$1.5 Billion Longs Liquidated as Bitcoin Price Tumbled Below $53,000

Over the past 24 hours, bears had the upper hand in the market as the price for Bitcoin, as well as that for the majority of cryptocurrencies, tumbled. This resulted in an overwhelming amount of long positions being liquidated across major exchanges.

- As CryptoPotato reported earlier today, Bitcoin lost about $5,500 in hours, tumbling below the $53K mark. The bears took charge yesterday, and it shows.

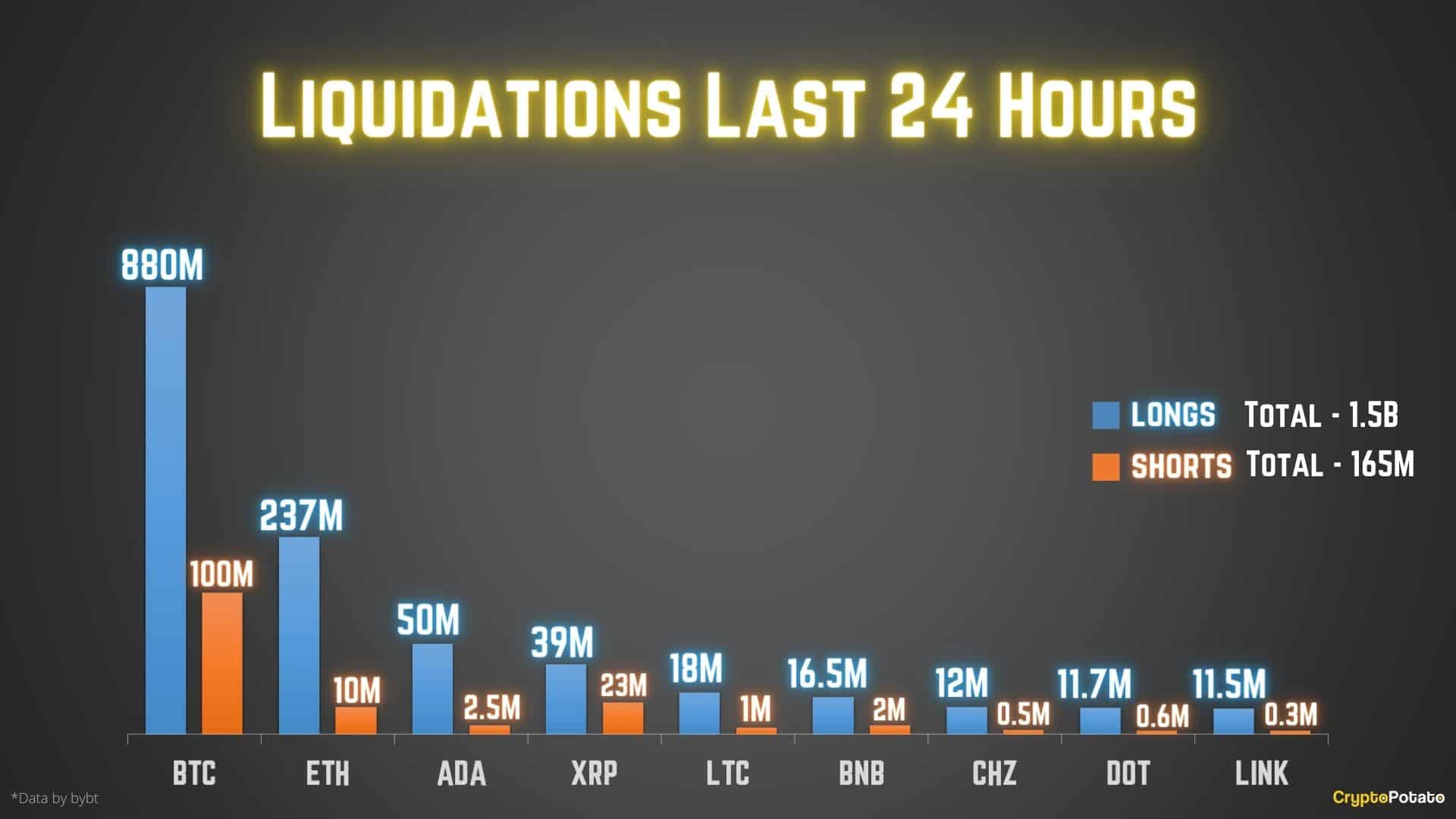

- Data shows that there are over $1.65 billion in liquidated positions as of the time of this writing. The overwhelming majority of them were longs as bears clearly had the upper hand.

- As seen in the above image, most of the liquidations came from Bitcoin, accounting for almost $1 billion, where most of them were also longs.

- In aggregate, long liquidations amassed to about $1.5 billion, whereas the shorts – to $165 million.

- As it’s almost always the case, the bulk of the liquidations (53.6%) happened on Binance’s Futures platform, followed by Bybit and Huobi.

- The largest single liquidation order took place on Huobi. It was a Bitcoin position with a face value of $10.2 million.

- In any case, at the time of this writing, BTC’s price is just below $55K while its dominance has been reduced to 59.7%.

- The major cryptocurrencies are also in the red, with the exception of two.

- Ripple is trading for a 12% daily increase, followed by THETA with similar gains. The latter managed to break into the top 10, surpassing Chainlink’s LINK in terms of total market capitalization.