$1.5 Billion Liquidations in 24 Hours as Bitcoin Price Recovers

The past 24 hours have seen almost $1.5 billion in liquidated positions. This is the total for both long and short trades, as Bitcoin’s price went on a rollercoaster.

$1.5 Billion Liquidated

Cryptocurrency trading has a certain allure to it. After all, in the past 24 hours, we saw Bitcoin’s price go from $40,000 to $36,000 and back above $41,000. The same is true for many other cryptocurrencies.

This rampant volatility creates opportunities for serious gains in a short amount of time. However, what a lot of people fail to realize is that it is much more dangerous. As highlighted by the most recent data, almost $1.5 billion positions were liquidated. That is to say, the trade didn’t go their way and they lost their margin. The majority of it, as of the time of this writing, comes from long positions, which is a direct result of Bitcoin’s volatility and crash in last night’s trading session.

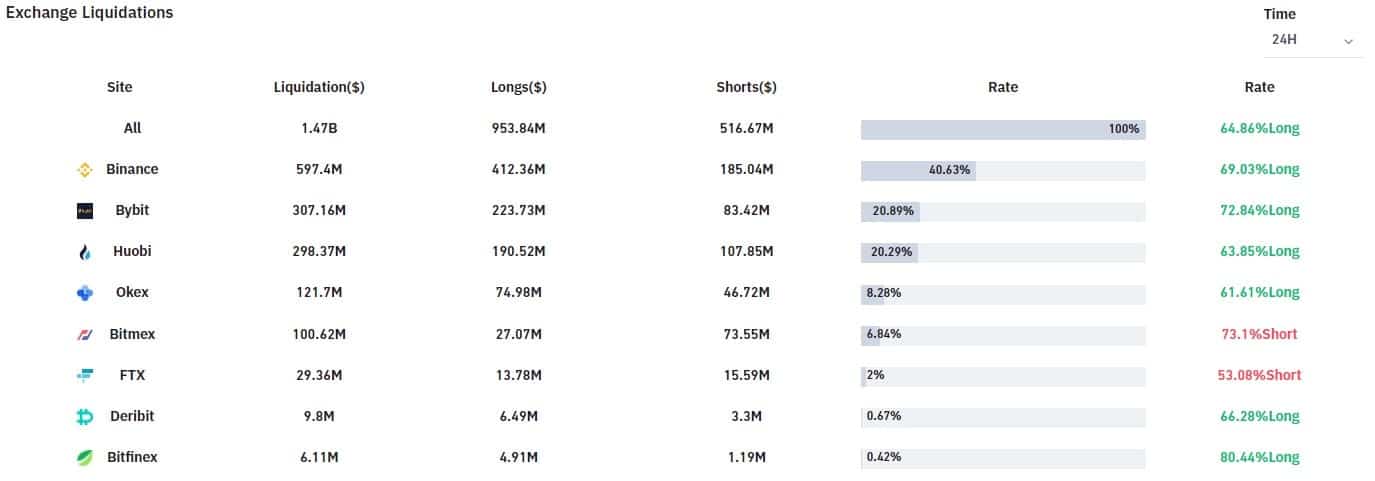

The total amount of liquidated longs sits at $953 million, whereas the liquidated short positions currently sit at $516 million. This happened in less than a day.

As evidenced in the chart above, the majority of the liquidations came from Binance, which is to be expected – it’s the largest exchange by volume.

Following are Bybit, Huobi, OKEx, and BitMEX.

$20 Million Single Liquidation Order

In the past hour, we saw about $60 million of liquidations. What’s interesting about this is that an overwhelming amount of it came from a single order.

A trader has lost $20.2 million on BitMEX. This is the largest single liquidation order and it involved ETH trading. This only goes to highlight the dangers of leveraged trading.

It’s important to remember that this is a zero-sum game. In simplest terms, this means that in order for some to win, others have to lose.

Nevertheless, the situation continues to be particularly exciting. The total trading volume in the past 24 hours is around $200 billion and Bitcoin’s Dominance surpassed 70%.