn’t slowed down since the start of the new year. Recent data indicated that the AUM has grown by another $10 billion in a little over a month and is now north of $30 billion. This means a 50% increase in about five weeks.

02/04/21 UPDATE: Net Assets Under Management, Holdings per Share, and Market Price per Share for our Investment Products.

Total AUM: $30.1 billion$BTC $BCH $ETH $ETC $ZEN $LTC $XLM $ZEC pic.twitter.com/EJusspgOnK

— Grayscale (@Grayscale) February 4, 2021

The company has repeatedly highlighted the growing interest from institutions towards its products, which is best exemplified with the numbers above.

However, it seems that accredited investors are looking in the altcoin market as well, as Grayscale has filed documents to launch Trusts following the performance of numerous new altcoins. Those include Polkadot, Chainlink, Tezos, Aave, Monero, and more.

Bitcoin and Ethereum Still Dominate

Although Grayscale has Trusts for several cryptocurrencies and is looking into launching more, most of the AUM is concentrated in the two top digital assets – Bitcoin and Ethereum.

As the AUM update from above shows, the Grayscale Bitcoin Trust (GBTC) has over $24.3 billion, while the Grayscale Ethereum Trust (ETHE) has nearly $5 billion.

This means that GBTC is responsible for almost 81% of the total holdings while ETHE for 16.5%. Or, the two SEC-reporting Trusts account for over 97% of all assets under management.

Interestingly, GBTC’s share had actually decreased since the end of 2020 when it was at 85%, according to the Q4 report. This could be attributed to ETH’s skyrocketing price to new all-time highs and the massive accumulation rate adopted by the company lately.

Over the past week alone, Grayscale has added nearly 84,000 ETH to its portfolio – worth about $140 million. This is a significant increase from the average weekly inflows registered during Q4 2020 of $26 million.